Personal financial planning paves the road to success

Establishing clarity around your finances is arguably one of the most critical things you can do for your overall financial success. It is important to understand your financial needs and then to create a financial plan to meet them.

Without understanding what is needed, it can be extremely difficult to achieve financial security. Actually, it can be next to impossible. Once you have a good understanding of what you need to have a healthy financial life, you can then create goals as a way to help you improve your financial situation.

The benefits of personal financial planning

There are countless advantages of financial planning that come immediately from having a financial plan. From emotional and health associated benefits to social and financial benefits, financial planning has a net positive impact on every aspect of your life.

While several dozen benefits exist, there are some that have more impact than others. Below are several key benefits that come as a direct result of creating a financial plan.

- The process of financial planning helps you set goals

- Financial planning is a great source of motivation and commitment

- Financial plans provide a guide for action and decision-making

- Financial plans set performance standards

- Financial planning has additional emotional and mental health benefits

- Financial planning is shown to improve financial outcomes

With these in mind, let’s take a more detailed look into each one of these to get a better understanding of the benefits of financial planning and the impact it can have on your life.

Benefit 1. Financial planning helps you set and reach your goals

Financial plans help individuals create and set goals to work towards. Goals are what give people direction and purpose in their lives. When individuals have clear goals in mind, it gives them something to focus on.

People that have clear goals they are actively working towards are around 10 times more likely to succeed. Yes, ten times! That alone should be enough motivation to create a plan for your finances.

Financial goals are important for people to have when it comes to having a stable and enjoyable life. Personal finances are an intimate part of every person’s life because money is often a medium to help people achieve their most cherished life goals. It’s particularly important to balance short-term, medium-term, and long-term goals with your finances.

Here are a few recommendations for setting and achieving solid financial goals:

- Personalize your goals: It is important to make sure that you have personalized goals according to the life that you want to live and according to your personal situation.

- Make educated goals: Having an understanding of what things are needed to protect and establish yourself financially is very important. It is important to do your research and due diligence when you set your goals.

- Review your goals often: The more you review your goals the higher probability you have of achieving them. This is because every time you review them you are focusing on them. We accomplish the things that we focus on. This is why Savology recommends that you review your goals often, at least monthly. Many people review their goals daily and find success in doing so.

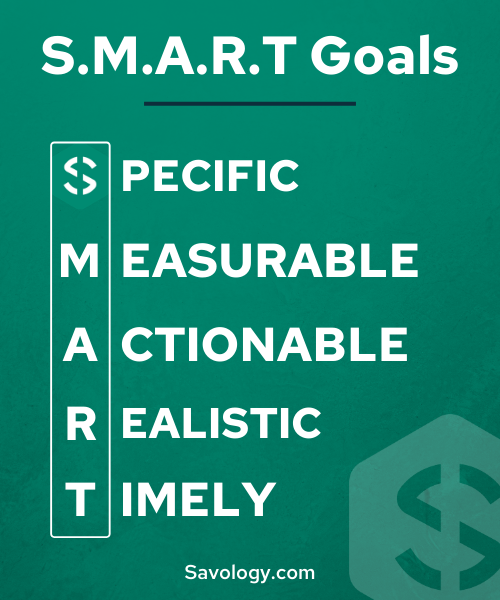

- Set SMART Goals: You need to know what your goal actually is and when it is considered to be completed. With a smart goal, the key is to have a specific goal that is measurable, achievable, relevant, and timely.

- Visualize your goals: The act of visualizing your goals before they happen is a powerful technique to help you gain momentum toward achieving them. Michael Jordan always took the last shot in his mind before he ever took one in real life. Visualize your financial goals every day in order to make them a reality.

- Align goals with values: When goals are aligned with your values it creates a much stronger motivation to accomplish them. When you have a strong enough “why” behind the goals you are seeking to accomplish, you will find a way to make the goal happen.

Goals help to give you direction, purpose, and motivation in your life.

A notable religious leader, Thomas S. Monson, once said, “Our purpose is to steer an undeviating course in that direction. A man without a purpose is like a ship without a rudder—never likely to reach home port. To us comes the signal: Chart your course, set your sail, position your rudder, and proceed.”

This is exactly what a financial plan can do for you.

Benefit 2. Financial plans are a great source of motivation and commitment

People are not often motivated when they do not have clear goals and do not know what is expected of them. A financial plan reduces uncertainty around finances by providing clarity and indicating what you are expected to accomplish. You are more likely to work toward a goal that you know and understand.

