If you missed the New Year’s Resolution train or any other “prime” time to reset your habits, there’s good news: there is no bad time to start making healthy financial habits.

Whether you want to eventually achieve financial freedom or want to get out of debt, it all starts with forming good money habits (and getting rid of the bad financial habits).

To help you get started, here are 8 solid financial habits to adopt (at any point!) this year.

You can also view a summary of the financial habits as a web story.

Financial habit #1: Regularly review and update your financial plan

Having a plan for your money is arguably one of the best financial decisions you’ll ever have. However, just creating an initial plan isn’t enough. It’s equally important, if not more important, to make sure you’re reviewing and updating your plan regularly.

Your financial plan is there to help you assess, plan, and improve your present and future financial life. It takes a snapshot of your current financial picture along with your goals to help you create an action plan so you can navigate financial decisions with ease.

To make the most of your plan and improve your chances of success, you’ll want to regularly check your plan at least once a month and aim to update any important information at least every three to six months. Importantly, you should be updating your plan whenever significant life events take place—purchasing a new home, getting married, getting a new job or a salary increase, or having a baby, to name a few.

💡 Tip: You can create a personalized financial plan in just a few minutes with Savology, for free. |

Financial habit #2: Set financial goals that are meaningful

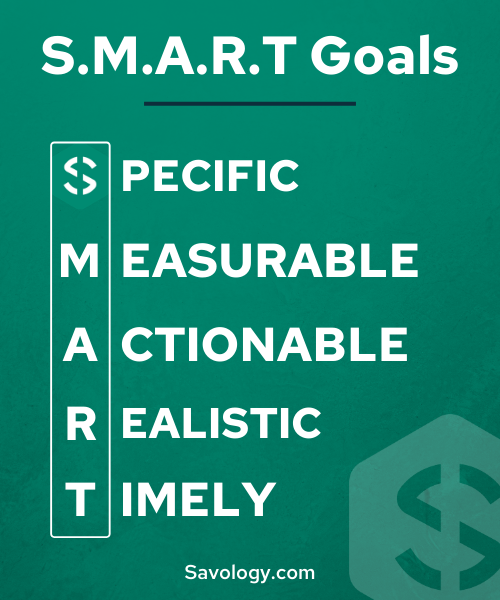

Setting goals is the first and arguably the most important step to financial success. Without goals, you aren’t able to track progress and celebrate milestones. When forming goals, it’s important to make them “S.M.A.R.T” goals: specific, measurable, achievable, relevant and time-bound.

Here are a few examples of SMART financial goals:

- Pay off $25,000 of debt in 7 months

- Make $10,000 from a rental property in one year

- Increase net worth by $30,000 this year

You can see how all of these follow our S.M.A.R.T goal guidelines. Each goal is measurable and time-bound, making it easy to keep track and hold you accountable to a deadline. They are also specific and relevant to financial success and not impossible to achieve. These examples are much more powerful than vague goals such as “pay off debt soon” or “make more money.”

This financial habit is also scalable and can be done at various points throughout your year. For example, you can create a weekly goal of adding at least $10 to an investment account or a goal that states you will invest at least $500 into your retirement savings each month.

As you can see, financial goals can be big or small — what matters is forming this habit as soon as you can so you can hold yourself accountable towards your success!

It’s also important to make sure that you are setting both short-term and long-term financial goals. By having both, you’ll stay motivated while focused on working towards your financial future.

Financial habit #3: Create a budget and use it to guide your spending

According to Debt.com, nearly 70% of Americans try to maintain a family budget. Are you one of them?

Forming a budget is an important financial habit to make because you should always know how much money is coming in and going out of your accounts each month. Without knowing this vital financial information, you may be spending more than you make — leading to a life of debt and poor credit.

When forming your budget, keep in mind how much money you bring in every month from your paycheck, how much you typically spend on “needs” such as living expenses and groceries, and how much you allocate for “wants” like eating out, travel and shopping.

There are a ton of ways you can approach your monthly budget but the most important thing is to pick something that makes sense for you and your lifestyle. If you are able to save 20%, 30% — or even half — of your monthly income for savings or investments, you are setting yourself up for financial success!

If you’re not sure where to start, consider these budgeting tips to help you get started.

