Next level financial wellness and planning technology

Provide game-changing financial wellness to employers, retirement plans, clients, and prospects with a scalable planning platform designed to reach new markets.

The #1 financial wellness platform for financial advisors

AUM of Partner Firms

$470B+

Advisor Partners

1050+

Reach and service new markets

Savology helps financial professionals access and succeed in two underserved markets.

Deliver foundational planning

to the middle market

- Prospect more efficiently with middle market and mass affluent households

- Streamline the consultations, onboarding, and servicing of new clients

- Provide subscription-based planning or coaching services

Provide financial wellness

through employers

- Provide corporate financial wellness programs or benefits through employers

- Win more corporate retirement plans by providing a differentiated service

- Find new private clients by prospecting through large groups of employees

Deliver foundational planning

to the middle market

- Prospect more efficiently with middle market and mass affluent households

- Streamline the consultations, onboarding, and servicing of new clients

- Provide subscription-based planning or coaching services

Provide financial wellness

through employers

- Provide corporate financial wellness programs or benefits through employers

- Win more corporate retirement plans by providing a differentiated service

- Find new private clients by prospecting through large groups of employees

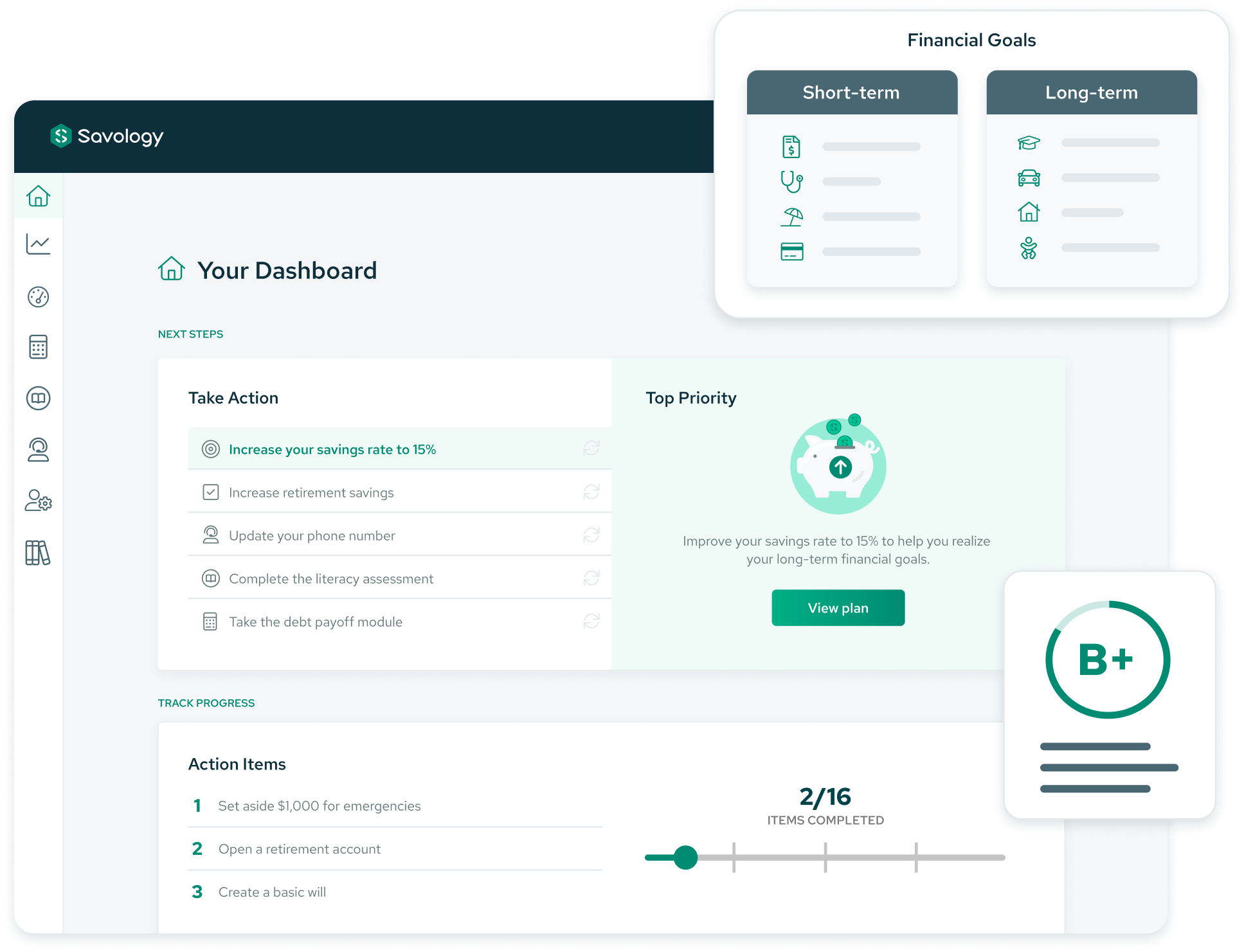

A client-led financial planning experience

Equip your firm with the right technology to deliver the value your clients need.

