The Savology answers you’re looking for.

We get asked several questions about our financial plans, our recommendations, how we work with employers and advisors, and more. If you have any questions yourself, there’s a good chance you can find the answers you’ve been looking for below.

Savology Frequently Asked Questions

Savology Introduction

General

What is Savology?

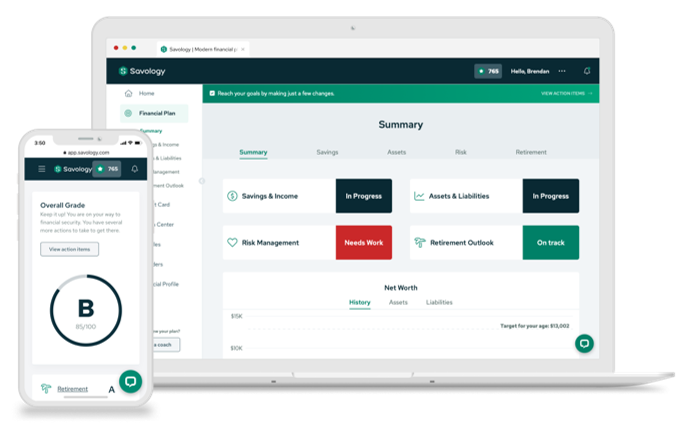

Savology is a digital financial planning and financial wellness company. Our mission is to increase the financial security of millions of American households by making financial planning and wellness more accessible, more actionable, and more effective than ever before.

Who is Savology for?

Savology provides accessible financial wellness and financial planning to a few markets. Savology primarily works with financial advisors and with employers, but does have some limited direct-to-consumer options as well.

Who is a Savology plan for?

Savology is designed to provide foundational planning and financial wellness to the masses. Savology was built for the everyday person as a way of making financial planning more accessible.

Savology provides planning for households that are in the accumulation phases, meaning those who are still earning and saving and are not yet in retirement. Savology is especially applicable for those between the ages of 18 and 60 and those making $25,000 to $250,000 per year regardless of marital status or family size.

While a Savology plan is most commonly a first financial plan, it can serve as a second opinion or a financial progress tracker for those who already have another plan.

How is Savology different?

First and foremost, Savology is designed specifically for the middle market to make planning more accessible. It is not another planning software built for high net-worth households.

Second, Savology is able to save people time and money compared to traditional financial planning means. Starting in just 5 easy minutes, Savology users can build a comprehensive financial plan, holistic report card, personalized action items, and more.

Financial Plan

What is a financial plan?

A financial plan is more than just an analysis of where one is right now with their personal finances, it is also a strategic game plan for achieving future objectives across all areas of their financial life. An effective plan should include a savings strategy, a risk management plan, an estate plan, and a retirement roadmap.

Savology uses hundreds of key indicators, metrics, and calculations to create a comprehensive plan, holistic report card, and personalized recommendations to help people improve their financial situation and prepare for retirement.

How long does it take to prepare?

Traditional financial planning takes hours of fact-finding, preparation, calculation, and analysis to prepare a plan. Savology uses proprietary technology and algorithms to create foundational financial plans in about 5 minutes.

Implementing the plan takes additional time. It is recommended to spend at least a few minutes every month to update the plan and take the necessary steps to improve.

Is this just a retirement calculator?

Savology does provide retirement calculations similar to other retirement calculators, including projections on earnings, income, investments, and social security. But, Savology is much more than just a retirement calculator; it is a digital financial planning and financial wellness platform.

Savology takes it even further by providing analysis and recommendations on what changes to make to reach goals or to adjust goals to be more realistic and attainable.

While Savology could certainly be used as a one-time check-up or calculator, it is best utilized by continuously updating, revisiting, and progressing over months or years.

How It Works

How long does it take to build a plan?

Most people are able to complete all the information needed to build their plan in about 5 minutes. If someone is less familiar with their personal finances it may take a bit longer. After answering the questions in the survey, Savology generates a personalized financial plan in a matter of seconds.

Financial planning, however, is a marathon, not a sprint. So even though a plan can be created upfront quickly, it can take time to implement the recommended changes. Meanwhile, the plan updates continuously to reflect ever-changing financial situations and recommend new actions.

