Achieving your goals, first relies on your envisioning them and creating expectations for yourself. Without being able to envision them as a reality, achieving them can often feel like an uphill battle.

This rings true for anything in life, but especially with your personal finances. Planning for a solid and successful financial future can be challenging. But setting the right type of financial goals helps keep you motivated, on track, and focused.

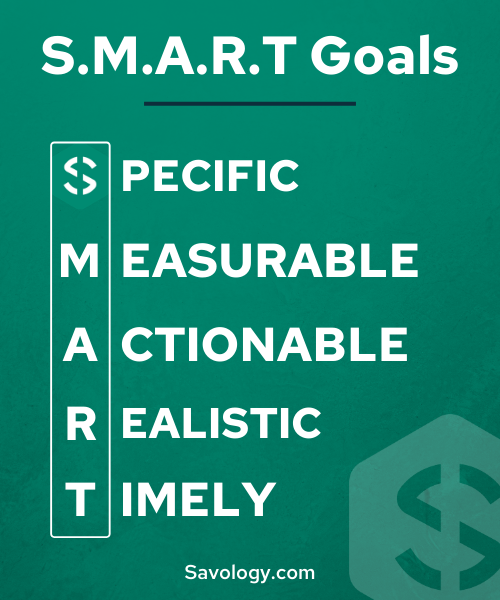

However, not all goals are created equally. If you’re serious about reaching your financial goals and improving your chances of success, focus on setting S.M.A.R.T. financial goals. Here’s what it stands for:

By sticking to this formula and creating S.M.A.R.T. financial goals, you’ll be able to visualize and plan for the end result, the exact steps you need to get there, and how exactly you can get started on working towards your new goal.

Let’s take a look at each of the different steps involved to better understand how to set and focus on S.M.A.R.T. financial goals. You can also view a quick summary of how to set S.M.A.R.T. financial goals as a web story.

Set specific financial goals to improve your outcome

When you set new goals, the first thing you should be focused on is making sure your goals are specific. This also happens to be the most important step because it helps pave the way for the others.

The more specific your goal is, the more likely you are to plan for it and achieve it. The reason being is simple: you have more information available, which means you can narrow your focus towards a specific outcome.

When working on making your goals specific, the best thing to do is to describe them. For example, while “buying a new home” is a great goal, it’s not specific enough to work in favor. Instead, your goal should be something along the lines of “buying a new home worth $350,000 with a $50,000 down payment before turning 30”.

By adding details, you are providing more specific information about your goal that will help you make it a reality.

A good exercise is utilizing the five W’s (and the ‘how’) to break down your goal even further:

- Who: Will you and your spouse be doing this together, or are you purchasing your new home alone?

- What: Purchasing a new home valued at $350,000 with a down payment of $50,000.

- When: Before you turn 30.

- Where: Where do you want to live? Location can help you narrow your focus.

- Why: To build home equity and achieve a level of security for retirement.

- How: By contributing a down payment of $50,000 and obtaining mortgage financing through a local credit union.

Make your financial goals measurable

The next step in the S.M.A.R.T. framework is making sure that your goals are measurable.

After you set and define your goals, identify the methods you’ll be using to make sure you are making sure you’re making progress. It will also pay off in the long run to create a consistent schedule so that you’re able to frequently check in on the progress you’ve made.

For example, when it comes to your goal of “buying a new home worth $350,000 with a $50,000 down payment before turning 30”, there are a few ways of measuring your progress. For one, you’ll want to measure your savings for the down payment.

Measuring your progress with a home buying goal is easy. You set a budget to save for the down payment, then you count the mortgage payments until you own the home outright. That’s assuming, of course, that everything goes according to plan. Loss of a job could throw your savings plan off track. An increase in income could accelerate it.

One of the benefits of laying the framework for a SMART financial goal is that you can be flexible about the way you execute it if you have to. You want to stay on track, but you can always move your deadline when life gets in the way. You can also, in the case of something like a purchase, double up on payments if you fall behind.

Make your financial goals achievable

Next, you need to ask yourself if your financial goal is achievable given your current situation and the resources you currently have available.

If you’re confident that you’re able to achieve your goal, then you’re all set. If not, it’s time to revisit the ‘drawing board’ to make a few changes to your goal to make sure that it’s something you are able to achieve.

For example, if you are currently 29 without any sufficient savings for a down payment, then purchasing your first home with a $50,000 down payment contribution before you turn 30 might be a little out of reach.

In this situation there are a few things that you can do:

- Set your sights a little lower and plan to buy something smaller with less of a down payment contribution.

- Keep the final outcome the same but push back your timeline by two years so that it’s within reach and realistic.

- Consider working on smaller goals first that you can use as stepping stones towards purchasing your home.

The number one thing here is to make sure that you are setting yourself up for success. This means that while every goal you set should be challenging, it needs to be achievable.

Avoid setting goals that are impossible to reach. This will only lead to frustration and will deter you from taking consistent action in your finances. Remember, your goals are there to provide motivation and encourage you to make improvements, not the opposite.

Make your financial goals realistic

While there are some overlapping fundamentals between being achievable and realistic, the two are inherently different.

An achievable goal asks the question of whether or not you can reach your specific goal either right now or in the future, even with having to make a few changes.

A realistic goal asks the question of whether or not your specific goal makes sense for your situation now and in the future.

Setting realistic goals is also known as living within your means. When you start crunching numbers, don’t leave yourself without a margin for error. That’s not realistic. There are always curveballs in life that will set you back. The longer the term of your goal, the more likely that there will be a hiccup of some kind along the way. Leave yourself some wiggle room for that.

Assign your financial goals a timeline

Last but not least, the ‘T’ in S.M.A.R.T. stands for timely (time-bound, time frame, time-limited).

It’s important and critical to your financial success that every goal you set has a time frame associated with it. By placing a timeline on your goals, you’re ensuring that you are taking action within a specific time period, rather than letting your goals slip because there isn’t a prescribed ‘deadline’.

In our example that we’ve been using throughout this article, you’ll notice that we stated a time frame of ‘before 30’ for buying your home. This is an example of providing a time frame for a specific goal.

Adding timelines to your goals can also help you measure your progress and the work you are making on your goals by allowing you to set ‘check-ins’ at regular intervals leading up to timestamp. Time can be one of the best indicators helping you gauge whether or not you are on track and within reach of your goals.

Moving forward with setting S.M.A.R.T. financial goals

It’s important to make sure that you focus on setting a combination of long-term financial goals as well short-term financial goals. Your long-term goals are there to help guide you towards where you want to be, while your short-term goals will help you reinforce your good financial habits and provide steady motivation to keep you working towards those longer-term goals.

The next time you sit down and work on your goals, make sure that you are setting S.M.A.R.T. goals to improve your chances of reaching financial success. For the best results, we always recommend building and sticking to a financial plan as a proven way to help you create and reach your financial goals.