What is Lively HSA?

Lively is a Health Savings Account (HSA) provider, built on a modern platform for employers and individuals. Lively is the #1 user rated HSA by HSA Search and named a Top HSA Provider of 2019 and 2020 by Morningstar.

It was designed to be incredibly user friendly. With such an intuitive experience, Lively HSA allows users to get the most out of their HSA. Lively has a simple account setup, paperless account management, and transparent pricing. For individuals, Lively is free!

Lively was made to help consumers to optimize their healthcare spending, maximize their savings, and better their livelihood.

A Quick Note On HSAs

Before analyzing Lively HSA in detail, let’s review the fundamentals of Health Savings Accounts.

Why would someone use a Health Savings Account?

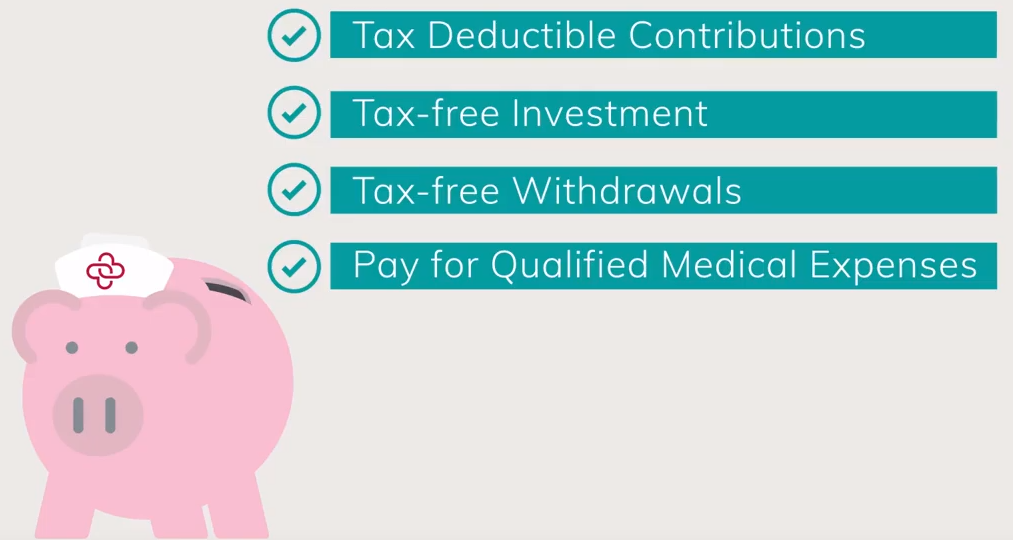

Health care is one of the biggest costs for individuals throughout their life. An HSA is a more cost-effective way to handle these medical expenses. An HSA is designed to help you pay for your current health care expenses and save for future health care expenses in a tax-advantaged way.

An HSA is a tax-favored health care account. It’s like a 401(k) for health care, but better. With an HSA you can make tax-deductible contributions, invest the contributions tax-free, and take tax-free withdrawals to pay for qualified medical expenses.

In retirement, you get these same tax advantages for qualified medical expenses but can also withdraw funds for everyday expenses the same way that you can from an IRA or 401(k). These withdrawals, however, will be taxed at your ordinary-income tax rate for the year if not used for qualified medical expenses.

In order to set up an HSA you need to be enrolled in a high deductible health plan (HDHP). This is a health insurance plan with higher deductibles and lower premiums. This means lower monthly payments for insurance, but higher out-of-pocket costs when you have medical expenses.

How do you know if you are in a HDHP that qualifies for an HSA?

Based on 2021 IRS specifications, qualifying HSA health plans must have minimum deductibles of $1,400 for individuals and $2,800 for families. In addition, qualifying plans must have a maximum out-of-pocket amounts of less than $7,000 for individuals and $14,000 for families.

For more information on if you qualify for an HSA check out IRS publication 969.

A final important benefit of the HSA is the funds do not expire. The funds roll over from year-to-year, unlike a Flexible Spending Account (FSA) where you either use the money or lose it.

In an HSA, you can use the funds with great flexibility. You can spend money contributed this year tax-free on qualified medical expenses this year, next year, or even 30 years from now.

Lively HSA Overall Rating: 4.4 ★ / 5.0 ★

Lively HSA is an affordable and effective option for HSAs. They leverage technology to create a user experience that is second to none.

Lively is simple to use on everything from the account setup to ongoing account usage.. It is easy to track your medical expenses and investments all in one place. They are integrated with two investment partners, TD Ameritrade and Devenir to give users a wide array of investment options at a low cost.

They have excellent customer support and resources like HSA calculators and HSA guides to help you make more educated decisions as if you are a professional.

Pros & Cons of Lively

Pros of Lively

- Lively is a fee-free HSA provider for individuals

- Provides many investment options through integrations

- Invest on day one, no minimum balance required

- 100 percent online (paperless)

- Account setup takes as little as 5 minutes

- Simple and user-friendly platform

- Offers web access and mobile app

Cons of Lively

- Live customer service isn’t 24/7 like some HSA providers, but IVR support is 24/7

- Investment accounts are offered through TD Ameritrade which introduces some fees

Commissions & Fees: 4.9 ★

Lively is a free platform for individuals. The average HSA provider has $26 in annual hidden fees per user. Lively has built its reputation on being transparent on how they make money.

Lively truly has no hidden fees.