What does Savology do with personal information?

Savology keeps information private and does not sell any user information. Savology uses the information gathered in the survey to build comprehensive plans and provide the most relevant and accurate recommendations possible. Savology limits the personally identifiable information collected by not asking for sensitive information such as a last name, social security number, date of birth, or account numbers when building a plan.

For those who sign up for Savology through a partner, there are additional considerations. It is important to note that a connected financial advisor would have access to information. Savology does not, however, share sensitive information with Employers beyond account status and aggregate group metrics.

Is Savology secure?

Savology uses industry best practices to keep information and our systems secure. Savology limits the personally identifiable information collected by not asking for sensitive data like last name, social security number, or date of birth when building a plan which further minimizes risk.

What types of providers does Savology recommend?

Recommended providers can come from multiple sources. Savology may directly recommend top-rated providers to help people complete action items, manage their finances, and make progress on their financial plans. Savology makes these recommendations without bias and does not receive compensation for its provider recommendations.

Other recommended providers can come from a connected financial professional or employer. In the case of financial professionals, they may feature their own products or services. Employers on the other hand often include their benefits.

Recommended providers could include retirement accounts, life insurance providers, budgeting tools, bank accounts, mortgages, investment management services, health savings accounts, other insurances, and much more.

Team and Careers

What are Savology’s specialties?

Savology is made up of a team of specialists with expertise in personal financial planning, budgeting, financial coaching, estate planning, 401(k) and retirement planning, technology, and more.

As a company, Savology specializes in financial planning, financial wellness, financial technology, and financial coaching.

Are there any career opportunities with Savology?

Savology often posts new career and hiring opportunities. To view and stay on top of current job openings, visit the LinkedIn company page. Any new job openings and career opportunities to join the team will be posted there.

Contacting Savology

Does Savology have a physical address?

Savology is currently headquartered in Lehi, Utah. The physical address is 2701 N Thanksgiving Way Suite 100 Lehi, UT 84043.

What is the best way to get in touch with the Savology team?

To get in touch with the Savology team with general inquiries, including questions about financial plans, reach out to Savology by email at support[at]savology.com.

What if I want to interview the CEO or feature Savology?

For media inquiries, please send an email to our marketing team at press[at]savology.com.

Savology Introduction

Savology for Advisors

Savology for Advisors: General

What is Savology for Advisors?

Savology for Advisors is a modern digital financial planning and financial wellness platform for financial professionals and their clients. Savology’s platform makes it easy for financial advisors and firms to provide game-changing financial wellness to employers, retirement plans, clients, and prospects with a scalable planning platform designed to reach new markets.

Who can use Savology for Advisors?

Savology partners with all different types of financial professionals, ranging in shapes and sizes from top 10 RIAs to individual financial coaches. Savology works with financial advisors, financial planners, financial coaches, CPAs, benefits brokers, insurance agents, and more.

Why use Savology for Advisors?

Savology helps financial professionals grow and scale in new ways. With Savology, advisors can access and succeed in two markets that traditional technologies and business models have not previously allowed.

Savology provides foundational financial planning tools for the middle market and scalable financial wellness programs through employers.

This enables advisors to find, win, and service more clients more effectively than ever before while making a meaningful difference with many of those who need it most.

Why consider Savology’s financial planning for clients?

Many firms compete to service the same households in the top 1-5% of income or net worth. Yet, all other households could benefit from some form of financial planning.

With the Savology platform, financial professionals can provide a client-led planning experience that can make it scalable and profitable to work with these additional households in ways that weren’t possible with traditional advisor technologies.

What is foundational financial planning?

Foundational financial planning (or foundational planning) refers to early financial planning geared towards those who need help getting started, setting a direction, and staying the course. It generally encompasses savings and income, assets and liabilities, risk management, and retirement outlook.

While foundational planning is holistic in nature, it focuses on those who are in the accumulation phase and is not the same as advanced financial planning which would likely include investment portfolio optimization and personalized tax planning.

What is financial wellness?

Financial wellness refers to an individual’s overall financial health. For us, this includes an individual’s actual financial situation, the direction they are heading, and their financial-related stress in the short term and long term.