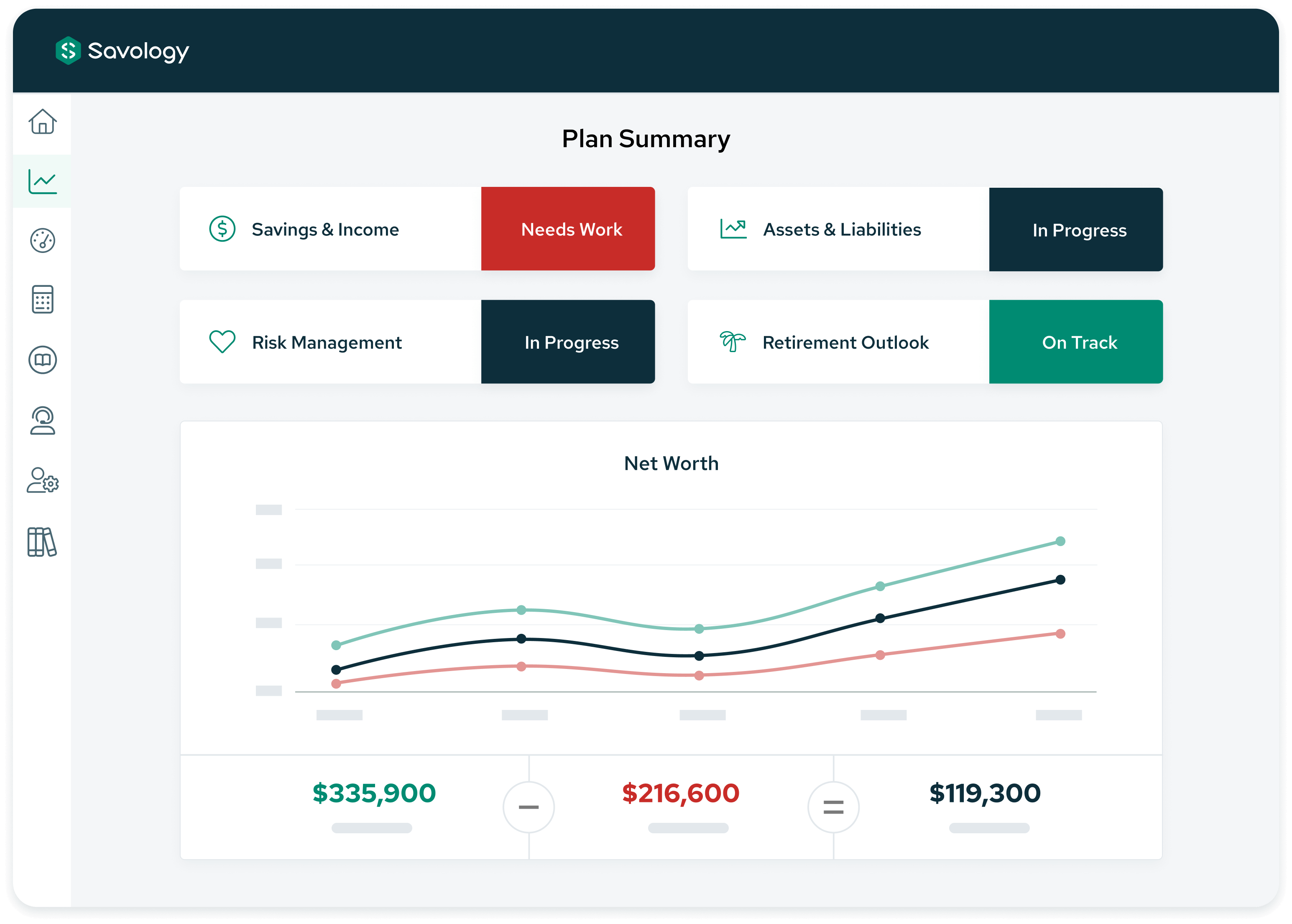

Foundational financial plans

Clients get customized plans with retirement projections, net worth tracking, savings rate analysis, risk management, and more.

Personalized action items

Each plan prescribes specific next steps and individualized recommendations to make significant financial improvements.

Planning modules and calculators

Clients manage finances and enhance planning with tools for debt payoff, goals, subscription tracking, and budget analysis.

Holistic financial report card

Measure financial wellbeing and duress with personal grades across 10+ categories like savings, debt, and insurance.

Custom recommended providers

Clients discover other featured products or services you provide to help them make meaningful progress on their plans.

Literacy tools and resources

Empower clients to improve their financial knowledge with effective resources such as lessons, quizzes, articles, and surveys.

