Overview

Planning for retirement is a big deal. It is probably something that you know you should be doing. Maybe you’re already putting money in a 401(k) or saving in other ways for retirement, but you’re not clear on how much you need to have saved or how you’ll get there.

In this guide, we’ll help you set a few important retirement goals. From there, you’ll learn the basics of retirement planning and general best practices for how to save and invest so that you can reach your retirement goals.

Planning For Retirement

Set Goals

Having goals helps you plan for retirement. Start with two simple goals: your retirement age and your expected lifestyle. Once you have determined these goals, the rest of your retirement plan comes together pretty naturally.

Age of Retirement

Having a goal for when you want to retire makes other parts of retirement planning much more straightforward. The default retirement age for many people right now is 65, but many people are choosing to work even longer. When setting your retirement age goal, consider the following:

- Your career: Will you be able to keep working until you want to retire? Is it common for people in your line of work to continue to work until retirement, or will you have to change jobs to make that happen?

- Your health: How long do you expect to live? Do you live a healthy, active lifestyle? Does your family have a history of health complications or longevity?

- Your financial situation: Think about how much you will have saved and how long that might last in retirement.

- Your retirement benefits: Are you counting on social security? Keep in mind that for anyone born in 1960 or later, you have to be 67 to take full advantage of the social security benefit. If you have a 401(k), 403(b), or a pension, you may have limitations for when you can start withdrawing and should keep those in mind as you set your goal.

Expected Lifestyle

After determining when you want to retire, think about what kind of lifestyle you want to lead during retirement. For most people, this boils down to one of 3 lifestyle choices:

- A simple, minimalist lifestyle: This may include living in a paid-off or down-sized home, infrequent travel, and a slower pace of living. You would need to replace approximately 70% of your pre-retirement income for a simple retirement lifestyle.

- About the same lifestyle as now: For this lifestyle, your allocation of expenses may change, but you would generally maintain the life you are leading now. To maintain a similar lifestyle, you’ll need to replace approximately 80% of your pre-retirement income.

- A more expensive lifestyle: Say you want to travel more, upgrade your cars or home, and dine out frequently. You would need to replace approximately 100% of your pre-retirement income for a more expensive lifestyle.

Know Your Retirement Numbers

Setting goals for your retirement age and expected lifestyle puts you in an excellent position to determine a few of your essential retirement numbers, including your retirement savings target and your target savings rate.

Retirement Savings Target

There are a few methods for determining how much money you will need for retirement. By far, the simplest is the “multiple” method. Essentially, you take your current income and multiply it by a number, 15 being the industry standard, and that tells you how much you will need to save for retirement. So, say your current household income is $75,000. So, using the multiple method would tell you that you need $1,125,000 to retire comfortably. To account for different lifestyles or other mitigating factors, just scale the multiple up or down accordingly.

While the multiple method helps give you a quick estimate, Savology’s digital financial plans use the retirement income replacement percentage method. This method is much more specific and reliable. However, it can be pretty complicated for individuals to set up for themselves.

Target Savings Rate

Once you have a retirement savings target, your target savings rate brings that future goal into the present so you can do something about it.

Your savings rate is the percentage of your income that goes toward savings. Most financial professionals recommend a general savings rate between 10% and 15%, though the current savings rate in the US is only 6.9%. Yikes!

Your target savings rate can vary depending on the goals discussed earlier, i.e., how long you have until retirement and how much you need to save to achieve your desired lifestyle. If you start saving early, you might be able to get by with a lower savings rate. However, the later you start saving and the more you expect in retirement, the higher your savings rate will need to be to get the same results.

Make a Plan for Retirement

Okay, now that you know your numbers and have a couple of retirement goals, let’s talk about planning for retirement.

First, an encouraging stat: people with a financial plan are 2.5x more likely to save enough for retirement. That’s powerful! Just by having a financial plan, however simple, you are already taking a massive step toward bettering your financial future. Financial planning can get complicated, but for now, you just need to answer the following questions:

How much will you save now?

When you start saving toward retirement, your savings rate might be lower than your target. While this can be discouraging, remember that saving anything is better than not saving at all. The key is to be consistent work toward reaching your target. Then, it’s just a matter of staying the course.

How will you make that happen?

To meet your retirement savings goals, you may need to consider making changes. Look at your cash flow. Are you spending more than you need to in some categories? If so, cut back. Do you have a lot of debt? Prioritize paying it off so you can contribute more to savings. After you ask yourself a couple of these questions, you may find that you just don’t have enough income to feasibly increase your savings rate. In this case, you may need to explore ways to improve your income.