Across the broader industry, financial wellness often refers to specific services, benefits, or programs that financial professionals typically provide through employers. Financial wellness can be provided as a standalone employer-sponsored benefit, as part of a corporate retirement plan, or as a free program to win more private wealth clients.

Savology for Advisors: Product

How do we get started?

Working with an account executive on our team, you can learn about the platform, see it in action, and decide which service level and customizations are right for you.

From there, most firms are able to implement Savology in 2 weeks or less, but some firms are live on day 1. Our onboarding process only requires a little effort upfront. You select a service level, sign an agreement, and provide some basic company information. Then you work with our onboarding team to configure the platform and then you are off to the races.

Ready to get started or book a demo? Schedule some time with us.

How are other advisors using Savology?

Advisors use Savology in a variety of ways depending on their specific needs or goals. Here are some of the most common use cases:

- Prospecting with the middle market or mass affluent

- Streamline consultations or onboarding

- Offering monthly financial planning or coaching subscriptions

- Adding financial wellness to win or retain corporate retirement plans

- Converting retirement plan participants to private wealth clients

- Providing financial wellness programs as an employer-sponsored benefit

- Servicing the children of current clients through planning and financial literacy

How do our clients get started with Savology?

There are a couple of main options to get your clients or prospects started with Savology.

The vast majority of plans are created with a self-serve or client-led approach. You can send them a custom invitation from the administrative platform or provide them with a custom link. This allows them to provide their information and build a plan on their own without requiring your intervention.

Alternatively, an advisor or administrator can take the lead in starting or creating a plan. The advisor provides any or all of the information needed to create a plan and optionally transfers it to a client to access, complete, or collaborate when ready.

What do our clients get with Savology?

Depending on your service tier (Advisor Standard, Advanced, or Premier), clients will gain access to different features and platform benefits. All plans, however, provide clients with foundational financial plans, holistic financial report cards, and personalized action items. You can also choose to include recommended providers from you and your firm, planning modules and calculators, and literacy tools or personal finance resources.

You can view a list of features on the Savology for Advisors page.

Does Savology offer integrations with other platforms?

Savology’s platform offers integration to improve planning workflow and your client experience. Clients can connect or aggregate bank accounts or other financial accounts to pull in real-time data from more than 16,000 financial institutions. This provides both you and your clients with a more complete and accurate picture of their financial lives.

Additionally, the Premier plan provides access to Savology’s Zapier API integration to connect and integrate with many existing third-party tools your firm is using such as Wealthbox CRM, Redtail CRM, Zoom, Gmail, Slack, and many more.

Can we brand or co-brand the platform?

The Savology experience can be co-branded with your company name and logo, which includes landing pages, the onboarding survey, custom invitations, and the client-facing planning platform.

With the Advisor Advanced or Premier tier, you can replace Savology’s logo for a more white-labeled experience. This will not change domains or remove references from Savology completely but it will bring your firm front and center.

And finally, there are additional options for branding or co-branding the platform with the logos of employers as well for a financial wellness benefit.

Can we see client data?

Savology does provide access for advisors to see client data such as their financial profile, financial calculations, report card grades, action items, user activity, and metrics. That access can be turned off for a firm when needed.

Within financial wellness programs through employers, advisors can still access user data but employers are prevented from accessing user financial data for the privacy and comfort of their employees.

What else can be customized within Savology?

Advisors often choose to customize their platform to meet the compliance requirements or other needs of their business. Several of these important customizations include:

- Branding or co-branding platform options

- Default planning assumptions

- Firm information, advisor bios, and display titles

- Custom products, services, and providers

- Available literacy courses and planning modules

- Action items that can be assigned

- Articles, guides, & resources for clients

Savology for Advisors: Pricing

How much does Savology for Advisors cost?

Savology offers three different service tiers, Advisor Standard, Advanced, and Premier, providing the flexibility to select the feature set and level of additional support that best fits those needs. The monthly license cost per advisor ranges from $70-$199 per month depending on the tier selected and the number of licenses purchased. Additional pricing options are available for firms or accounts that expect to have more than 50 administrative licenses.

Pricing options and a feature comparison can be found on the Savology for Advisors page.

