There are few things that can make a difference in your financial outcome more than having a financial plan.

To start to understand the importance and impact of financial planning, let’s consider these real-life examples below.

Would you play a new board game without perusing the instructions? What about solving a puzzle without seeing the picture? Probably not.

Would you walk or drive to a completely new destination without having a map or a set of directions? I know I wouldn’t.

How about building a house? Would you build a house without having the blueprints? I really hope not.

And lastly, what about managing your finances? Would you navigate your finances along with some of the most important life decisions including your retirement without having a financial plan? Unfortunately, most of us do even though we shouldn’t.

More than 72% of households in the United States manage their finances without a financial plan.

That means the majority of households are essentially navigating their finances blindfolded. It’s leaving most of them completely in the unknown or in situations where they are stuck making uninformed financial decisions.

That is the complete opposite of setting themselves up for success.

Savology has found that households that have a written financial plan are 2.5X more likely to save enough for their retirement. Meaning there is a significant correlation to financial planning and financial success.

No longer can financial plans be considered an afterthought when it comes to your money. A financial plan is arguably the most essential tool to make sure you improve your finances. It should also be one of the first steps everyone takes when beginning their financial journey.

Keep reading this guide to learn more about what a financial plan is, the necessary components of a good financial plan, how you can get one for free, and even some of the common financial planning myths.

Part I. What is a financial plan?

On the surface, a financial plan is exactly what it sounds like: a plan for your personal finances. Looking deeper, however, it is more than just an analysis of where you are right now, it is also a strategic game plan for achieving future objectives across all areas of your financial life.

The analogy I often find myself using is this:

Your financial plan is like a dedicated roadmap for your finances. It helps you navigate bending roads, forked roads, and detours. These are the important financial decisions you’re faced with. If there are any significant detours when things don’t go as expected, your roadmap will reroute you back towards the main road. Ultimately, this roadmap (your plan) keeps you on track and moving forward towards your destination. Reaching your financial goals.

Importantly, a financial plan looks at the present and the future. Your plan takes a snapshot, or an assessment, of your current financial picture along with your future financial goals and how you want to live during your retirement years. It will help you strategize and navigate your financial decisions by showing you the steps you need to take in order to bridge the gap between your current and future situation.

By doing this, your plan helps you make important financial decisions that will keep you on track and progressing towards your financial goals.

Lastly, your financial plan consists of all of the major areas of your financial life. It takes into consideration your household income and savings. It takes into consideration your debts and liabilities to identify how borrowing impacts your future success. It takes into consideration your insurance and risk management to identify how and where insurance can play a role in an optimal way. It will even take a look at your estate to make sure you are properly prepared and your family is protected.

This is exactly why having a proper financial plan is so critical to your future financial success.

Using a debt payoff planner like Savvy by Ascend Finance can also help you tackle your debts and liabilities by showing you how to get out of debt and plan for the future. Ascend has a Chapter 7 means test or bankruptcy means test if bankruptcy seems to be in your future.

Part II. Who is financial planning for?

The short answer is everyone.

This is primarily because every single one of us is responsible for managing our money and making important decisions. It is also because of the impact it has on our future and our chances of reaching financial success.

There are really only a few exceptions when it comes to who might not benefit from having a financial plan.

- If you’re already well into your retirement years, then you might not need a traditional financial plan. But, even in this case, having a second opinion on how you’re managing your money to make sure the well doesn’t dry up is necessary.

- If you’re a minor currently living with your parents (or guardians) and you have relatively zero financial responsibilities, then having a financial plan might not be necessary. However, it is something that you should be considering. The sooner you get started, the better.

There are also situations where having a financial plan is an absolute necessity:

- If you are a newly wedded couple, or are just starting a family, now is the time to make sure you build your plan and protect your family’s future.

- If you are a recent grad who is navigating through new financial responsibilities, then having a financial plan is critical for building the foundation of your success.

- If you are mid-way in your working career and closing in on retirement in the next 10 years, then having a financial plan can help you cement your financial picture.

