In November of 2016, my wife and I had a combined total of $262,000 in student loan debt. Truth be told, earlier that year the number was just north of $300,000, and at its peak, over $310,000.

Yet, as I sit here and write this post today, we are proud to share that as of July 2020, we are 100% free and clear of our student loan debt!

I won’t lie to you, it wasn’t always an easy journey becoming debt free.

There were bumps along the way and factors that played against us, but also helped us (like having a low cost of living). We said the magic two-letter word “No” to just about everything and anything most millennials typically enjoy.

Our commitment to becoming debt free meant a smaller wedding, no honeymoon, delaying on starting a family, sometimes eating really weird stuff, and downgrading just about every aspect of our lifestyle until we achieved student loan debt freedom.

That being said, I can hands down say it was 100% worth the effort, and today I aim to share how we did it and why working to debt freedom is worth the price!

Our $300,000 Student Loan Problem

When I first met my beautiful wife and she told me she was going to be a Doctor of Physical Therapy, I knew I had hit the jackpot in more ways than just one.

My wife had the looks, the smarts, the athleticism, the soon-to-be a career as a DPT, and how could I forget… she was set to have over $275,000 in student loans when it was all said and done.

Truthfully, it didn’t really occur to me that student loan debt would one day be a problem for us. Prior to getting married I always just thought my $40,000 in student loans was mine, her $275,000 was hers.

However, that all changed when we got engaged and realized two things:

- When married, the ‘what’s yours is mine and mine is yours’ thing applied to debt too

- Marriage is also spelled T-E-A-M, in other words, getting on the same page financially was vital

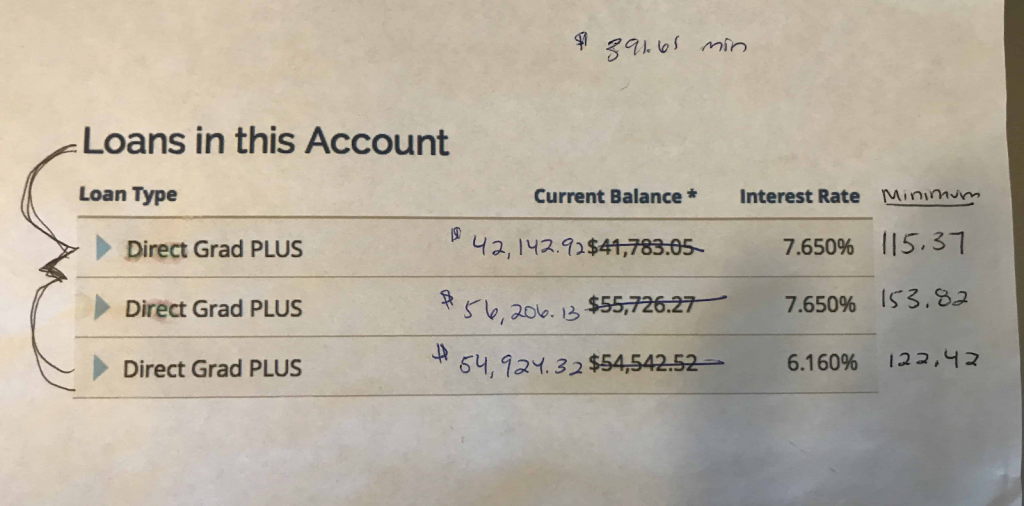

So, in February 2016, with our wedding just five months away, we made the decision that we would pay off all student loans (this is a screenshot from each year (3) at grad school alone from February 2016):

Recognizing that we needed to do something, we met with a financially savvy couple who helped us understand how interest worked and gave us some recommendations to knock out:

- My roughly $18,000 in student loans (originally $40,000)

- Lauren’s graduate school loans over $160,000

- Lauren’s undergrad student loans over $100,000

Here are the steps we took next to pay off our student loans in 4.5 years:

February 2016: A whopping $300,000

As previously mentioned, 2016 was the year we decided we would start our journey to becoming debt-free, the best decision we have ever made.

Becoming debt free starts easier than you might think: You simply make the decision.