A modern financial wellness platform for innovative advisors

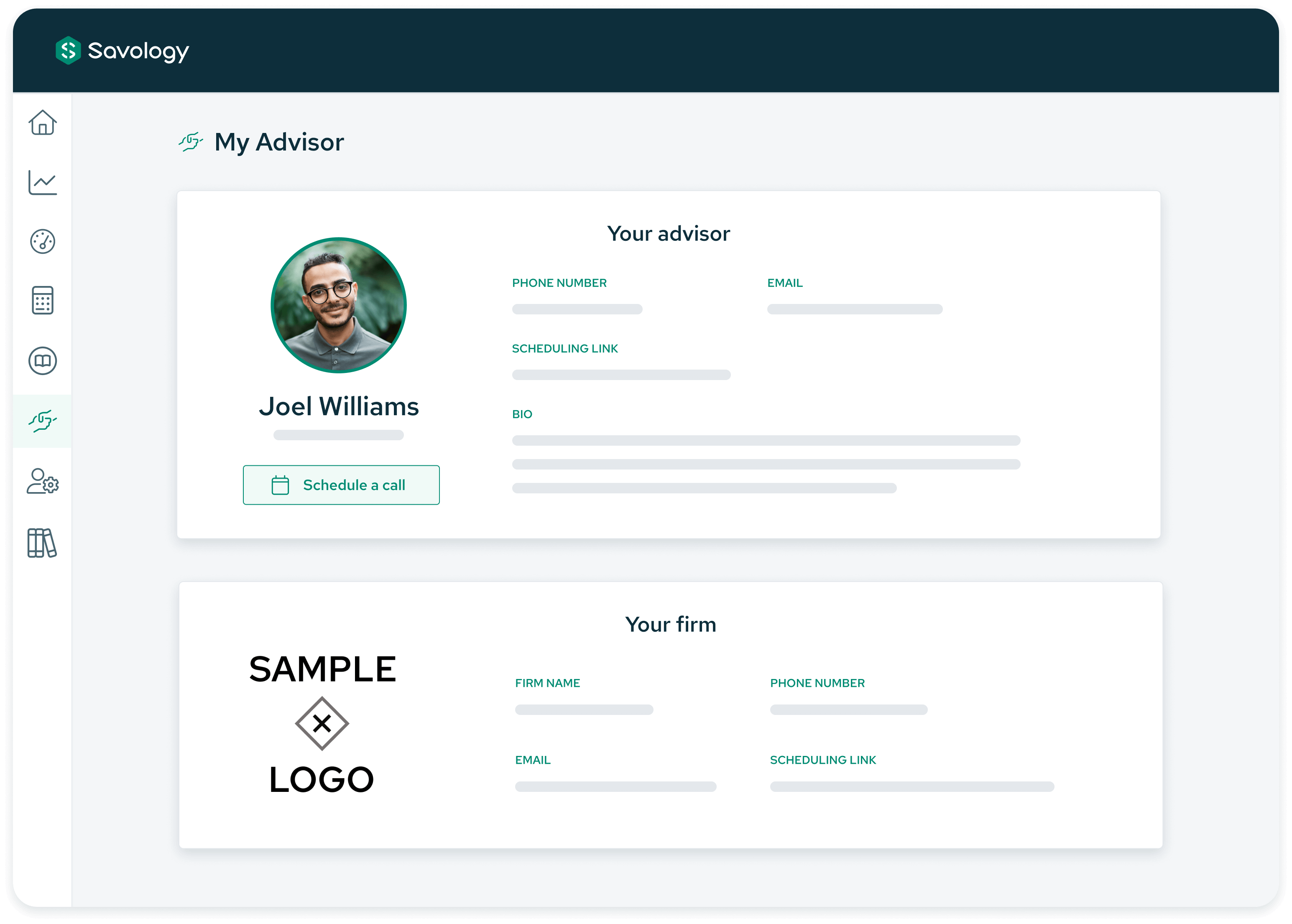

Savology works with financial professionals to provide solutions that make a meaningful difference for more people.

