Introduction

Financial professionals including financial planners, advisors, and coaches are primarily in the business of helping people. Many professionals report that as the reason they got into the industry in the first place and even more indicate that it is the primary reason why they are happy with their work. Yet, traditional business models that focus on serving high-net-worth households often limit the impact that a financial professional can have by largely leaving out the mass affluent and middle market.

The industry is evolving – impacting private wealth management and financial planning alike. Innovations in technology and business models are making financial advice and financial planning more accessible. In this guide, we will explore how financial professionals can effectively serve the middle market, addressing the needs of the market with different business models and tools to make it scalable.

The Middle Market

The terminology used across the industry is not always consistent. We frequently hear the terms middle class, middle market, and mass affluent used interchangeably to refer to those who could benefit from financial products and services but are not yet rich. For the sake of clarity, let’s define and differentiate these in terms of income, net worth, and investable assets:

Middle Class

This is primarily determined by annual income with approximate ranges from the 20th to 80th percentile of household income, which is approximately $35,000 to $150,000. By definition, this includes 60% of the adult population. Because this term focuses only on income and carries other social connotations, it is too broad and inappropriate for segmentation in the financial industry.

Middle Market

Households that make more than the median national income of approximately $75,000 and have investable assets between $50,000 and $1,000,000 are considered to be in the middle market. This term is used more frequently in the industry than the middle class because it includes a criterion for investable assets and excludes those from the 20th to 50th percentile of annual household income. This segment makes up about 35% of the adult population, including such careers as professors, managers, chiropractors, judges, psychologists, architects, electricians, truck drivers, nurses, analysts, realtors, and more.

Mass Affluent

Households that make 50% more than the median national income, which would be approximately $115,000 per year, and have investable assets between $100,000 and $1,000,000 are considered to be mass affluent. This segment makes up about 25% of the population, including such careers as engineers, physicians, sales professionals, software developers, accountants, veterinarians, business executives, and more.

HENRYs

A final term to examine is the segment for those who are often acronymized HENRY as High Earners, Not Rich Yet. These households have high annual incomes, doubling the national median – usually over $150,000 – but have not saved enough yet to be considered rich. This usually means they have investable assets less than their annual salary. Many HENRYs are still younger in age (<45) and are burdened by student loan debt. This segment makes up about 10% of the population, including such careers as dentists, physicians, and lawyers, particularly in their first few years of practice.

A Venn diagram containing each of these segments would show significant overlap between the circles but would also highlight the few key differences, primarily in investable assets and income levels. Considering the extent of overlap, we are going to refer to the whole segment or the combination of segments herein as the middle market.

Mistakes with the Middle Market

Some financial professionals have attempted or at least considered serving this large segment over the last thirty years. Many, however, have been less than successful as they make one or more of the common mistakes we have observed:

- Disregarding the market segment entirely

- Ignoring or misunderstanding the differences in financial needs

- Offering the same products and services

- Applying traditional business models

- Using the same technology platforms

We will provide additional information about and review recommendations for addressing each of these mistakes in more detail. We will inspect the size and needs of the market and different business models and technologies that financial professionals can use to better serve the middle market.

Why Serve the Middle Market

The size of this market alone is a reason for many financial professionals to consider serving these segments, but that certainly isn’t the only reason.

- Market opportunity: It is estimated that the market size by revenue of the middle market is just shy of $100B in annual revenue.

- Competitive landscape: Most financial professionals compete heavily for the top 2% of the market by wealth. The middle market has significantly less competition.

- Great wealth transfer: Baby boomers will pass down between $70 trillion and $85 trillion over the next 20 years, most of which will go to this market.

- Referral opportunities: A significant amount of business comes from word-of-mouth and referrals. Opening up the market to more clients means more word of mouth and the potential for more referrals.

- Client loyalty: Many people in the middle market will build more wealth over time and stay with the financial professionals who earned their business early on.

- Stability in economic downturns: Wealth in this segment does not fluctuate as much during recessions, providing additional stability to a financial practice.

- Developing associates: Financial professionals need to start somewhere, and it isn’t always easy to catch the big fish when just getting started. This market provides excellent training and development opportunities for early professionals.

