Increasing your income is always a smart move, especially if you want to pay off debt and build wealth. Fortunately, it can be relatively easy to make more money. All you need to do is decide how much time and energy you can invest to make it happen. Side hustles and passive income streams are two popular tactics used to achieve a higher level of income on top of your typical paycheck.

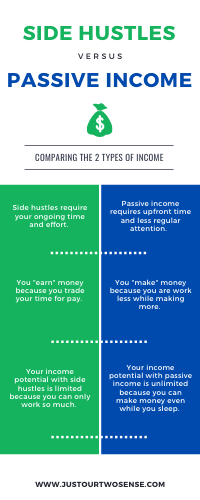

The key difference between the two? One is an active way to earn money and the other is a passive way. You’ll learn side hustles typically require your time and energy to make money and passive income requires little upkeep and time. Both options are valuable ways to increase your income and build wealth faster than normal.

Personally, we have experience in both income streams. Brian and I have taken on side jobs such as doing small handyman tasks in the neighborhood or selling clothes online. More recently, we have grown our passive income portfolio by investing in a handful of rental properties, which generate a few grand every month, as well as investing in the stock market. Over the years, we have figured out what works for us and stuck with it (and that’s what matters most!)

Check out the differences between side hustles and passive income below and how to decide which income stream is right for you.

What is a side hustle?

A side hustle is any additional income from another job outside of your full-time employment. Side hustles are considered “active income” because you are actively involved — you have to be present in order to make your money. However, side hustles do offer more freedom than part-time jobs because you can set your own schedule. You call the shots and work when you want and make as much as you want.

Examples of side hustles

There are hundreds of side hustle ideas to help you make money on the side of your regular job. Here are just a few:

- Walk dogs for Rover or Wag

- Babysit for family and neighbors

- Offer freelance services, such as marketing, graphic design or writing

- Drive for Uber or Lyft

- Deliver for UberEats, GrubHub or other food delivery services

- Game apps to win real money (you’d be surprised by how many people are doing this)

These side gigs provide an added income stream for your savings but do require your time and energy in order to earn money. You will have to take on these jobs on a free weekend or an evening after your standard job.

Let’s say you work a standard 9 to 5 job and have evenings or weekends free. You could potentially earn an extra $70 a week by walking one dog every day for $10. That adds up to over $3500 a year just by walking one dog for 30 minutes a day after work! See how simple it can be to grow your income with a side hustle?

In addition to the above examples, you’d be surprised by the amount of different and creative ways people are earning extra income. I’ve first-hand witnessed people making money using 3D printers, and even selling candles. It just goes to show you that there are literally thousands of different ways to earn an extra dollar or two.

What is passive income?

Unlike side hustles, passive income is money made from an enterprise in which a person is not actively involved. As famous entrepreneur Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” In short: passive income helps you diversify your earnings and creates an efficient way to earn money because your time isn’t always required.

While many passive income efforts involve upfront investments and set-up time, your involvement greatly decreases over time until you are completely hands-off or can hand over responsibilities to someone else. Passive income is a great way to build wealth faster because you make money with almost zero limits.

Examples of passive income

As with side hustles, the opportunities for passive income are endless. Here are a few examples:

- Invest in a rental property or Airbnb

- Earn dividends from stocks

- Rent out space in your home

- Rent your car

- Own a business

As we mentioned before, Brian has invested in a handful of rental properties. This endeavor does require upfront time and money for a down payment, but if you do it correctly, you can make thousands more a month like he is.

One more unique passive income endeavor is renting out space in your home. This move can offset your mortgage costs — and with the cost of living rising almost 14% over the last three years, this can greatly put you ahead of your financial goals. You can learn more about these unique passive income streams and how to get started in our Passive Income Playbook.

The similarities and differences between side hustles and passive income

There is one key difference between earning money with side hustles and earning money with passive income: your time. With side hustles you “earn” money, with passive income you “make” money. This is because with side hustles you are trading your time and involvement in return for payment, whereas for passive income, you are making money that is not tied to your active participation.

However, they do share some similarities:

- They are both taxed

- They both increase your level of income

- They both can put you on the path to financial freedom faster

How to decide which income method is right for you

Now that you understand a little more about side hustles and passive income, there are a few questions to ask yourself to determine which one is right for you (or if both are!).

Before you get started, the most important thing is to see how it fits within your financial plan. The questions below can help guide your decision, including how much money you are able to set aside and how much time you can dedicate towards your income goals.

Important questions to ask yourself:

- What is your ultimate income goal? (Or, how much additional income are you looking to save?)

- What is your timeline to achieve your goal?

- How much time can you invest in an additional source of income each month?

- How much money do you have to invest in an additional source of income?

No matter which route you decide to take, you can be introduced to a world where you can discover your new passions and skill sets that can put you closer towards financial freedom. For example, you may take on a new side gig with dog walking and invent a new tangle-free leash that walks up to three dogs. Or if you decide to invest in a rental property, you may figure out you love doing DIY home renovations and want to start a new renovation business.

The most important step is to get started — which route will you take?