We first created an emergency fund by combining our existing savings accounts. This is a vital first step in paying off debt so you can avoid having to take out debt in case of an emergency (which ended up happening in 2018 and 2019).

Next, with decisions comes commitments to stick to your plan. We made a commitment to no longer travel to distant weddings, have a smaller wedding for ourselves, agreeing to wait for kids/honeymoon, and beginning to cut out all extra spending.

Simply combing through our budget helped us generate just over $1,000 a month which we could now dedicate to our student loans. Personally, we had little to no issues saying no to trips, saying no to going out on the weekends, and limiting eating out.

^^ This is where I see most people struggle when striving to stretch towards their financial goals so here are a few tips that most “How to pay off student loans” articles forget to mention:

1. Avoid the Comparison Game

Look, in 2020 and beyond social media is rampant and here to stay. This is both good and bad depending on how you look at it.

If every time you sign on to Facebook you see babies, trips, and friends going out – that can impact your ability to focus and stay the course. However, on the flip side, if you can avoid these natural inclinations to compare yourself, well you can stay focused easier.

Additionally, when you’re paying off debt sometimes you feel like you might be taking a step back in society. I know when all my friends got new SUV’s and I still had my beater, I felt a little disheartened.

But I just kept reminding myself that it was worth the price to achieve debt freedom!

2. Associate with supportive people

Similarly to not comparing yourself, you will want to avoid friend groups and social circles that do not support your goal.

Remember, other people’s opinions don’t pay the bills. Regardless of what people think of your goal, either they support you or they don’t. This might seem a bit extreme but logically think about it.

If one of your friends constantly pressures you to go out and spend money every time you get together, they’re not supporting your goal. Communicate to them your goal and let them know you’re serious about getting out of student loan debt.

What you will quickly learn is that it’s really not a big deal and there are plenty of fun things to do for free!

“Those who mind don’t matter, those who matter don’t mind”

~Dr. Seus

3. Recognize it’s temporary

I hear this quite often, “I don’t know if I can make those commitments to become debt free.”

In life there are two ways of looking at things, we are either WILLING to do something or we are NOT WILLING to do something.

Oftentimes we are not willing to do something because we are usually comparing past experiences to future expectations. This can sometimes mean we are afraid to commit to ourselves.

When it comes to student loan debt, this means you have to recognize that the sacrifices you might have to make are short term.

I will share with you this. Now that we are debt-free having $6,000+ each month to invest, travel, save – do whatever really – is amazing. But, had we not made some short term sacrifices, we would have never come close to that number!

November 2016: Down to $262,000

This month is worth specifically noting for several reasons. Prior to November of 2016, we were paying off any and all small balances that were eating up our cash flow.

My car, Lauren’s car, our wedding savings (we were now married at this point), my student loan, and some of her smaller student loans from undergrad were all paid off at this point. By doing this, it allowed us to take as much money as possible to concentrate on ONE student loan at a time.

Additionally, this happens to be the same month we were introduced to a unique strategy where we leveraged the equity in our home to pay down the high-interest grad school loan principals.

While I do not recommend this for everyone, it is worth noting that leveraging a HELOC was one of the strategies we used in conjunction with the debt avalanche (knocking out high-interest loans first). I am not an advocate for a one size fit’s all plan. I only share this so people understand how we did it.

Leveraging equity in your home to pay off your debt in another area isn’t geared for everyone. Use the shopping cart approach when it comes to money and take what helps you the most, read up, and keep in mind that personal finance is always personal – so stick with your plan!

2016 highlights and points to note:

- Made the decision & commitment to each work as a team

- Eliminated all fluff in our budget (apps, gym, eating out, travel)

- Paid off cars and my student loan first to have as much money as possible

- Created an emergency fund that was 3 months and some

December 2017: Now around $200,000

By leveraging the aforementioned HELOC to help rapidly increase the principal pay down on student loans, 2017 was the year things really started to roll for us. By the end of 2017, we were finally breaking into the “100’s” as it pertained to how much we owed in student loans.

One of the reasons we were so determined to knock out our student loans was because of the annual interest charges. Even though we paid off a significant chunk of our student loans, we had $17,000 in interest charges in 2017 alone.