- Technology adoption: The middle market is increasingly tech-savvy. In addition to being willing to adapt technologies, these clients can help drive the adoption of new technology trends that can improve efficiencies and experience in other areas their business.

- Ethical considerations: Serving a broader range of clients aligns with ethical considerations in the financial industry, promoting financial equity and inclusion.

- Personal satisfaction: Many financial professionals find increased satisfaction in helping individuals and families achieve their financial goals. Financial professionals can make a meaningful difference on a larger scale.

Overall, by serving the middle market, financial professionals can better position themselves for long-term success, building an innovative and resilient practice.

Needs of the Middle Market

In the early days of Savology, we surveyed the middle market to see what they truly needed. It was no surprise that they had different needs than the higher net worth markets. We found that they primarily wanted to be told how they are doing financially, what they need to do next, and how to do it.

Financial professionals can better meet the needs of the middle market by building their offerings around any of these four primary services:

- Foundational Financial Planning

- Financial Management

- Financial Literacy

- Financial Coaching

Although these clients may also need other products and services including asset management and insurance products to prepare them for the future, those are generally not the top priority, nor will they be what make the biggest difference, for them in the long run.

Foundational Financial Planning

At Savology, we have found that households with financial plans are 2.5x more likely to save enough for retirement. While that may not be the definitive indicator of financial success, it showed that having a plan can make a significant difference, especially if that is an appropriate plan.

The middle market needs foundational financial planning, which refers to a more fundamental level of planning focused on broad financial wellness, high-level goals, understanding financial concepts, and establishing good financial habits to progress in the right direction overall.

While a foundational financial plan is still a plan detailing one’s financial circumstances, financial goals, and strategies to achieve those goals, it has a larger emphasis on the early stages of accumulation with a high-level projection into retirement. It focuses on savings rate, debt management, and risk mitigation. It includes plans for cash flow, emergency savings, debt payoff, basic insurance needs, and early estate planning.

Foundational financial planning does not generally include tax planning, investment portfolio optimization, scenario modeling, or advanced estate planning. So a foundational plan should not require the same 5-10 hours of work that a comprehensive financial plan often does.

Financial Management

The middle market often needs more direction on how much exactly they should be saving and how they can achieve that savings rate. In other words, the financial management they need is directly related to budgeting and cash flow. Helping a client improve their savings rate by managing their money more effectively is one of the most important things that a financial professional can do early on to impact the client’s financial well-being. This often means identifying opportunities to improve income, decrease spending, and increase savings while developing healthy habits and financial discipline.

In the same way that there is not one right way to build a financial plan, there is not one right way to help clients budget. Some planners provide clients access to online budgeting platforms or interactive spreadsheets, others have clients fill out a simple worksheet or bring in copies of their recent bank and credit card statements to review. Regardless of how it is done, clients in this market are looking for support with proven structure, independent advice, and ongoing accountability.

Financial Literacy

Many adults are not as financially literate as they would like to be. They may have learned a thing or two about money from personal experience, but have yet to learn all the fundamentals of personal finance. They are often left with a foundation built on misconceptions, myths, and misinformation from social media.

The public education system hasn’t exactly helped in this regard, either. Less than half of states require some form of financial literacy in high school, which is certainly an improvement from the turn of the century when no states did. However, it means that many adults still struggle with financial literacy on key concepts. This market wants and needs to learn about the credit scoring system, the basics of taxes, the power of compound interest, different budgeting methodologies, behavioral finance, and so much more to improve their ability to manage their money and make good decisions.

Financial education can come in the form of pre-built lessons or courses, live education or webinars, one-on-one coaching, financial calculators, or other materials like videos and articles. As long as it accomplishes the primary goals of teaching clients about personal finance and improving their financial literacy, the method of delivery isn’t necessarily important.

Unfortunately, financial literacy on its own is not strongly correlated with financial success and long-term outcomes. But, when paired with other skills or resources like planning or coaching, it absolutely can make a meaningful difference in decision-making abilities and results.

Financial Coaching

Finally, one of the most impactful services that a financial professional can offer to the middle market is financial coaching. Financial coaching generally includes some form of the aforementioned financial planning, budgeting, and education to help clients manage their money, develop healthy habits, reduce financial stress, and make better financial decisions.

