While we all have our unique and individual goals when it comes to money, there are also many common denominators that most of us share.

We want to retire at a reasonable age and avoid working well into our sixties or seventies. We want to own our home, maybe even more than one. We want to eliminate our debts and avoid taking on any unnecessary debts where we can. And we want to continue building our wealth and the amount of assets we have in our name.

So really, what we’re talking about here is increasing our net worth over time.

If you’re already familiar with the term net worth, that’s a good start. If you’re not familiar with it, even better because you’re in the right spot. Keep reading to learn more about net worth, why it’s important and how you can calculate your net worth in minutes.

What is net worth?

When we talk about net worth on an individual basis, what we really mean is how much an individual is worth based on their financial standing. Your net worth is simply the monetary value that is left after subtracting the total amount of your liabilities from the total amount of your assets.

You might not have known this, but your net worth is one of the major (and common) calculations in any proper financial plan. It’s commonly used as a measurement of your financial standing and the progress you’re making in your everyday financial decisions.

Why understanding and tracking your net worth is important

Net worth compares how your assets are doing against your liabilities. When you compare the two, you are able to have a much greater understanding of how your overall financial health is doing.

Tracking your net worth gives you a better snapshot of your financial progress over time. It can show you that all of the small financial decisions you’ve been making over the months and even years are paying off. It can also help you stay focused and motivated on making steady improvements along the way by seeing what’s working and what isn’t.

If you haven’t been tracking your net worth as an overall measurement of your financial health, I’d recommend doing so. You’ll feel much more confident, focused, and driven to improve your finances.

Calculating your net worth

The formula for calculating your net worth is actually quite simple. But it does require you to have a list of everything you own (your assets) and everything you’re borrowing (your debts and liabilities).

Net worth is calculated by subtracting your total liabilities from your total assets. An asset can be defined as anything owned and has monetary value, while liabilities on the other hand are obligations that deplete resources.

Examples of assets include:

- Checking and savings account balances

- The value of securities (e.g., stocks or bonds)

- Real property value

- The market value of an automobile

Examples of liabilities (debt) on the other hand include:

- Mortgage loans

- Credit card debt (balances)

- Student loans

- Automotive loans

A positive net worth is when your total assets exceed your total liabilities, while a negative net worth results when your total liabilities exceed your total assets.

It’s also extremely important to know that positive and increasing net worth is an indicator of good financial standing while a negative or decreasing net worth can be a cause for concern and can have serious implications on your overall financial health.

An example of calculating net worth:

Consider a young, married couple with the following assets to their name: a new home valued at $300,000, a portfolio of investments with a market value of $50,000, and vehicles and other assets that are valued around $25,000.

Their total liabilities on the other hand are an outstanding balance on their mortgage of $100,000 and an outstanding amount on their car loan of $10,000.

The couple’s current day net worth would be calculated as follows:

[$300,000 + $50,000 + $25,000] – [$100,000 + $10,000] = $265,000

Meaning that their current net worth is around $265,000. Not bad at all!

Now, let’s make an assumption here that ten years into the future, their financial situation changes. Their home decreases in value and is now worth $275,000, their investment portfolio is worth a whopping $180,000, they have accumulated an emergency fund worth $20,000, and their vehicle is only worth $5,000.

On the liabilities side, their mortgage loan balance is down to $30,000, and their car loan was paid off entirely five years ago, so there isn’t anything remaining there.

The couple’s net worth ten years later would be calculated as follows:

[$275,000 + $180,000 + $20,000 + $5,000] – $30,000 = $450,000

Despite the decreased value in their home and vehicle, the couple was able to increase the amount of investments and savings, and reduce their overall outstanding debt from their mortgage and car loans, which significantly bolstered their net worth.

