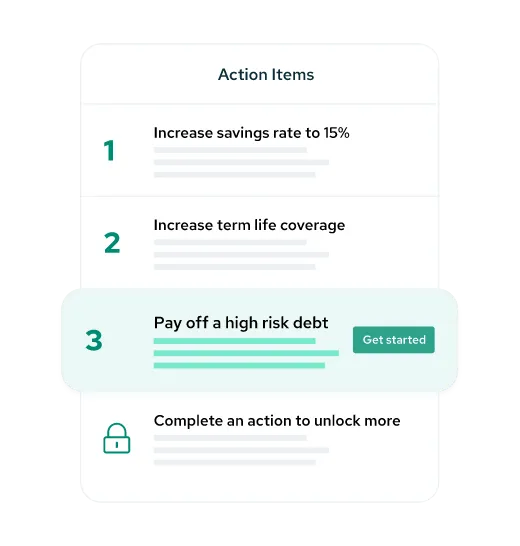

User-led financial planning

Foundational plans include a financial report card and personalized action items that prescribe next steps to improve financial wellness.

Financial literacy and education

Engaging literacy lessons, quizzes, articles, and resources to help households advance their financial knowledge and wellbeing.

Personal financial management tools

Accessible tools to monitor credit scores, create budgets or debt payoff plans, track net worth, set goals, and more.

Support from financial professionals

Savology makes it easy to collaborate with financial advisors, planners, or coaches directly within the platform.