Literacy courses

We provide lessons on a variety of beginner and advanced topics including budgeting, credit, insurance, HSAs, and more.

Live webinars

Each month we host live webinars with financial professionals and discuss important financial subjects.

Provider reviews

A frequent question we get is which financial providers are best. We unbiasedly review and recommend the best platforms to make it easy.

Financial coaches

You can meet with a financial coach to help you work through your financial plan and answer general or specific financial questions.

Expert guides

We create expert guides on a variety of money topics to educate and provide recommendations to improve your financial standing.

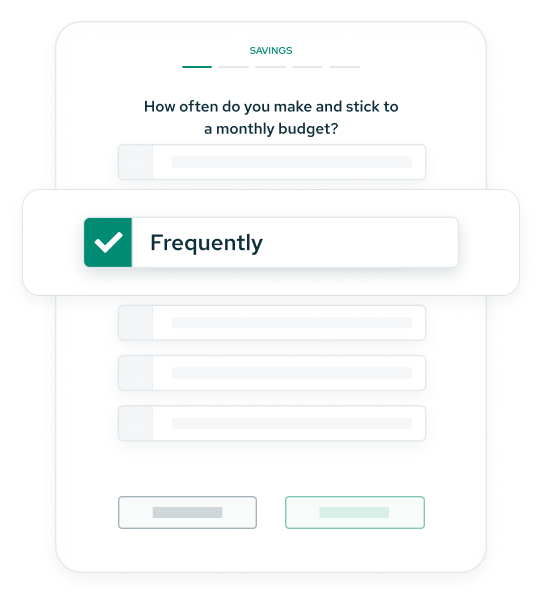

Planning modules

Whether you need help planning your budget, paying off debt, or something else, Savology planning modules help you take action.