Financial coaching is effectively personal financial training, money therapy, and personal finance instruction combined into one programmatic service. As such, coaching can be done without significant technology involvement or it can be completely reliant on technology More than anything, financial coaching is about providing ongoing support, accountability, and professional recommendations.

Business Models for the Middle Market

When asked what hesitations financial professionals had in servicing the middle market, one of the most commonly cited reasons is that it can be harder to scale or service profitably. That would surely be the case with the careless application of the same service model that a traditional asset manager or financial planner uses for high-net-worth clients.

The revenue per client is indeed lower, but that doesn’t mean it can’t be lucrative or profitable with the right business model. Advancements in technology and more modern business models have enabled more financial professionals to service this market in a way that makes sense for the business.

Here are the most popular ways that we see financial professionals work with this market:

- Subscription-based planning

- Financial coaching programs

- Financial wellness through employers

- Asset management

Subscription-Based Planning

It is less common for prospective clients in this market to be willing to pay $2,500 or more out-of-pocket upfront for a financial plan. With that being the approximate median cost of a financial plan, financial professionals have found better ways to spread out the cost over time. Most clients in this market grew up in the subscription economy and often have disposable income to allocate to a worthwhile cause, which makes them more willing and able to subscribe to financial planning as an ongoing service.

This has led to the trend in the industry to provide subscription-based planning or coaching services in a variety of shapes and sizes. Some of the most common arrangements we have seen successfully offered to the middle market include:

- Planning lite: Billed monthly at $50-$75/month to spread out payments. Meet once or twice per year, usually virtually. Review total cash flow and prescribed actions. Answer ongoing questions. Provide other resources including literacy courses or budgeting tools.

- Quarterly engagement: Billed monthly at $75-$150/month with annual commitment. Meet once or twice per quarter. Emphasis on cash flow and high-level money management.

- Monthly engagement: Billed monthly at $150-$250 with annual commitment. Meet once or twice per month. Prepare budgets and review cash flow. Set and track goals.

- Annual planning: Billed annually at $1,000-$2,500/year. Prepare or revise the financial plan. Review taxes. This may include asset management for those without significant investable assets.

- Income-based planning: Billed monthly or annually at 1% of household income. Provide services relevant to the income level. Review taxes. Prepare or revise the financial plan. Review retirement contributions and investment allocations. This may include asset management for those without significant investable assets.

Except for financial coaches and the few firms that only work with the middle market, most firms create a subscription offering as a level of service that acts as an alternative to, not a replacement for, traditional or high-net-worth engagements. That way they have a level of service to sell to any client that comes in for a consultation and an invaluable pipeline for future high-net-worth clients as these subscribers improve their financial positions.

Financial Coaching Programs

Not all engagements need to be as open-ended as an ongoing subscription. Financial professionals have also found success in providing time-bound financial coaching programs. The intent behind these programs is to get a client to make systematic improvements throughout the engagement toward an end goal. This usually includes one or more live check-ins, some valuable planning or budgeting resources, and educational content like literacy courses, webinars, articles, or videos.

Many of these coaching programs are focused on budgeting or cutting expenses, paying off debt, planning for student loans, or some form of financial therapy for couples. On occasion, a program is focused more on financial education, but that is less common. Overall though, because coaching programs do not entail investment advice, licenses and registrations are not required, but some coaches still acquire certifications such as CFP™, PFS, CFC, and AFC.

- One-month coaching: $250-$500 billed upfront. Meet weekly for 60-90 minutes with homework assignments each time. 5-20 hours of prepared content and resources. Outline and create a new financial management system.

- 12-week or 90-day boot camp: $300-$750, billed upfront or divided monthly. An hour-long, monthly coaching call and 15-minute weekly check-ins. Provide templates and worksheets for budgeting and debt repayment.

- One-year coaching: Billed at $500-$1,500 for the year, paid upfront or monthly. Has an initial analysis of the financial situation and then intermittent meetings depending on price. Provides a different emphasis each quarter, starting with budgeting and saving, with options for debt, credit, investing, and retirement preparation in later quarters.

- Self-guided: Billed at $10-$30 per month. Provides access to online courses, resources, or other software. Does not include live coaching.