Saving For Retirement

Saving for retirement is no walk in the park. However, you will be much more likely to achieve your goals if you follow a few key retirement savings principles.

1. Start early

Time is your ally when it comes to saving for retirement. If you start early, you will spread your time horizon out. You will be able to put away less in savings each month and still meet your goals. This phenomenon is primarily due to the exponential effects of compounding growth or compound interest. We’ll talk more about compound interest later, but just know that Albert Einstein said it was “the most powerful force in the universe” and “the eighth wonder of the world.”

If you didn’t start saving early like so many Americans, that doesn’t mean you should give up now. The best time to start saving was years ago. The second best time to start saving is today.

2. Take advantage of retirement accounts

There are a number of savings accounts that are geared toward retirement. For example, many employers offer tax-advantaged retirement plans like a 401(k), 403(b), or 457(b). If you have access to a retirement plan through your employer, that is a smart place to start saving, especially if your employer provides a contribution match. Even if you can’t contribute the maximum amount, you should still find ways to take advantage of any employer incentives. Find out what is available to you and start taking advantage right away.

Individual Retirement Accounts (IRAs) can provide similar tax advantages, but you don’t have to access them through an employer. If you do not have access to a retirement plan through your employer or are already maxing out contributions to your employer plan, you might consider an IRA.

Nearly all employer plans and IRAs have you invest the money in those accounts, allowing you to multiply your returns over time.

Whether you use an employer plan or an IRA, using a retirement-specific account instead of a traditional bank account can provide substantial tax advantages and protections for your retirement nest egg.

3. Save as much as you can

Again, many experts recommend saving 10-15% of your salary towards retirement. If 10-15% of your salary seems unrealistic, review your monthly expenses to see if you can cut back anywhere to save more for retirement.

Most budgets have more wiggle room than you would expect. In a recent budget analysis, we found that reducing spending–not even eliminating it–in a few categories could save a family nearly $500 per month. Some common categories to cut back on include eating out, vacations, clothing, entertainment, and alcoholic or caffeinated beverages.

Take a look at your own budget. By simply making minor budget cuts in a few of these categories, you could increase your cash flow and save more for retirement.

Lastly, if you pay yourself first (i.e., put money in savings before spending it on other things), it is much easier to save enough.

4. Increase your contributions over time

Many retirement accounts, including 401(k) plans and IRAs, are tax-advantaged accounts that can help you save money on a tax-deferred basis. Using a pre-tax account allows you to save more from each check now without affecting your take-home pay as much.

In that same vein, you are likely to get raises or bonuses throughout your career. The average raise in America is about 3% every year. If you increase your retirement contribution by just 1-2%, you still end up with 1-2% in additional discretionary income. Likewise, you could contribute a portion of any bonus or tax refund you receive to your retirement savings. These saving habits are a win-win for your wallet and your retirement

Make the decision now to increase your contributions over time by saving a portion of your money before it ever hits your bank account. Doing this will improve your chances of retiring comfortably.

5. Bonus Tip: Don’t forget to account for inflation

It is easy to forget that future expenses come with a higher price tag. If your current income is $50,000, that income will have much less buying power when you retire due to inflation. You can mitigate this by thinking of your target retirement income in terms of buying power. So, say you plan to retire in 2050. According to current estimates, if you want $50,000 of buying power in 2050, you’ll need around $100,000 and then more each subsequent year to account for inflation in retirement. Something to keep in mind as you plan.

Investing For Retirement

We’ve already touched on the power of investing your retirement savings and the effects of compound interest. Many retirement accounts allow you to invest your savings, and some will even manage your investments for you. However, it is vital that you are familiar with some best practices so you can feel confident as you make investment decisions for retirement.

Invest in the Market

Investing in the market means putting your money to work for you by purchasing stocks and bonds intended to increase in value or appreciate over time.

The stock market has an overall track record of success, with average annual returns ranging from 8-11%. That doesn’t mean that every year produces high returns, but over time, the stock market has consistently trended in a positive direction that has outpaced inflation.

With the average length of a working career at about 40 years, investments can have a significant amount of time to appreciate.

For example, an investor who started investing in the S&P 500 in 1980 would have experienced an annual 8.8% return over 40 years. That puts their overall re A one-time investment of $10,000 at that time would be worth nearly $240,000 in 2020, and an investor who contributed $10,000 per year starting in 1980 would have over $3 million after 40 years, despite having contributed only $400,000 during that period.

With that in mind, investing in the market is key to improving your retirement outlook.

Compound Interest

Investing in the market allows your savings to experience the power of compound growth.