- Monthly Maintenance: $0

- Account Opening Fee: $0

- Account Closing Fee: $0

- Funds Transfer (Out/In) Fee: $0

- Debit Cards (Up to 3): $0

- Excess Contribution Fee: $0

- Point of Sale Fee: $0

- Minimum Balance Fee: $0

- Reimbursement Fee: $0

- Access to Investments at TD Ameritrade: $0

- Access to Guided Portfolio with Devenir: 0.50% annually on invested assets

It’s clear to see that Lively is an affordable option for someone who is looking for an HSA at a low cost. It is noteworthy that Lively’s investment partners, TD Ameritrade and Devenir, charge minimal fees that may apply to you if you choose to invest.

You might be asking, how does Lively make money?

Here are the primary ways Lively makes money in order to offer accounts for free to individuals:

- Employers can offer HSA through Lively for employees. Lively charges employers $2.95 per employee per month.

- Like many financial service companies that offer a debit card, Lively collects a percentage of merchant fees on transactions.

- Lively can also earn interest on your money that is not invested. They negotiate contracts with banking institutions to get better interest rates, pay you some of that interest, and keep the difference.

Customer Service: 4.2 ★

Lively has customer service available Monday through Friday from 6:00 AM to 6:00 PM Pacific Time. You can reach them on the phone or through email. If you go to their website, they also have a live chat where you can talk to Lively support staff. Although live support is not available 24/7, Lively does have IVR support to answer many basic questions around the clock.

Lively has created additional self-service tools and resources. This includes an HSA guide where they will answer many of your HSA questions and an HSA calculator.

They have an exhaustive FAQ page where they answer general questions about their platform, medical expense questions, and more.

While these customer service options are excellent overall, other alternative providers in the industry offer 24/7 phone support.

Ease of Use: 4.4 ★

Lively is extremely easy to use. The platform is intuitive and it’s very easy to setup an account in as little as 5 minutes.

It is simple to link your bank account or have your employer contribute directly from your paycheck. If your employer uses a different provider with lots of fees, you could even use Lively’s platform. In this case, you would transfer funds from a different HSA provider to Lively.

Lively’s goal is to make account setup simple and effective, which they seem to have figured out. They want to help their end users get the most out of their HSA account.

Lively comes with a debit card to make paying for your medical expenses easier. Lively is paperless, meaning everything is online, and has a dashboard where you can view your account balance, investment growth, medical expenses, and more.

This makes it easy to manage all of your information in one centralized location. Lively has both a mobile and desktop version where you can access your dashboard.

When it comes to HSA providers, Lively has created a user experience that is second to none.

Tools & Resources: 4.0 ★

Lively has many tools and resources to help make your HSA experience more seamless.

One valuable tool in particular is a tool to save medical receipts. This can be used to apply your present medical expenses to offset future HSA withdrawals. It’s also helpful because you don’t have to worry about keeping hard copy receipts for many months or even years at a time.

They also have a comprehensive HSA guide, several pages of FAQs, and Lively HSA topic resources to answer all of your questions.

In their HSA calculator, they are able to calculate your HSA savings and investment potential over time, tell you how much you can contribute to your HSA, and compare one health plan costs compared to other health plans.

Lively accounts are FDIC and NCUA insured. This means that your money that is sitting in cash is insured by the United States government up to $250,000 per account. And finally, as mentioned earlier, Lively has a debit card to make paying for medical expenses easy.

Investment Options: 4.6 ★

Lively has partnered with two different financial institutions to provide different investment accounts and experiences. The first, TD Ameritrade is a highly-rated discount brokerage firm with lots of tools and resources. Lively is integrated with TD Ameritrade’s self-directed brokerage platform so you have a variety of options. You can invest in 300 commission-free ETFs as well as 13,000+ mutual funds, stocks, bonds, CDs, and more. This provides users with a number of options and flexibility when it comes to investing HSA assets.

Starting in August of 2020, Lively announced the launch of its robo-advisor tool called HSA Guided Portfolio, which is powered by Devenir. Devenir is an industry leader in the investment solutions for HSAs and other health-based investment accounts. With this option, you are provided with a personalized portfolio recommendation based on risk tolerance and investment time horizon and it incorporates low-cost funds and automatic re-balancing. Unlike the TD brokerage option, there is an annual fee of 0.50% of invested assets.

Lively does not offer advice when it comes to your investments because they are not a registered investment advisor, but you can get advice from TD Ameritrade and Devenir about how to invest your HSA.

One significant benefit with Lively is that there is no minimum balance required to open an account or start investing with either of the two options. You can start investing as soon as you get money into the account.

Lively also pays interest on your HSA funds that are not invested. As of January 23, 2020, Lively accounts earn anywhere from 0.25% to 0.60% of interest depending on how much you have in the account:

- Less than $2,500: 0.25%

- $2,500-$4,999: 0.35%

- $5,000-$14,999: 0.45%

- $15,000+: 0.60%

Is Lively Right For You?

Lively is an excellent choice in the HSA marketplace. It has many investment options through its partnerships with TD Ameritrade and Devenir and has no fees to set up and use their platform. It is a secure platform with good customer service and your cash is FDIC insured. If you are looking for an affordable option that is user friendly, then Lively is a great option for you.

Lively HSA Review

Lively is a Health Savings Account (HSA) provider, built on a modern platform for employers and individuals. Lively is the #1 user rated HSA by HSA Search.

This review is provided by and expresses the opinions of Savology to help users make informed financial decisions. Savology does not receive compensation for its product or provider recommendations but views such recommendations as an important part of helping people progress toward financial security.