At the end of a coaching program, it is also valuable to have a plan for what to do with these clients. In some cases, that could be selling them into another product or service such as a follow-up coaching program, ongoing subscription, comprehensive planning engagement, or asset management arrangement if they are ready. In other cases, it might be referring them to another firm that can handle their specific needs.

Financial Wellness through Employers

One of the largest challenges in working with the middle market is distribution. Marketing or selling to targets with a lower average revenue per client may not always feel worthwhile unless you have a way to do so in bulk. While working through employers may not feel like an engagement directly with the middle market, it is certainly one of the best ways to access the middle market.

Financial wellness also happens to be an emerging trend in the industry, both with employers adopting it at an increasing pace and advisors looking to provide it more frequently. Financial wellness, in this context, refers to the provision of services as a benefit to employees, that are designed to improve the financial well-being, financial literacy, and financial outcomes of those who engage.

Employers are finding mutual benefit in this as well. As employees improve their financial well-being and decrease their financial stress, they are more engaged as employees, more productive at work, and more likely to stay with the company. This has been shown to produce a positive return on investment for employers that offer financial wellness services (CFPB, Enrich, PWC).

Financial wellness engagements vary as there isn’t one correct way to work with employers and their employees. Some of the successful options that we have seen include:

- Employer-sponsored financial wellness for all: Employers may pay $5-$15 per month per employee for a financial professional to provide financial wellness as a benefit for their employees. This may include some financial planning, personal coaching, and live education offered by the financial professional.

- Financial wellness reseller: Some financial professionals would prefer to have someone else provide the services. In that case, they can resell another company’s financial wellness services and get an ongoing commission or revenue share, if desired.

- Retirement plan value-add: Financial advisors who already service a corporate retirement plan may choose to add more value by providing some level of financial wellness on top of the base services. Some advisors increase their fee by 10-25% for doing so, others use it strategically as a free add-on to drive more loyalty, win more retirement plans, or convert plan participants into paying private wealth or planning clients.

- Seminars or education: Financial wellness services do not have to be ongoing, or long-term engagements. Some financial professionals find success in offering a seminar, or even a small series of lectures, through employers. Topics may include home buying, budgeting, investing, credit, taxes, or insurance. These can be paid or unpaid, but generally have an associated goal of identifying and attracting new prospects for the financial professional.

Asset Management

As previously mentioned, financial professionals will find it difficult to just provide the same services in the same way to this demographic as they do for wealthier clients successfully. But that doesn’t mean that some of the same services, including asset management, wouldn’t be worthwhile to provide at all. After all, billing on the assets of a middle-market client might only provide $500-$1,500 of revenue per year instead of the $5,000 – $10,000 that many advisors target per client.

Hundreds of thousands of B2B and B2C companies scale with average contract values of $1,000 per year, so there isn’t any reason why a financial professional could not as well with the right approach. When serving this market, spending less time per client is critical, maybe only meeting once per year, automating many communications, and having the majority of the assets invested on auto-pilot using another service model and custodial platform altogether.

Furthermore, this service is best provided as part of or in addition to another one of the aforementioned services. Although the mathematical model or pro forma might make sense on paper to provide asset management services to these clients, that doesn’t mean it needs to be the primary reason to do it. Generally, the goal is still to increase the value of the client over time, and as their assets grow, so will their total value as a client.

Technology and Tools to Serve the Middle Market

The right business model paired with the right technology can make all the difference when serving the middle market. Technology can improve efficiencies, margins, and scalability for the financial professional while improving value, experience, and loyalty for clients. Financial professionals should consider using technologies for financial planning, financial wellness, budgeting, and financial literacy to better accommodate or meet the needs of this market.

Financial Planning

Comprehensive planning software like eMoney and MoneyGuide Pro are great for serving the high-net-worth markets. Many financial professionals report spending 5 to 10 hours per client to build a comprehensive plan and a couple more hours to deliver it, which would not be scalable for engagements with values less than $2,500 and which might not meet the specific needs of the middle market.