To put it in perspective, for every $3,000 we paid towards student loans, $1,200 went to the bank. That is like rolling down the window and just tossing $1,200 out the window (at least that is how it felt) every time we made a student loan payment.

Knowing this, we actually became more motivated to knock out our student loans.

That summer we started Money Life Wax to help supplement some income long term, but also to inspire others to go for their financial goals. This leads to another valid point of note:

Figure out how to create more income:

Whether you work one overtime shift a month, start a blog, walk dogs, pick up a part-time job – it doesn’t matter, just keep in mind that an extra $500 a month can go a long, long way!

For us, this meant renting a room out in our home for $650 per month! This covered all the utilities and then some, which allowed us to throw more at our student loans!

I am not a huge advocate for working multiple jobs long term simply because it can be stressful, but I am an advocate for doing what you got to do at the moment. Cutting expenses is very, very important when you’re looking to pay off your student loans.

However, if 1A is cutting back on your spending, 1B is looking to make sure you figure out how to make extra money.

This is also a blessing. Our journey to create more income has made us very creative and we now like to teach others how to pay off debt and make more money!

Highlights and points to note:

- Started Money Life Wax in September 2017

- Counted and focused on every dollar

- Made extra monthly payments each month towards ONE specific student loan at a time

- Lived 100% off my salary, committed 100% of Lauen’s salary to debt

December 2018: Sitting at $130,000

When it came to paying off student loan debt, 2018 was our year. When it was all said and done we managed to pay off over $70,000 in 2018 alone.

Much of this success in 2018 can be attributed to a few things:

- We had basically streamlined almost our entire life to make sure we were paying off debt at a rate of $5,000 to $7,000 per month.

- This meant reducing our living expenses to extreme lows, something we made a conscious decision to do (remember do what you’re willing to do and run your race)

- I had purchased a plot of land with my brother some years prior that we sold, which allowed us to take the net profits and throw at our student loans

- Finally able to refinance our student loans

Refinancing student loans:

The most common advice we heard from just about everyone when we started paying off our student loans was to simply “Refinance your student loans.”

While this is not necessarily bad advice in itself, for us it was not the right answer, in fact it would have been detrimental to our financial future.

By refinancing with a private lender, you are consolidating all of your loans into one, removing your loans from federal perks, and oftentimes getting a better interest rate. This is usually a good move for most, however, not for us.

With so much in student loans, consolidating close to $300,000 in student loans when we started would have hurt our ability to target specific loans one at a time, and two, we would have lost income-based repayment.

IBR, or income-based repayment, is a federal perk that allows student loan borrowers to make payments based on their income. In theory, it’s a good idea but it can sometimes hurt borrowers. Hence, when you see those people who have loans increasing even though they’re paying.

However, if used properly you can pay IBR on some loans while making extra payments on targeted loans to quickly pay down one at a time. This might seem complex but it’s really simple, you take as much cash flow as possible and pay off one specific student loan at a time.

By refinancing, we would have lost the ability to do this, so we waited. Once we got our total balance below $150,000, we refinanced the remaining portion of Lauren’s grad school loans ($83,000). This would save some money in interest and we were at a point where we could absorb the loss of federal loan perks.

Highlights and points to note:

- Refinanced once it made sense, it’s not a one size fits all.

- Sold land I co-owned and used net profits to pay down loans.

- Successfully paid off over $70,000 in student loan debt principal

December 2019: $73,000 left to go!

If 2018 was our best year, 2019 was most likely our worst, but this was prior to what 2020 had to offer.

All jokes aside, it started off with us making the decision to no longer rent a room out in our home. We were in our 30’s and we need personal space back. With our roommate moving for a new job, it just made sense to no longer rent the room (I begrudgingly still wanted to at times).

Then March happened.

Two days after my 32nd birthday, my wife came home to find what she thought was brownie batter all over the house. Smelling like Charlie’s Chocolate Factory, my wife found our chocolate lab, Morgan, on the couch panting, covered in cocoa powder.

She had gotten into the pantry and decided she was going to make some brownies evidently. This would turn out to cost us $4,300 because she had eaten so much cocoa powder she legally overdosed (in dog terms).