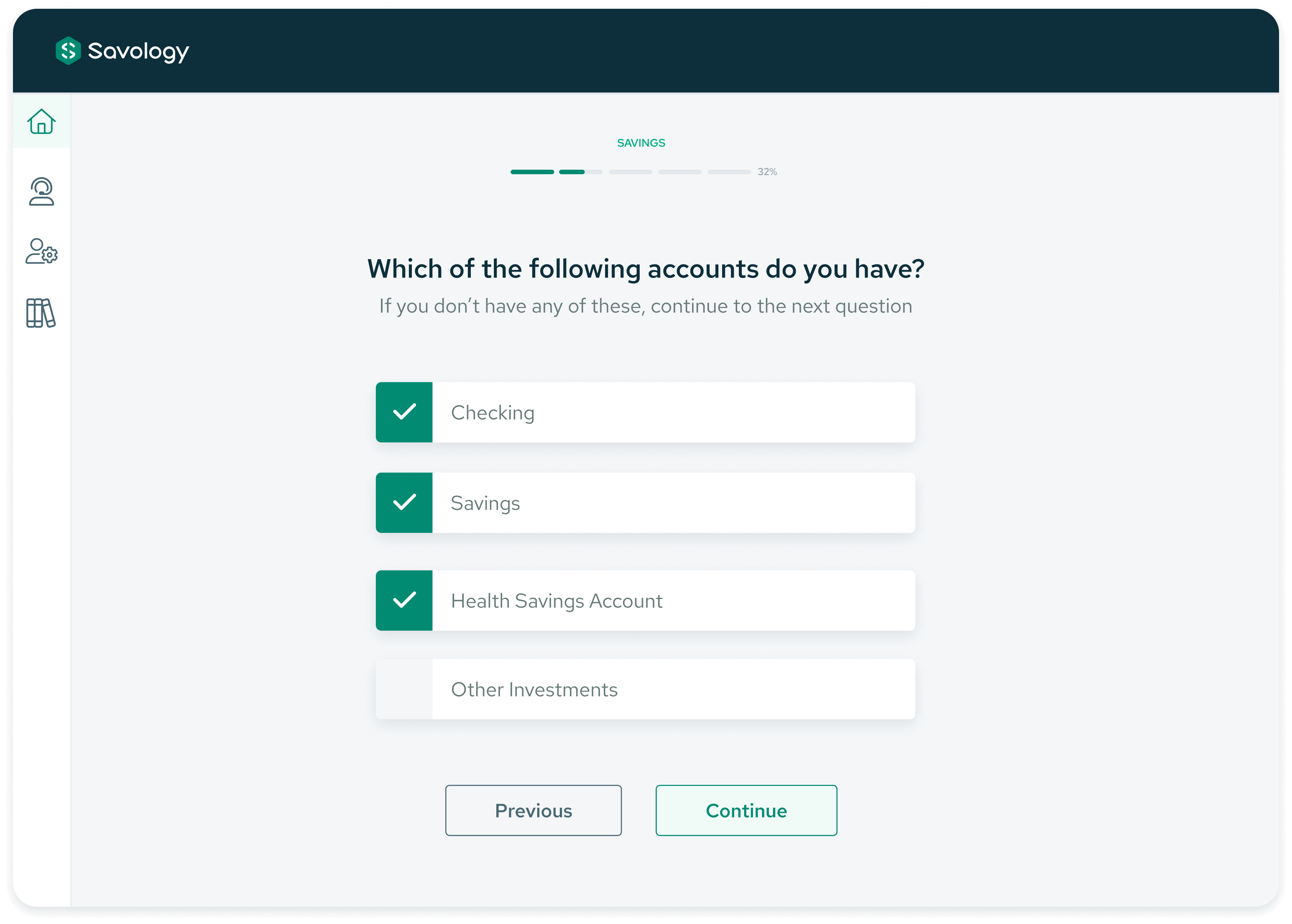

Digital onboarding and prospecting

Savology tools and surveys help advisors gain valuable financial information from clients and prospects.

Foundational financial planning

Client-led planning technology makes it possible to work with more clients throughout their financial journey.

Subscription-based planning and coaching

Create new revenue streams with subscription-based planning or coaching using Savology.