As mentioned earlier, compound interest is the interest, or returns, calculated on the initial principal as well as the accumulated interest over time. In other words, it is interest you earn on top of interest, or money that makes you more money.

Still confused? Let’s look at an example:

Suppose you receive a bonus of $5,000. Congratulations! However, instead of blowing it all right away, you decide you want to save the money. So, what’s the best way to save it? Putting the money in a savings account at your bank, you could earn 0.06% in interest year over year. After 10 years, assuming you don’t touch the money, you would have accumulated an additional $30, bringing your total to $5,030. That’s not a lot of growth in ten years, especially considering the inflation rate is between 2% and 3% most years.

If, however, you invested that $5,000 in the market, you would see drastically different results. After diversifying your investments, you could realize a realistic annual return of 7.27%, the average 10-year return of some investment portfolios. After 10 years, your account would have accumulated an additional $5,086, more than doubling your money!

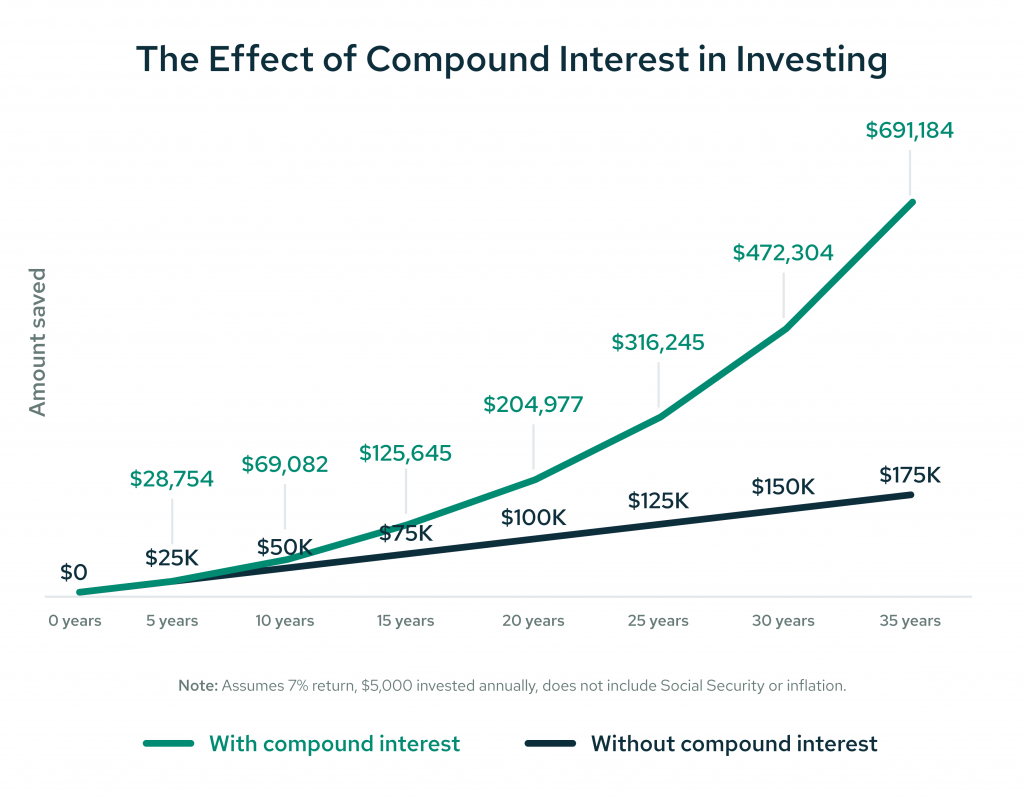

When you are investing for retirement, you should also consider the effect of making annual contributions to your retirement accounts. Let’s look at the effect of saving $5,000 per year. Even if you start with $0, if you save consistently, your results may surprise you.

Your nest egg can grow to be nearly $700,000 in 35 years, despite only having contributed $175,000. That is a difference of more than half a million dollars.

That is why compound interest is so powerful. Saving enough for a comfortable retirement would be next to impossible without it.

Index Investing

There is a lot to consider when it comes to investing your money. Some of the most important considerations are cost, risk, and diversification.

Navigating individual stocks, bonds, and mutual funds can be difficult, expensive, and risky. Furthermore, if you have all of your eggs in one basket, you may be exposing your retirement savings to unnecessary risk, especially during times of uncertainty or recession.

You might have heard of the good, better, best framework. Let’s apply that to investing.

Good: In this case, investing in the market, even if it is in individual stocks could be considered good. You have the chance of increasing your savings if that one stock performs well. But that doesn’t come without risk.