Financial planning is just as critical as budgeting, if not more so. While it is not yet as ubiquitous as budgeting, it certainly should be, especially when you consider the impact financial planning has on budgeting. Ultimately, a financial plan can help you understand how much to budget and why you are budgeting.

Part III. What are the components of a financial plan?

Your financial plan should provide you with an overview of information making it easy to track your progress and understand what you need to do next to keep making progress.

It also should provide a detailed breakdown of the major components.

Like we mentioned above, your financial plan consists of all of the major areas of your financial life. That means much more than just budgeting and investing methods despite what most people think.

In total, your financial plan encompasses several major areas of your financial life that can be summarized into these four pillars:

- Savings and income

- Assets and liabilities

- Risk management

- Retirement outlook

These four pillars of your financial plan can then be broken into 12+ sub-parts or key performance indicators. Each of them takes on an important role individually and collectively to work together like a well-oiled machine.

Let’s take a look at the major pillars and key performance indicators of your financial plan below:

Pillar 1: Savings and income

The first component of your financial plan, which is the one most people associate with, is your savings and income. There are three important sub-areas (key performance indicators) to measure here:

Household income

Your household income is just as it sounds. The estimated amount of gross income your household is bringing in. This number is typically calculated on an annual basis and includes things such as your regular salary, side hustles, and investments. This part of your plan can also show you the average household income for your age and how you compare. This can be a good performance indicator to determine what you should aim for.

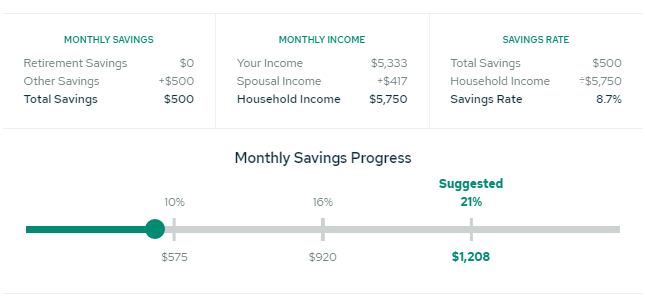

Savings rate

Your savings rate calculates how much you are currently saving on a monthly basis. This number is calculated as a percentage of your current gross monthly income.

Your plan will not only show you what your current savings rate is, but it will also show you a detailed breakdown of how much you should be increasing your savings rate in order to reach your personal goals and retire on time.

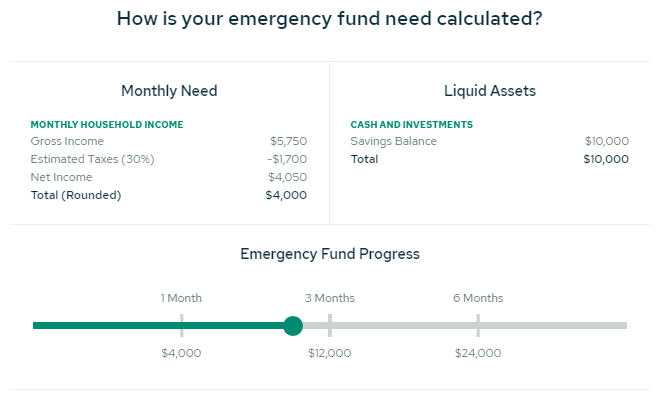

Emergency fund

Your emergency fund calculation will show you how much you currently have in liquid assets, along with the optimal amount of emergency savings you need to be working towards. Ideally, you will want to save up to 6 months as an adequate emergency fund.

The calculation itself is quite simple. Take your gross monthly income, subtract estimated taxes (around 30% for many households) and then round that number for ease of calculation. From there, you will know what one month’s worth of an emergency saving buffer is. Multiply that number by three or six to determine how much you should have to properly protect yourself for three to six months.