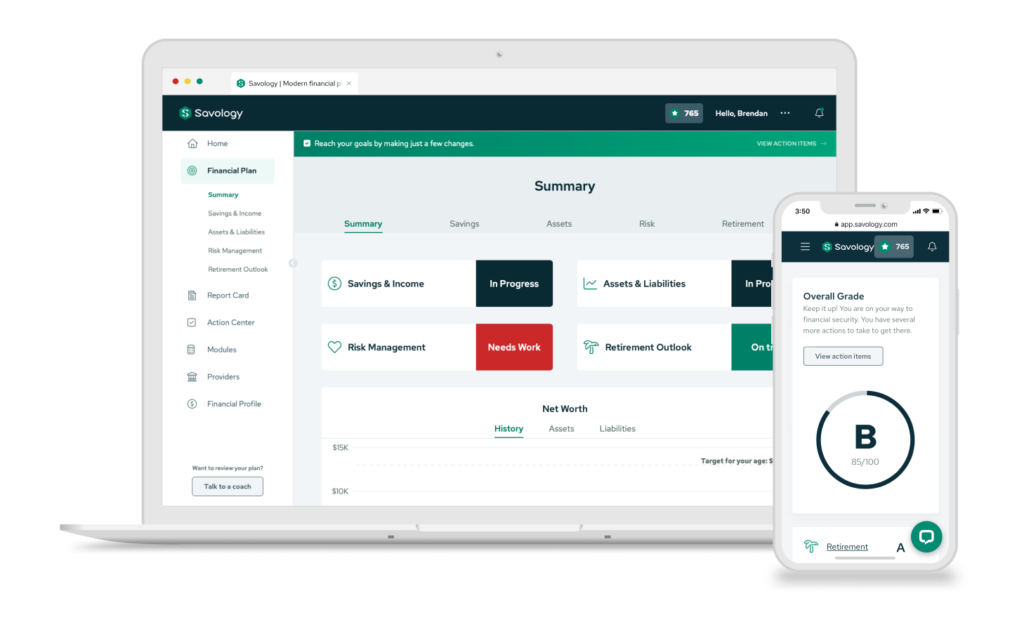

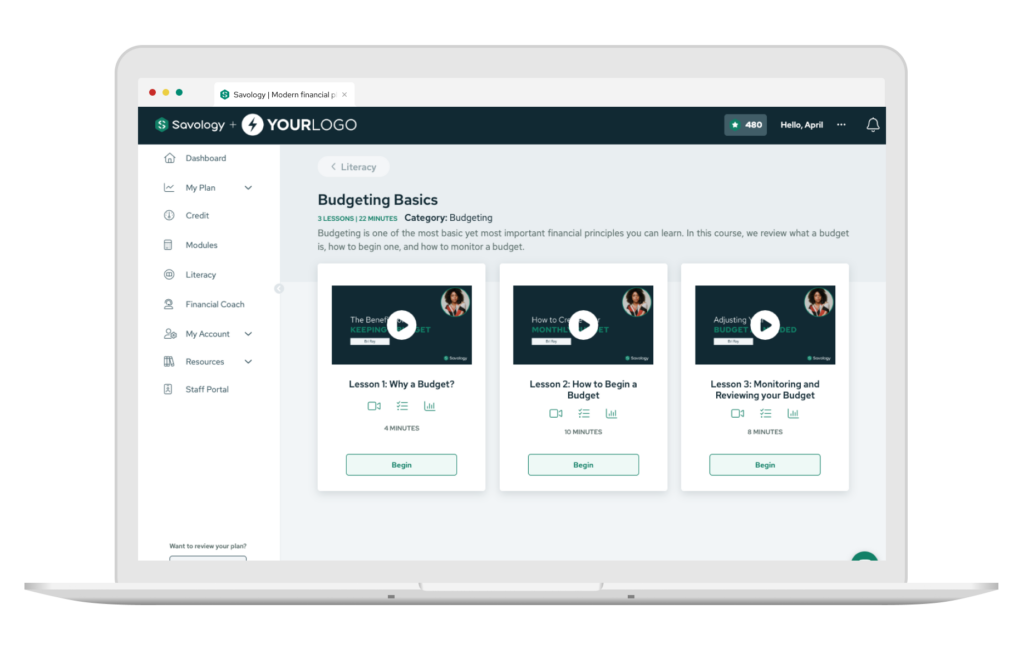

Savology was specifically designed to do financial planning for the middle market, with a client-led planning experience to save a financial professional time while better addressing the needs of this demographic. Savology quickly provides a personalized report card, action items, retirement projections, and more to tell a client how they are doing right now and what specifically they need to do to improve. Savology also includes additional financial management tools and financial literacy courses to round out the experience, which saves time for a financial professional and improves outcomes for middle-market clients.