Financial habit #4: Find passive income to improve your income

If you want to build wealth and pay off debt faster, you have to find ways to make more monthly with passive income. Passive income is essentially money you make residually through endeavors with minimal routine upkeep. A few examples of passive income include rental properties, dividends from stocks, or a side business.

How does this work? With the examples listed above, you only invest time and money upfront to set everything up. Then you can expect to make a certain return from those investments for the short term or long term.

To make this a financial habit, get creative. You don’t need to invest a ton of money into something to get a return. You could rent a room out in your home or even rent out your car on the weekends! Figure out ways to “hack” your life and it can add up substantially — helping you build wealth faster than what you may earn from a standard paycheck.

Even if your passive income stream brings in $50 a month, that can add up — you’d have $600 extra at your disposal to pay off debt or put towards retirement!

Financial habit #5: Build an emergency fund to protect your assets

Did you know just 40 percent of Americans are able to cover an unexpected $1,000 expense? What if your refrigerator breaks or your dog needs emergency surgery or your car has a flat tire?

An emergency fund is a critical safety net to ensure you don’t dip into your other funds designated for your routine expenses. If you don’t have one, your chances of accumulating debt greatly increases because you may have to use money that you planned for credit cards or other bills in order to pay for the emergency expense.

Experts suggest having an emergency fund that covers three to six months of living expenses. This amount is especially true if you have one source of household income, are paying off debt, or have just started budgeting.

If you haven’t started working towards this critical financial habit, start setting aside money to save for emergencies — even if it’s only a small amount from each paycheck. Your financial future will thank you!

Financial habit #6: Pay off credit cards in full

It’s time to forget the myth that carrying a balance on your credit card is better than paying it off in full each month. To understand why, you have to know what factors impact your credit score.

According to Experian, payment history is the most important factor in determining your credit score. The second most important factor is your credit utilization. The lower your utilization rate, the better your credit score. That means you should try to keep your utilization ratio (or how much credit you’re using) as low as possible.

If you can’t pay off your credit card in full each month, aim to keep it under 30% utilization. For example, if you have a $1000 credit limit, you should keep a balance of $300 or less every month.

You risk accumulating even more debt from interest payments if you don’t pay off your credit card each month. Snowballing interest payments from your credit card company can add up (thanks to compound interest) and eventually put your credit at risk.

And if your credit gets too bad, getting approved for loans — like a mortgage — is more difficult because people will see you as a financial risk. Repairing your credit can be harder than just paying off your balance each month!

Financial habit #7: Bring food from home / Cut down on the take out

Are you guilty of buying a coffee and bagel on your way to work or grabbing a sandwich on your lunch break? If so, you could be wasting thousands of dollars each year.

In fact, I did my own calculations and realized my $5 to $10 food splurges added up to well over $3,000 a year! That was enough for me to start packing food as much as possible.

I get it: meal prepping can be hard and it’s boring to eat the same thing all week! But you can work up to this goal by only eating out for lunch once or twice a week and pack the rest. You’ll be amazed at how much packing food can help you save for your financial goals.

In the current climate, considering a good percentage of the workforce remain working from home, focus on keeping to home-cooked meals, and saying no to ordering takeout. Don’t feel bad about spoiling yourself every so often, but ordering takeout on the regular, especially through food apps, can end up being considerably expensive.

Financial habit #8: Talk openly about money with your friends

Have open and honest money conversations with your friends and family is a great way to continue learning new money management approaches and money tips to improve your literacy and overall motivation.

It can also be an extremely great way to get over any existing fears about money or taking those next steps to start working on your financial goals.

The more you talk about money and financial management with friends, or an accountability partners, the more confident you will be in progress you’re making to better your financial future.

Focus on reinforcing your good financial habits

There are tons of good financial habits you can start adopting this year. Some can be easy — like packing your lunch two days a week. And some can be a little more involved — like finding ways to make passive income.

Remember this: no matter what financial habit you decide to take up, you will be that much closer to achieving your financial goals. All that matters is that you start.

What new financial habits do you want to pick up?

Starting your financial future today

Savology is a free planning platform where you can build a free, unbiased, personalized financial plan in about 5 minutes. Your Savology plan will give you action items to start working on as well as an overview of your current financial situation. After you have made some progress, Savology can connect you with some of the world’s top providers to help you accomplish your financial goals.