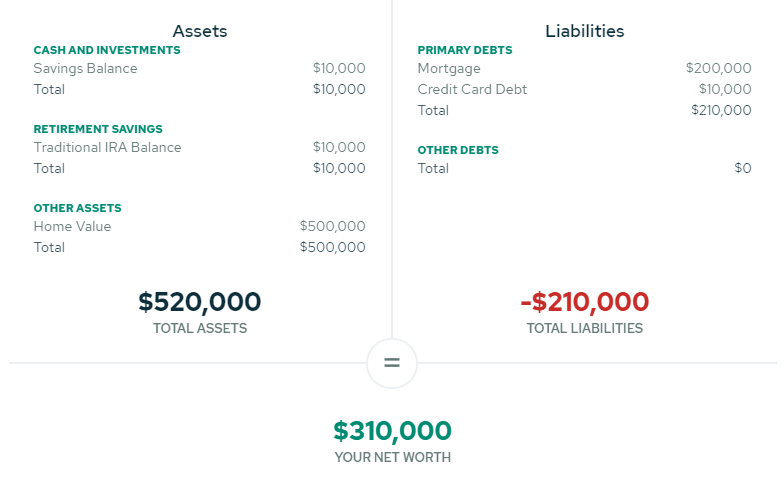

Calculating your net worth with Savology

When you sign-up and build a free financial plan with Savology, your plan will automatically calculate your net worth by taking your total assets and subtracting your total liabilities. By doing so, you’ll be able to quick track, update and measure the financial progress you’re making.

Your Savology plan will also provide personalized recommendations that will show you ways to improve your net worth and reach your financial goals. All in one place, for free, and without you having to crunch any numbers on your own.

How can you increase your net worth?

There are two primary ways you can increase your net worth. The first, is by increasing the amount of total assets in your name. The second, is by decreasing the amount of total liabilities in your name. Doing either of the two, or a combination of both will increase your individual net worth.

Examples of increasing your assets include increasing your savings rate and your monthly contributions to your retirement funds, purchasing and owning a second home, purchasing and investing in individual stocks, and taking advantage of employer-matching contributions to your 401(k) plan.

Examples of decreasing your liabilities include: paying down your outstanding mortgage loan, paying off your credit cards in full, paying a lump sum payment towards student loans, etc.

Net worth averages by age

Now that you have a good understanding of what exactly net worth is and how the formula used to calculate it, let’s take a look at Nation averages to see how you compare.

| Age Range | Average Net Worth | Median Net Worth |

| 18 to 24 | $93,983.00 | $4,395.00 |

| 25 to 29 | $39,566.00 | $8,972.00 |

| 30 to 34 | $95,236.00 | $29,125.00 |

| 35 to 39 | $257,582.00 | $40,667.00 |

| 40 to 44 | $316,661.00 | $87,843.00 |

| 45 to 49 | $599,194.00 | $105,717.00 |

| 50 to 54 | $838,703.00 | $137,867.00 |

| 55 to 59 | $1,150,038.00 | $168,044.00 |

| 60 to 64 | $1,180,378.00 | $224,775.00 |

| 65 to 69 | $1,056,484.00 | $209,575.00 |

| 70 to 74 | $1,062,428.00 | $233,614.00 |

| 75 to 70 | $1,097,415.00 | $242,700.00 |

| 80+ | $1,039,818.00 | $270,904.00 |

The above table provides both the average and median net worth broken out by age ranges. You can use this table as a quick reference to determine where exactly you fit in regards to your overall net worth.

If your net worth is well above the average for your age, then you’re on the right track to making steady financial progress. However, if your net worth falls well below the average for your age, then you’ll want to review your current financial standing (by reviewing your plan) to determine where you can make changes and improvements that will improve your net worth over time.

Net worth vs. income

There is a common misconception that your income and your net worth are the same. Many people are under the impression that if you’re making $60,000 a year, then your net worth is $60,000.

While your income can have a significant impact on your net worth, it does not define your net worth. In the most basic definition, your income is the money you receive and earn through work and investments. It’s essentially this money that you are using to further save, invest and acquire assets that improve your net worth.

In addition to helping you increase the assets to your name, your income can also help you decrease your debts and liabilities. For example, the money you earn through regular salaried earnings or a bonus can be used to pay off credit cards, or pay down a large lump sum on your mortgage balance.

This is why it’s so critical to continue increasing your income whenever you can. An increased income will provide you with more opportunity to increase your assets, decrease your liabilities, and ultimately improve your net worth.

Moving forward with your net worth

Better understanding your net worth and tracking it over time will help you understand where you are in your financial journey and the progress you’re making. By keeping track of your net worth, you’ll be able to determine whether or not the actions and decisions you’ve been making are having positive or negative implications on your financial health.

And remember, your net worth will change over time. If your net worth is currently negative or behind the national averages (or median), don’t let that discourage you from taking action. In fact, you should look at it as an opportunity to re-evaluate your financial standing and the decisions you’re making so that you can work on improving your net worth and your overall financial well-being.