Pillar 2: Assets and liabilities

The second component of your financial plan is your assets and liabilities. There are three important key performance indicators to measure here:

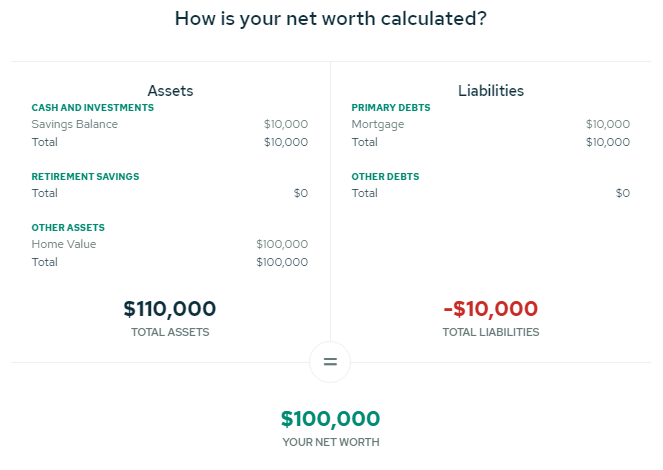

Net Worth

This part of your plan will calculate your current estimated net worth valuation and should come with target net worth goals for your age. This is a simple calculation that is done by subtracting your liabilities from your total assets. The number you have leftover is your estimated net worth.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is the percentage of your monthly gross income that goes toward paying debts. This usually includes your housing cost, even if you rent. The lower this number, the less of a risk you are to banks and other lenders. Your plan will calculate your current DTI and will show you what you need to be aiming for. As you reduce your DTI, you can start saving more.

There are two great ways to keep our DTI number down:

- Earn more income

- Pay down your current debts to lower the amount owed

Housing

This key performance indicator will take a look at how housing impacts your net worth, your monthly spending, and your financial plan. It is done by assessing your housing status to determine whether or not you are servicing a mortgage, paying rent, or you have a mortgage already paid off. The calculations and analysis are different for each of these situations but ends with a similar result of analyzing the impact of housing on your finances and recommending how much you can afford to pay in housing.

Pillar 3: Risk management

The third pillar of your financial plan takes an overall view of how you are managing your risk. This is arguably the most overlooked pillar, yet one of most important in ensuring positive outcomes and avoiding negative outcomes. There are three important key performance indicators to measure here:

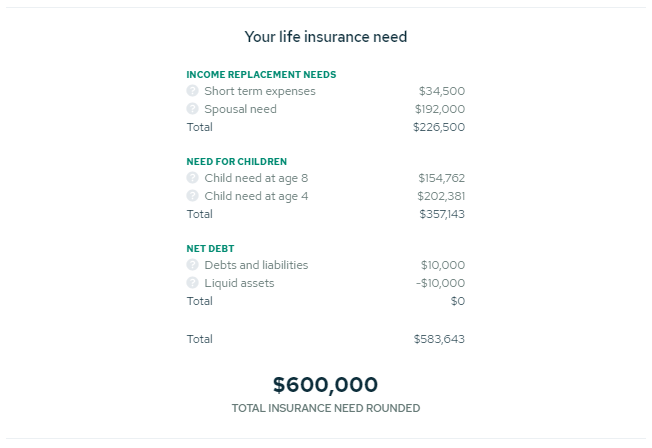

Life insurance coverage

Your life insurance coverage details will provide an overview of how much coverage you currently have, how much coverage you need, and your corresponding coverage gap. This calculation is based on a number of variables, coverage for your dependents, and coverage for your current debts. If you have a spouse, it’s important to also determine their life insurance coverage, which a good plan will include.

Estate plan

Your estate plan is one of those areas that feels grim to talk about, but the sooner you start planning the better off you and your family will feel. Your plan will determine if you have critical documents in place for your estate such as:

- Guardianship nominations

- Last will and testament

- Living trusts

- Durable power of attorney

- Advance health care directive

- Final disposition instructions

Other insurance needs

Lastly, when it comes to your risk management, it’s important to determine which additional insurance coverages you will need to protect against risk. This includes, but is not limited to:

- Disability insurance

- Auto insurance

- Health insurance

- Homeowners or rental insurance

Pillar 4: Retirement outlook

The last component of your financial plan is focused on calculating your retirement, which includes goals and outlook. There are three important sub-areas to cover here:

Current trajectory

Your current trajectory will provide a snapshot of whether or not you are on track to retire by your desired retirement age and even if you’re on track to retire early. This is determined and summarized by calculating your retirement income replacement as the one number indicator of how much money you will likely have to live on each year in retirement.