Better: Investing in select mutual funds or ETFs would be better. By doing so, you are gaining investment exposure to a broader array of companies, sometimes even several hundred at a time. This makes it less risky. However, notable downsides could be that they generally are more expensive and still don’t help you diversify across all asset classes.

Best: Index funds could be considered the “best” option for investing in equities, especially for beginners. Index funds are very large, well-diversified securities within a specific asset class that are selected by investment professionals to match the performance of a specific index, such as the S&P 500 or NASDAQ. Because there isn’t a middle man actively managing the funds, index funds have lower fees and they mirror an entire index, so they are well diversified.

For reference, here are a few examples of index funds:

- SPDR S&P 500 ETF (SPY)

- Vanguard Total Stock Market ETF (VTI)

- iShares Russell 2000 ETF (IWM), and

- Fidelity U.S. Sustainability Index Fund (FITLX)

Successful investors have been using this index investing technique for years.

Billionaire investor Warren Buffett advised:

“By periodically investing in an index fund, the know-nothing investors can actually outperform most investment professionals.”

Statistically speaking, outperforming index funds is very difficult, especially over a long period. Over a recent 15-year period, nearly 92% of professionally-managed funds underperformed the related index when also factoring in fund expenses.

Our advice: Don’t gamble with your hard-earned money trying to chase returns by buying individual stocks. Don’t let investment management fees eat away at your potential earnings. Investing in index funds with your retirement account is a simple, low-cost, and well-diversified option that will produce great returns while mitigating risk.

Model Portfolios and Target Date Funds

Using index funds can help you diversify across an individual asset class, but may still leave some opportunity on the table for managing risk and reward.

For reference, an asset class is a group of similar investments. For example, equities or stocks are an asset class. Fixed income or bonds is another asset class. Real Estate, Commodities, and Currencies are asset classes, too. You get the picture.

With that in mind, you may want to consider diversifying across multiple index funds, one or more for each asset class you want exposure to.

If you don’t want to pick index funds on your own, Model Portfolios and Target Date Funds are good options. These two investments introduce multiple asset classes into one investable bundle to create a diversified portfolio.

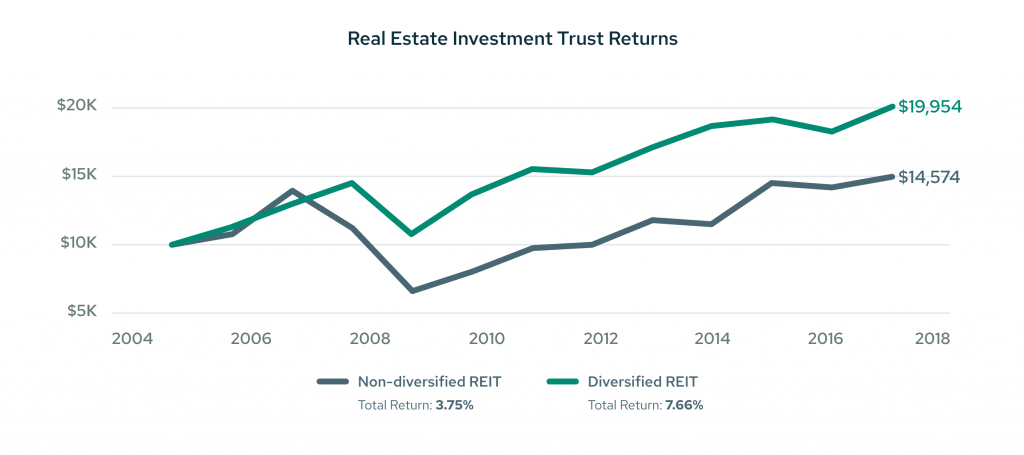

To demonstrate the effects of diversification, let’s look at recent real data of a single asset class, a Real Estate Investment Trust containing real estate properties.

The gray line in the chart below shows funds that are not diversified. As you can see, they achieved an average return of 3.75% over this period because of the volatility of the fund, especially in the decline during the 2008-2009 recession.

The green line, however, represents a diversified portfolio consisting of several different funds from several different asset classes. You can see that its diversification improved its stability throughout the 2008 crisis. It produced a 7.66% return over that same period.