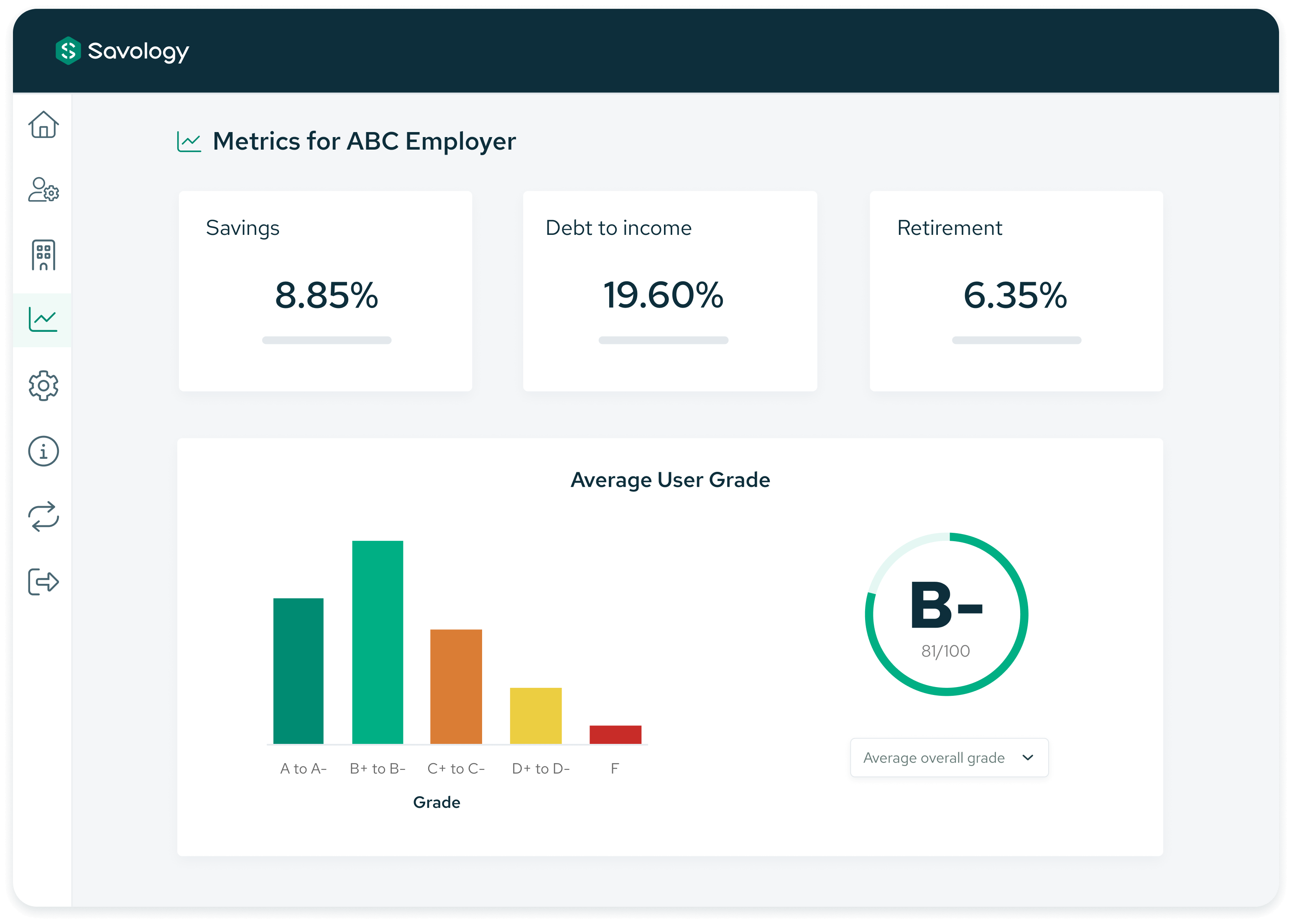

Financial wellness services for employers

Win new business by providing financial wellness services through employers of all shapes and sizes.

Invest in your success

Flexible and affordable packages help you maximize your return on investment.

Standard

-

Onboarding financial survey

-

Digital & printable financial plans

-

Report cards & action items

-

Retirement projections

-

Net worth, savings rate, & debt

-

Core planning modules

-

Literacy courses & assessments

-

Duress and risk scores

-

Social financial comparisons

-

Custom planning assumptions

-

Basic user groups

-

Activity metrics & reporting

-

Admin help center

Advanced

-

ALL STANDARD FEATURES +

-

White-labeled platform

-

Employer & prospecting groups

-

Risk tolerance module

-

User audiences & exports

-

Bulk activities & automations

-

Prospecting starter plans

-

Custom product providers

-

Linked content resources

-

Advanced admin roles

-

Free guardianship nominations

-

Additional user add-ons available

-

Dedicated account manager

Premier

-

ALL ADVANCED FEATURES +

-

Unlimited user groups

-

Account aggregation for 100 users

-

Premium employer organization

-

Platform integrations

-

Preferred firm for referrals

-

Additional user add-ons available

-

-

-

-

-

-

Optional add-ons

Incorporate additional products into your subscription to maximize the user experience.

Account aggregation

Connect user financial accounts with MX to increase planning accuracy, incorporate transactions and investment holdings, and keep plans updated.

Credit scores

Integrate an Experian credit report, credit score, debt analysis, credit alerts, and simulator tools for more user engagement and value.

Premium employer organizations

Customize the experience with premium employer organizations to include advanced branding and settings and company-sponsored benefits.

Live chat support

Provide an elevated support experience by enabling users to engage with live chat and get real-time assistance and immediate answers to inquiries.

Ready to scale with Savology?

If you are interested in learning more about how Savology can help you grow your business and help your clients, fill out the form here and someone from our team will be in touch to set up a demo.