Your financial goals

Here’s where you will determine and set your financial and retirement goals. This includes the age at which you would like to retire and the type of lifestyle you want in retirement, determined by the replacement income goal.

Proposed trajectory

Your proposed trajectory is extremely important to pay attention to. This calculation works by focusing on achieving your desired retirement lifestyle goals by showing you what you need to do in order to reach this goal. In other words, how much you need to be saving to reach your retirement on time. In some cases, it may not be feasible to reach your exact goals, and in that case, a plan can help you recalibrate and come up with adjusted goals.

Part IV. How and where can you get a financial plan?

This is the part where most people get stuck.

There is a lot of uncertainty around how to get started with a financial plan and what the best option is. Take a look at these three common alternatives below:

Option 1: Create your own financial plan

While this isn’t the most popular option, it’s still one that needs to be considered. If you’re just starting out in your financial journey, I’d recommend steering clear of this as it will likely lead to more confusion and even frustration when things don’t go as planned.

However, there are still many financial experts that chose to do their own planning. They might use this as the only source of direction for their finances, or use this method in conjunction with getting a second opinion.

There are a lot of great personal finance books that can be used as guides and references when creating your own financial plan.

You can also take the financial planning pillars above and use those as a framework to build your financial plan. However, I will caution you that it will still be extremely time consuming and there will be numerous scenario-based calculations you will need to make.

Option 2: Hire a traditional financial planner

The second option is hiring a traditional financial planning professional to create your personal financial plan. Going this route can be extremely effective for those who can afford it. Your financial planner will take the time to sit down with you, review your current financial standing, map out your goals and create a plan on how to move forward.

If you’re interested in hiring a traditional financial planner, here are a few resources that can help you in your research:

- CFP Board

- NAPFA

- XY Planning Network

- The Garrett Planning Network

- Top Financial Certifications Guide by Wealthtender

This option has been around for decades, and is used by hundreds of thousands of households. But, traditionally financial planning comes with its drawbacks as well. Because of the cost and the time requirements, it is relatively inaccessible to the general population.

Option 3: Building your free financial plan with Savology

The third option is to build a free financial plan with Savology in about 5 minutes. The first and second option might work for some people, but they come with challenges that can be distracting and unsettling.

Creating your own financial plan will seem like a never-ending series of calculations. You’ll likely end up being more focused on the planning and calculation aspects than the execution of the plan after being creative.

Hiring a traditional financial planner is effective. But it can also be expensive, time-consuming and overwhelming. It might take you a few visits, totaling more than a few hours, to get a holistic financial plan that ends up being more than fifty pages to read through.

Savology, on the other hand, is fast and free. Your (Savology) financial plan will take those four major pillars and do the number crunching for you on an ongoing basis. Your plan will also give you personalized and prioritized action items to start working on as well as an overview of your current financial situation. In addition, you’ll end up saving even more time and money by being connected directly with quality providers (such as life insurance providers) that can help you accomplish your goals. And Savology will be there for you to come back and update your plans anytime your needs change.

Part V. Making the most of your financial plan

Creating your financial plan is only half the battle. Getting started is a big achievement and a step in the right direction, but it doesn’t simply end there.

Here are three things you can do to make the most of your financial plan and to set yourself up for success.

1. Be honest, realistic, and provide accurate information

First, you need to be honest and realistic with yourself. This includes being honest about your current financial situation. It also includes being realistic about your financial goals and the future financial life you are working towards.

Additionally, it’s critical that the information you provide is accurate, at least to the best of your knowledge. You can easily go in and make changes or revisions, but providing false information is a sure way of resulting in false predictions and calculations which can end up leading to an outcome that might look great, but isn’t achievable.