Three days at the emergency veterinary hospital and ton’s of medicine later, we had our dog home and an emergency fund that was now $4,300 less. We made the choice to take April’s student loan money and replenish our emergency fund, which set us back a month.

We still managed to pay off somewhere around $60,000 in 2019, but there is a vital point to hit on:

Life happens.

No matter what your goals are in life, something will pop up that will distract you. This can be a financial distraction, a family distraction, a work distraction, even a good distraction, but nonetheless, along the path, we will always have distractions.

The point is that you can’t avoid distractions and life happenings. However, you do decide how you navigate those distractions and stay the course.

After the dog incident my car, a 6-speed, rolled into the neighbor’s car and I had to pay insurance costs. We were three years into our debt-free journey and the excitement was beginning to wear off.

However, halfway through 2019, we broke the six-figure barrier and that gave us a kick-start to get the job done.

Highlights and points to note:

- Our dog ate chocolate. Had to pay $4,300 in veterinary bills, thank you emergency fund.

- No more roommate, pay raises, and marketing company helped with supplemental income

- Life will happen, so it’s better to dig your well before you’re thirsty and plan ahead

July 2020: Student loan debt free!

Aside from the absolute craziness that 2020 has brought us, overall, we are blessed to say that financially 2020 has been a great year.

While we recognize that this is not the case for everyone, 2020 has confirmed our thoughts that it is better to prepare than it is to repair. We weren’t asking for economic hardship, we just paid off our debt as if it would inevitably happen.

Like you, we just didn’t know it would come in the form of a worldwide pandemic.

This goes back to our initial purpose for getting debt free though. It wasn’t so much a matter of if something would happen, but more so a matter of when. While we couldn’t predict the future, after seeing parents struggle financially (I lost my mom to cancer in 2012) we knew it was vital to eliminate all unnecessary financial stress.

For us personally, this meant debt.

Even though we needed to make a new car purchase, by 2020, we were pros at paying off student loans. We had months when we were knocking out upwards of $8,000 off in student loans. Which was crazy to think about considering that prior to 2016, in 2015, I sometimes only had $300 to my name due to reckless spending and over-leveraging myself.

We adopted the mindset that frugal living was going to be a temporary state and truth be told, after meeting with our planner in June, he recommended we roll our remaining student loan balance into our mortgage and start saving/investing.

This meant that as of July 9th, 2020, our wedding anniversary, we were officially student loan debt free!!!!

Many asked how it felt, and truth be told it really wasn’t that big of a deal. Things we had been delaying like a kitchen table and a new computer were nice to purchase, but our financial habits had been so engrained we really just kept rolling as if we had debt.

The only adjustment was taking 50% of our extra money to save/invest, the other 50% to pay down our mortgage.

Highlights and points to note:

- Had to purchase a used (new to us) car in January, paid in cash

- Rolled the last $20,000 of the student loans into our mortgage (the numbers justified this move)

- Officially became 100% debt free outside of our mortgage in July of 2020

Final word

You can do it.

It is cliché and somewhat cheesy, but you can do it. Whatever your financial goals are, adopt the mindset that you can, and you will always figure out how.

I routinely write about how we as humans suffer from “Paralysis by Analysis,” in that we often overthink our goals. Having a plan is a start, but taking the steps to execute is how you put things in motion.

If you’re someone who has trouble starting things, or perhaps, you have trouble finishing, try, and work the problem backward. For example, if debt freedom is your goal, think about what you will get at the end of that. Next, align some action steps that are small stepping stones you can hit in the next 90 days.

Hit a goal, briefly celebrate, reflect, and reset your next 90-180 days. Routinely do this and you will see yourself really accomplishing some of your financial goals in a matter of 1-2 years.

Lastly, don’t get shortsighted.

This is easier said than done in our social media, digital world, but having a long term approach is vital to making really big things happen in your life. I am a firm believer that if you can simply have a 3, 5, 10-year game plan, you will really amaze yourself with what you can accomplish!

But remember, whatever it is you decide to do, just be sure to make sure it’s true to what you want to accomplish!

~Josh