Are there implementation fees or setup fees?

Each firm is assigned an onboarding manager to initially build, configure, and customize the platform to meet their needs. The onboarding manager also helps advisors get started successfully by answering questions, providing direction, and sharing best practices.

A setup fee allows Savology to provide the necessary services to help advisors be successful with their implementation and launch. These setup fees range from $100-$250 for the majority of firms, but Enterprise accounts may vary depending on size and complexity.

Do we have the option to pay monthly?

Yes! Monthly payment schedules are the most common arrangements with firms and advisors. This provides more flexibility in cash flow or budgets for smaller firms. There are, however, additional discounts offered for annual prepayment or longer-term commitments, which is often the preference of larger organizations.three

Savology for Advisors: Support

How do we learn more?

If you are interested in learning more about how Savology can help your clients improve their financial wellness, you can submit a request here and someone from our team will be in touch shortly to set up a call.

Does our subscription come with a dedicated account manager?

The Advisor Advanced and Advisor Premier tiers include a dedicated account manager that can help you get started, solve problems, and make the most of Savology. While Advisor Standard does not include a dedicated account manager, it still includes email support from an account management team.

As an existing client, where can I learn more about how to use the platform?

Savology has a Help Center for advisor clients. You can learn more about using the platform and find answers to other support questions at https://help.savology.com.

Savology for Advisors FAQs

Savology for Employers

Savology for Employers: General

What is Savology for Employers?

Savology for Employers is a financial wellness benefit that employers can provide to improve the financial outcomes and reduce the financial stress of their employees.

This financial wellness benefit includes digital financial planning, personal financial management tools, live financial coaching, and engaging financial literacy.

What is financial wellness?

Financial wellness refers to an individual’s overall financial health, which means the ability to manage financial-related stress and have control of financial situations or outcomes in the short term and long term.

Financial wellness as a benefit refers to an employer providing programs and resources to employees to help them improve their overall financial security.

Who is Savology for Employers for?

Savology provides this service as benefit to various employers across the United States, ranging from small businesses with 25 employees up to large companies with up to 10,000 employees.

In particular, Savology works with many companies in the following industries: technology, finance, professional services, healthcare, education, transportation, manufacturing, energy, and more.

How is Savology different from other financial wellness offerings?

Savology focuses on holistic financial planning for financial wellness, not just literacy or investment management. Savology combines financial literacy, actionable recommendations, and ongoing professional support in a manner that is accessible and personalized to each one of your employees. In just minutes, employees get a financial plan, holistic report card, personalized action items, financial planning modules, and much more.

Why should employers consider offing financial wellness?

Providing financial wellness for employees is a win-win. As employees decrease their financial stress and improve their financial outcomes, they are more productive, miss fewer days of work, are more engaged at work, and stay with their employer longer.

Recent studies have shown that nearly 90% of employees want their employer to provide some type of financial planning or wellness benefit. Employees are more likely to consider new jobs that offer financial wellness programs. So overall, an effective financial wellness solution can improve a companies bottom line.

Why do employees need a financial plan?

A financial plan is one of the key components to achieving short and long-term financial success. Households with financial plans are 2.5x more likely to save enough for retirement, and individuals with financial plans feel 83% better about their finances after just one year. This plays a critical role in and should serve as a baseline of financial wellness.

What if we already have a financial advisor?

It’s okay if you already have a financial advisor that works with your employees or retirement plan. Most of these advisors don’t provide holistic financial planning or financial wellness directly to your employees as part of their corporate retirement planning services. Savology’s financial wellness platform is complementary and can further enhance the advisors value. And in many cases, the advisor can also use Savology’s platform to better connect with and help employees with their money.

Savology for Employers: Product

How do we get started?

Most employers are able to provide their employees with our customized financial wellness platform in 2 weeks or less. Our onboarding process requires very little effort upfront – you provide some basic company and employee data, work with our Success team to determine a game plan for rollout and communications, and then leave it up to our team to do the rest and get things started.

To get started, you will need to talk to one of our account executives. You can reach out to request a demo here.

How do our employees sign up?