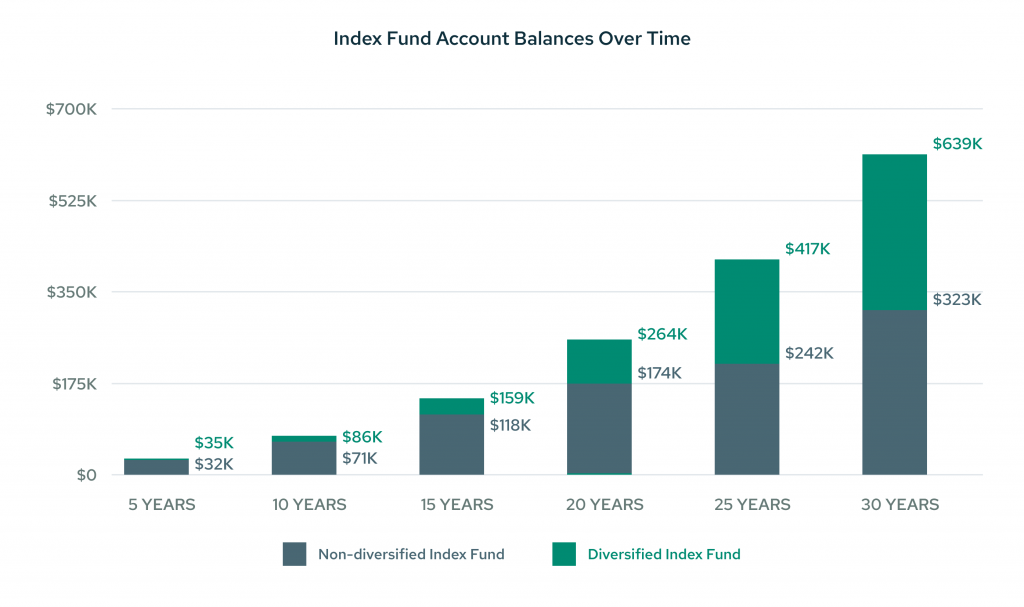

Over the course of your career, diversification can have a large impact on your index fund portfolio. As you can see in the chart below, over the course of 30 years, a well-diversified portfolio can experience nearly double the earnings of a non-diversified portfolio.

What Is a Model Portfolio?

Model Portfolios are also known as allocation models, risk-based models, or managed portfolios. The concept behind a model portfolio is that a fund manager, or management company, compiles a group of investments for someone to invest in, generally based on risk tolerance.

An aggressive model portfolio could have anywhere from 90% to 100% invested in equities. For example, a 90/10 model would mean 90% of the portfolio is invested in equities and 10% is invested in fixed-income investments like bonds. A conservative model might have 20% invested in equities for minimal exposure to domestic and international stocks, and the other 80% is invested in fixed-income investments.

It is up to you to figure out your risk tolerance and select an aggressive or conservative model accordingly.

For reference, here are a few examples of model portfolio funds:

- BlackRock 60/40 Target Allocation Fund (BAGPX): 60/40 ratio of equity to fixed income

- Fidelity Asset Manager 85% Fund (FAMRX): targets 85% allocation to equities

- Schwab Balanced Fund (SWOBX): targets 50 to 70% equity

A good rule of thumb is to assume more risk when you are younger, then decrease risk leading up to retirement, so your savings don’t fluctuate as much. A good way to automate that is with a target date fund.

What Is a Target Date Fund?

Target Date Funds are similar to Model Portfolios in many ways, but a primary difference is that Target Date Funds are designed to change over time according to your age or your target retirement age. For that reason, target-date funds are occasionally referred to as glide paths.

With a target-date fund, you select a target year of retirement and the fund adjusts for you over time by changing its underlying investment composition. Like model portfolios, they provide exposure to many asset classes.

For reference, here are a few examples of target-date funds. The year indicates the approximate age that you are planning to retire:

- Vanguard Target Retirement 2040 Fund (VFORX)

- American Funds 2035 Target Date Retirement Fund (AAFTX)

- Dimensional 2050 Target Date Retirement Income (DRIJX)

- Schwab Target 2060 Index Fund (SWYNX)

Although it isn’t generally recommended to just set it and forget it with investments, Target Date Funds provide a lot of value for minimal effort. Overall, they are a simple, yet sophisticated way to invest for retirement.

Conclusion

By now, you should have a good understanding of how much you need to have saved in order to retire with your preferred lifestyle. You should also be armed with the saving and investing know-how that you need to make smart decisions. Remember that the earlier you start, the better off you’ll be, but it’s never too late to start planning for retirement. Even if you’re only a few years away from retirement, having a plan is better than having no plan and just hoping for the best.

Remember your retirement numbers, and commit today to work toward your target savings rate. If you’re still feeling lost, check out our other articles on retirement planning, and create a financial plan with Savology. It’s free to sign up and we take care of all the calculations. No complicated spreadsheets or math that you haven’t done since middle school. Just a quick survey and then real actionable insights into your financial future. Try it today!