Taxes play a very significant role in our financial lives. This is why understanding how your taxes work, the tax rates you’re subjected to pay, and how to better manage your taxes can leave you in a much better position financially.

In this article, we’ll breakdown the effective tax rates across states so that you can get an idea of just how much you can expect to pay in taxes based on where you live and how that compares to other locations.

But first, let’s get a better idea of what exactly the effective tax rate (ETR) is.

What is the effective tax rate?

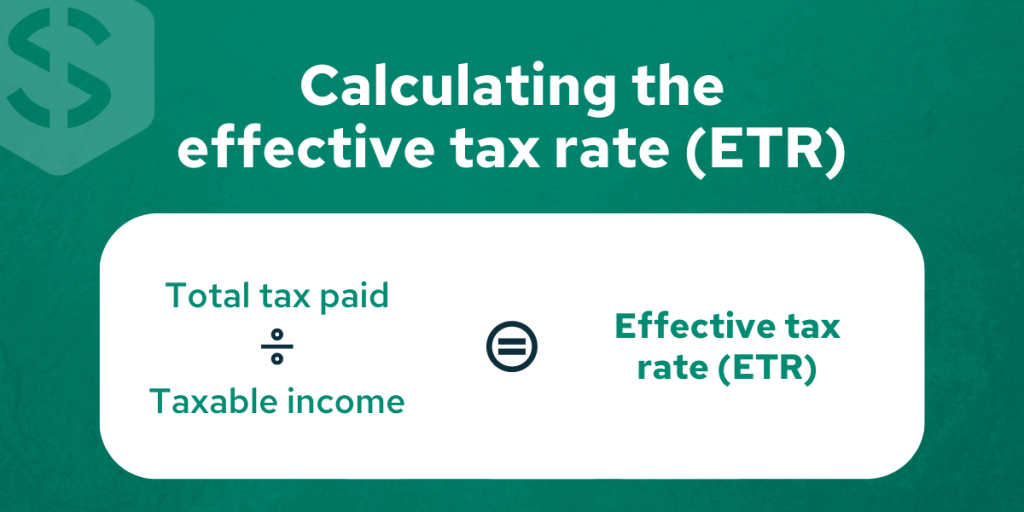

The percentage of your overall income that you actually end up paying in taxes is known as your effective tax rate. Here, the effective tax rates includes federal, local, and state taxes.

The calculation is as follows: ETR = Total Tax ÷ Taxable Income.

When we refer to the word ‘effective’, what we are really referring to here is the average. So the effective tax rate is essentially the average tax rate you pay.

Your effective tax rate differs from a marginal tax rate, and the effective rate is usually considerably less than your top marginal tax rate. The marginal tax rate is directly hinged to your income bracket and is the tax rate at which tax is incurred on every dollar of income you earn.

One of the most important things to keep in mind when understanding the effective tax rate is that an individual’s effective tax rate represents a combination of all tax brackets their income passes through as well as the total of all deductions and credits that lower their total income to their taxable income.

A quick example of effective tax rate

To get a better understanding before we dive into the state averages, let’s take a look at a quick example.

Sarah is a single individual who earned $75,000 in taxable income in 2019. Her marginal tax rate based on her income in this case would be 22%. That’s the highest bracket at which Sarah’s income would be taxed. However, Sarah’s effective tax rate would be around 16.5%, which is how much she would actually be paying in income taxes.

The easiest way to calculate the effective tax rate is to divide the total income that an individual pays in taxes by their total taxable income. Based on our example above, Sarah would have paid around $12,358 in taxes.

Effective Tax Rate (ETR) = Taxes Paid / Taxable Income = $12,358 / $75,000 = 16.48%.

To better understand how we arrived at Sarah’s effective tax rate, let’s break down the tax brackets and marginal tax rates that Sarah is subject to:

| Income Brackets | Marginal Tax Rate | Sarah’s Income | Taxes Paid |

| $0 – $9,700 | 10% | $9,700 | $970 |

| $9,701 – $39,475 | 12% | $27,775 | $3,573 |

| $39,476 – $84,200 | 22% | $35,525 | $7,815 |

| TOTAL: $75,000 | TOTAL: $12,358 |

State tax rates and rankings

Now, it’s to have some fun. The below table provides the effective tax rate averages across each state and Washington D.C. and how they rank on a national scale. Find your state to see the average effective tax rate and how it compares to other states.

| State (Location) | Effective Tax Rate | State Ranking |

| AK | 5.70% | 1 |

| DE | 6.14% | 2 |

| MT | 7.07% | 3 |

| WY | 8.05% | 4 |

| NV | 8.20% | 5 |

| UT | 8.39% | 6 |

| FL | 8.44% | 7 |

| ID | 8.56% | 8 |

| CO | 8.65% | 9 |

| TN | 8.73% | 10 |

| DC | 8.93% | 11 |

| CA | 8.94% | 12 |

| SC | 9.00% | 13 |

| OR | 9.10% | 14 |

| AL | 9.11% | 15 |

| WV | 9.66% | 16 |

| AZ | 9.69% | 17 |

| NH | 9.94% | 18 |

| ND | 10.03% | 19 |

| NM | 10.37% | 20 |

| GA | 10.44% | 21 |

| LA | 10.49% | 22 |

| HI | 10.60% | 23 |

| NC | 10.61% | 24 |

| VA | 10.68% | 25 |

| MA | 10.81% | 26 |

| SD | 11.03% | 27 |

| VT | 11.18% | 28 |

| AR | 11.25% | 29 |

| MN | 11.30% | 30 |

| MO | 11.30% | 31 |

| OK | 11.35% | 32 |

| MD | 11.40% | 33 |

| ME | 11.71% | 34 |

| IN | 11.76% | 35 |

| MS | 11.99% | 36 |

| WA | 12.08% | 37 |

| KY | 12.33% | 38 |

| NJ | 12.40% | 39 |

| MI | 12.43% | 40 |

| TX | 12.71% | 41 |

| IA | 12.92% | 42 |

| OH | 13.05% | 43 |

| RI | 13.21% | 44 |

| WI | 13.32% | 45 |

| KS | 13.35% | 46 |

| NE | 13.37% | 47 |

| NY | 13.74% | 48 |

| PA | 13.78% | 49 |

| CT | 14.41% | 50 |

| IL | 14.90% | 51 |

Based on the table and numbers above, are you paying more or less than the average effective tax rate in your state? If you’re not sure, determine what your total taxable income is, the amount you paid in taxes, and use the effective tax rate calculation provided earlier to find out. Once you determine your effective tax rate, focus on reducing your taxable income so that your hard-earned money stays in your wallet. By better managing and optimizing your taxes, you’ll be able to stay focused on your financial plan while working towards some of your other, smaller financial goals.