Other solutions to consider for various aspects of middle market planning include ProjectionLab, Elements, New Retirement, and Asset-Map.

Budgeting and Cash Flow

Financial professionals who want to focus on budgeting and cash flow as part of their offering may consider adopting a budgeting-specific solution that goes beyond spreadsheets and worksheets. Monarch Money and PocketGuard have budgeting platforms that include access for a financial professional and client. YNAB and EveryDollar also have renowned budgeting experiences but may lack some of the administrative tools like joint access or license management.

Some financial planning tools include limited-scope budgeting that might be appropriate for those who don’t focus on budgeting. For example, Savology includes a budgeting module at no additional cost and Right Capital includes budgeting tools with its planning suite.

Financial Wellness

For decades, financial professionals have had to create their own programs to work with employers, use technologies that weren’t designed for financial wellness, or use providers that aren’t advisor-friendly. An increased demand for financial wellness has changed the landscape as more and more employers are turning to financial professionals to provide financial wellness for employees.

Savology is the #1 financial wellness solution for advisors. Other financial professionals also use Savology to scalably work with retirement plans and employers to provide financial wellness. Savology’s financial wellness solution includes financial planning, financial literacy, and financial management tools for users with advanced tools for financial professionals to effectively manage products, groups, and organizations.

With Savology, financial professionals can use the software to market and provide financial wellness on their own or partner to have Savology assist in the provision of financial wellness services in various capacities.

Although no other financial wellness platform is as complete for advisors as Savology, there are other solutions that financial professionals can consider depending on their needs including Enrich, WellCents, Incentive, or SmartDollar.

Financial Literacy

When it comes to financial education, a financial professional has a few options. They can create their own content, use another company’s resources, or avoid education altogether. It doesn’t make sense to avoid education altogether for the middle market, so financial professionals only need to determine if it is worth their time to create their own content or just license resources.

Larger firms, or those who want literacy to be a fundamental part of their offering, may choose to create proprietary literacy content. For those who want to take it one step further and turn content into lessons or courses, they may want to consider additional software. Kajabi, Udemy, and Thinkific are three of the more popular course-building platforms.

Another solution worth considering for financial professionals is CentSai. They create and license financial education for advisors and financial institutions to use in marketing and other programs.

Savology and Enrich include financial literacy content in their financial wellness offerings, but only Savology does so in a financial planning platform. Savology includes articles, lessons, courses, assessments, and calculators designed to improve financial literacy in relevant and applicable areas to their financial wellness needs. This can save time and money for financial professionals making it easier and more efficient to work with the middle market.

Custodial Platform

Numerous custodial platforms are designed for financial advisors to work with higher-net-worth individuals, but it might be worth considering a specific solution for the middle market for advisors who want to work with smaller accounts.

Betterment for Advisors and Institutional Intelligent Portfolios by Charles Schwab are two such solutions that make it easier to work with the middle market by automating more of the asset management process. Betterment, for example, makes it easy for a client to open an investment account connected to an advisor, transfer funds, and invest automatically in portfolios with minimal effort from the advisor. Advisors can therefore open, manage, and bill on the small accounts more efficiently and profitably than they otherwise could with a platform like TD Ameritrade, Pershing, or SSG which are more suitable for larger accounts.

Other Technologies

In addition to the middle-market-specific technologies that we just mentioned, financial professionals should consider if or how their technology stack enables them to work efficiently and effectively with this market. The technology they use for the rest of their business, like a CRM, may apply across the board, but here are a few other technologies that financial professionals frequently use when working with the middle market:

- Calendly or Acuity for scheduling

- Zoom for virtual meetings

- FutureVault for document sharing and storage

- AdvicePay for recurring billing

- Wealth or Trust & Will for estate planning

Conclusion

The middle market should not be viewed as an inaccessible or inefficient market segment for financial professionals. With the right information, motivation, business model, and technologies, financial professionals can effectively serve the middle market. They can make a meaningful difference in the lives of some of the people who need it most while positioning themselves for long-term professional success and personal satisfaction.