Employees will need to sign up using one of the company’s custom links provided by Savology in order to properly be associated with the company and receive all of the platform’s benefits. Alternatively, you can send custom invitations to your employees directly from the administrative platform.

What do our employees get with Savology?

When signing up for Savology, employees get a custom financial plan, holistic report card, personalized action items, access to financial professionals, live credit scores, financial management tools, literacy courses, and much more. Savology provides the primary tools and resources needed to help employees reach financial security.

Can our employees speak to someone about their financial plan?

Not every unique situation or financial question can be answered through technology alone. Employees have access to personal chat with Savology Plus to help them navigate the platform and understand their plan. For additional guidance or coaching, employees can schedule one-on-one calls with financial professionals at no additional cost on the Pro tier.

Does Savology integrate with the other employee benefits that we offer?

Employers will provide information on existing benefits in order to implement custom employer activities, providers, and recommendations into the platform. This encourages employees to review and take advantage of the other employer-provided benefits that relate to their financial plan and situation. This usually won’t require any technical integration, but still provides the value.

Can we co-brand the platform?

The entire experience can be co-branded with your company name and logo, which include custom invitations, landing and information pages, initial onboarding survey, and the employee platform.

Can we see employee data?

Your employees’ personal and financial information is secure and private to them. Internal employer administrators can only see the names and email addresses for those who have signed up, but will have access to aggregated reporting and metrics in a non-personally identifiable manner.

Does Savology provide additional financial literacy resources?

The Savology platform includes targeted financial literacy resources for each employee’s unique situation. This includes engaging tools and resources such as literacy lessons, live webinars, learning modules, articles from financial professionals, surveys, calculators, and more.

Savology for Employers: Pricing

How much does Savology cost?

Savology has different service tiers to accommodate to each employer’s needs, budgets, and employee financial situations.

Savology Pro is the most popular option though with typical ranges between $5-$10 per employee per month depending on the total number of employees.

Are there implementation fees or setup fees?

Savology does not charge setup or implementation fees for most employer financial wellness programs as long as there are not advanced customizations, integrations, or enterprise solutions. This helps makes financial planning more accessible to every-day American workers.

Do we have the option to pay monthly?

Yes! Monthly payment schedules are the most common arrangements with employers. This can provide flexibility in cash flow or budgets. There are, however, additional discounts available for annual commitments or pre-payments, which are often the preference of larger organizations.

Are there any extra costs to work with financial professionals?

On both the Plus and Pro service tiers, employees get access to either chat with or schedule calls with financial professionals at no additional cost. These interactions can help employees get started with the platform, set goals, ask questions, review their plans, and more.

Savology for Employers: Support

How do we learn more?

If you are interested in learning more about how Savology can help your employees improve their financial wellness, you can submit a request here and someone from our team will be in touch shortly to set up a call.

Are employees’ plans supported by financial professionals?

Depending on the selected service tier, employees will have ongoing support for their account and financial plan. On Savology Plus, employees will have access to live chat through the platform. With Savology Pro, employees will have ongoing chat support and one-on-one calls with financial professionals to keep them accountable and accelerate progress.

Does Savology provide investment advice for my employee?

While often confused, traditional financial planning is different from investment advice. Savology does not provide specific investment advice to employees, but research shows that building better financial habits around saving more, saving early, and saving consistently are much more impactful to retirement outcomes than specific investment allocations. For that reason, the focus is more on changing behaviors through financial planning and goal setting.

Investments, however, are still important to many people. So Savology partners with some industry-leading providers that can help employees manage investments through their proprietary technologies when needed.

Savology for Employers FAQs

Savology for Individuals

Savology for Individuals: Direct Plans

Does Savology offer a direct plan for individuals?

Savology is on a mission to make the benefits of financial planning and wellness more accessible and affordable. The vast majority of this is accomplished through relationships with employers and advisors, helping their employees or clients improve their finances.

In the past, Savology offered some financial plans and premium subscriptions to the public, but now only provides new access through employers or financial professionals.

How can I access my financial plan or financial wellness account?

Those who have already created an account can log in to view their plan, manage their finances, or improve their financial literacy here.

Those seeking to build a new plan or create a new financial wellness account will need to be invited by an authorized employer or financial professional.