The more precise your information is when you are creating your financial plan, regardless of the three methods above that you decide to move forward with, the more precise your financial plan will be.

Not being honest, realistic, or accurate with the information you provide won’t do you any favors. Remember, you’re building this financial plan for yourself. Not for anyone else.

2. Update and maintain your plan

Like anything in life, your plan will only work if you commit yourself to it.

We recommend reviewing your plan monthly and updating your underlying data at least every three to six months. A lot can happen in the span of a few months and frequently checking in will make sure that your plan is still accurate and on track with your current lifestyle and goals.

You’ll also want to make sure you update your financial plan whenever significant life events occur. These can be things such as getting a new job, having a child, getting engaged or married, buying a first house, or moving. All of these things can have a significant impact on your savings, expenses, risk management, and more which ultimately change the trajectory of your financial future. This is why it’s so important to make sure your plan is updated to reflect your new lifestyle.

After creating your financial plan, I highly recommend setting calendar reminders for yourself once every three months to make sure that you are staying on top of your plan. If any significant life events happen between then you’ll have the chance to go in there and make those updates. And if there are so significant life events, these calendar reminders can still prompt you to go update your progress.

3. Stick to it over the long-term

Last but not least, it’s important to make sure you stick to your plan. Remember, just like we talked about at the beginning of this guide, your financial plan is a roadmap that is there to help you navigate your financial journey.

While this is true in any case, it’s especially true when you are faced with financial challenges and financial decisions you need to make.

By sticking to your plan, and the recommendations within your plan, you are ensuring that you are staying on track to reach your goals.

Part VI. Financial planning myths that exist

The topic of personal finance and money management practices in general, comes with a lot of misinformation and advice that is far from the truth.

While having access to an abundance of information is generally perceived as a great thing, you also need to be aware of any misleading information that can be detrimental to your plan.

Here are three of the most common financial myths that you may have heard from a good friend or read online. Be wary of any source that tells you these things.

Myth 1: Your budget is your financial plan

Definitely not.

While there are a lot of similarities, budgeting (and saving) is just one of the many major components of your financial plan that we talked about above. It is not your financial plan.

Your financial plan takes a holistic approach to your entire financial picture. It’s there to help guide you through all of the important decisions you need to be making, many of which include critical decisions you will need to make about your budget and your saving habits.

Myth 2: Financial planning is expensive

Traditional financial planning has been known to be expensive. Typically, getting access to a holistic and comprehensive financial plan was something reserved for the wealthy.

But this is just not the case anymore.

Thanks to technology, financial planning is becoming democratized and is more accessible now than ever before.

Savology is a financial planning platform providing households across the United States with access to free financial plans. In just 5 minutes, you can access a free financial plan with recommended next steps helping you bridge the gap between your current and future financial situation.

To get started, all you have to do is click here: Build my free financial plan today.

Myth 3: Once you have your financial plan you’re set

This is far from the truth.

Unfortunately, for most people, financial planning is a “set it and forget it” practice. Their financial plans collect dust on the shelves.

Just like we mentioned above, creating your financial plan is only half the battle. While getting started is a major step in the right direction, it’s what comes next that has the biggest impact.

After you create your plan, it’s important to review it and update it every three to six months. You’ll also want to make sure you actively update your plan as significant life events take place. Lastly, to improve your chances of success you will want to stick to your plan and make sure you are working on any recommended action items.

Part VII. Moving forward with your plan

By now you should be very familiar with the topic of financial planning. You’ll know things like what a financial plan is, what goes into creating one, and where you can get one.

Additionally, you now have a better understanding of how and why financial planning is so important to your success. Financial planning, and having a financial plan, needs to be ubiquitous. Everyone needs a financial plan!

While starting a puzzle, playing a game, and driving to new destinations are all insignificant in comparison to planning our finances, it’s important to adopt the same general approach of having guidelines established to improve your chances of success.

Failing to plan, is planning to fail. And when it comes to our money and our family’s future, that’s just not something any of us can afford to do.