When you have a clear call to action through a financial plan, the ambiguity is no longer there to cloud your judgment. When you are ready to make positive changes in your life, then the plan leaves room for little hesitation. This allows for quicker action which increases follow-through. The longer you wait before taking action, the less likely you will be to take action. Motivation and commitment to goals are very highly correlated with:

- Having a financial plan in place

- Having a big enough reason “why” behind your plan

- Making it easier to accomplish your goals

Benefit 3. Financial plans provide a guide for action and decision-making

Financial plans can direct actions toward desired outcomes.

When actions are coordinated and focused on specific outcomes they are much more effective. Savology has been able to identify and help solve the problem that many millennials don’t know where to get started with their finances.

Taking action with financial decisions can be hard for a multitude of reasons. There is a lot of stress and shame around money which makes people want to avoid talking or thinking about it. Personal finances often incorporate terms that many individuals are not familiar with. This creates an even larger problem when you add that to the fact that financial decisions are often big decisions that can have lasting consequences, negatively or positively affecting you for the long term.

Personal finances have many layers to them and it can be hard for one to make financial decisions when there are so many options out there.

A financial plan will help you identify clear actions to take in order to put yourself in the best financial position. When a trusted expert spells out what things need to be done, it is much easier to take action with confidence.

Benefit 4. Financial planning has additional emotional and mental health benefits

There are emotional and mental health benefits behind having a complete financial plan. Individuals with a plan are less stressed and tend to be more optimistic about their future compared to those that do not have any sort of financial plan.

Having a financial plan that you can refer to can increase mindfulness about your personal finances which in turn lowers stress levels around money. When you have a plan in place, you are more likely to overcome setbacks.

A recent survey indicated that 83 percent of people with a written financial plan feel better about their finances after just one year.

More importantly, when individuals improve their lives in one area it has a natural carry-over effect on other areas in their life. This means that having a written financial plan not only improves your finances, but it can help your overall health and well-being.

Benefit 5. Financial plans help set performance standards

Planning defines desired outcomes as well as milestones to define progress. These provide a standard for assessing when things are progressing and when they need correction.

There are general financial standards that individuals should be meeting in order to be in a good place financially. These include having money set aside for emergencies, not taking on too much debt, saving for retirement and more. When you have a personalized plan to follow, it allows you to know exactly what steps you need to be taking to meet your goals.

A few examples include the following:

- Increasing your savings rate to 15% to save enough to retire by 65

- Pay down $10,000 in high-interest debt to lower your debt-to-income ratio

- Get an additional $150,000 in term life insurance to have adequate coverage for your family

When you have a financial plan to measure yourself against it allows for both self-improvement and self-evaluation. You will have a comparison to overall standards and recommendations that will bring you to the best financial position for your goals and objectives.

Benefit 6. Financial planning is known to improve financial outcomes

Last but not least, having a financial plan often improves financial outcomes over time. Those with plans are more likely to be prepared for financial emergencies and retirement.

A financial plan allows you to begin with the end in mind. This gives people the proper perspective to balance their current goals and needs vs future goals and needs. A plan helps people to give attention to the future as well as today.

Savology’s own market research found that people with a written financial plan are two and a half times more likely to save enough money for retirement. You have to know better, in order to do better. A written financial plan helps individuals to know better so that they can start to do better.

Where to start planning your finances

If you’re not exactly sure how to start your financial planning journey, here are a few available options that can help you create your financial plan.

1. Read a personal finance book and create your own financial plan

If you have the dedication to learning how to plan on your own, there are a few good resources out there that can help. Here are a few of our favorite personal finance books to help you get started:

- I Will Teach You To Be Rich – Ramit Sethi

- The One-Page Financial Plan – Carl Richards

- Financial Freedom: Finding What Works For You – Greg Kesten

- The Ultimate Financial Plan – Jim Stovall and Tim Maurer

- The Financial Planning Workbook – Coventry House Publishing

2. Build a free financial plan with Savology

If you are just getting started on your financial journey, look for a fast and free financial planner that can get you moving in the right direction.

Savology is a free financial planning platform where you can receive a personalized financial plan in just 5 minutes.

Your free financial plan will give you action items to start working on as well as an overview of your current financial situation. Savology also saves you a considerable amount of time and money by connecting you with quality providers that can help you accomplish your advanced goals.

3. Use a traditional financial planner

Traditional financial planning can be very effective for those who can afford it. A good financial planner will take the time to review your current financial situation in detail and create a comprehensive plan to move forward. Here are a few resources that you can use to find a traditional financial planner:

Reaping the benefits of financial planning

As you can see, there are a lot of ways to go about financial planning as well as a lot of benefits that come with planning. The important thing is not necessarily how you go about it to begin, but that you get started. First, make the effort to create a financial plan to help guide your financial decision-making and improve your financial outcomes. Use the momentum you have gained to continue making progress and continue working towards your goals and final destination.