This comprehensive white paper empowers financial professionals to unlock the vast potential of the overlooked middle market. In this guide, you’ll discover how serving this market can benefit you, common mistakes to avoid, and varioius business models or technologies you can use to succeed.

Frequently asked questions (FAQs)

Savology helps financial professionals grow and scale in new ways. With Savology, advisors can access and succeed in two markets that traditional technologies and business models have not previously allowed.

Savology provides foundational financial planning tools for the middle market and scalable financial wellness programs through employers.

This enables advisors to win and service more clients more effectively than ever before while making a meaningful difference with many of those that need it most.

Advisors use Savology in a variety of ways depending on their specific goals.

- Many advisors use Savology for prospecting and onboarding with the middle market or mass affluent.

- Advisors create new revenue opportunities by offering financial planning or coaching subscriptions.

- Others use Savology to work with employers as part of a financial wellness program or corporate retirement plan.

Savology works with all different types of financial professionals, ranging in shapes and sizes from top 10 RIAs to individual financial coaches. Savology works with financial advisors, financial planners, financial coaches, CPAs, benefits brokers, insurance agents, and more.

Savology is approved for use by numerous top RIAs and several Broker-Dealers. Savology is always looking to expand this list, so if it is not already approved for use by your compliance team, Savology can work with them directly to gain the necessary approvals for you to use it.

Most firms are able to implement Savology in 2 weeks or less. Our onboarding process only requires a little effort upfront – you select a service level, provide some basic company information, work with our onboarding team to configure the platform, and then you are off to the races.

If you are interested in learning more about how Savology can help your firm access and succeed in new markets, you can schedule a call or submit a request above.