An Introduction to The Zebra Insurance

Auto insurance rates across the U.S. are higher than ever, and constantly increasing. The Zebra Insurance helps consumers compare their insurance options, which is helpful for a checkup on your current policy and education on where to get started.

The process is quick and easy, and inherently offers plenty of good insights to prepare the user to select the best policy for them. And with The Zebra, you’ll find plenty of additional insights to guide you through your decision. Their research is robust, having analyzed 73 million rates to reveal those trends impacting rates, and which drivers pay the most. So you can be confident you are finding the best option available.

The Zebra Overall Rating: 4.7 ★ / 5★

The Zebra is an obvious leader in the confusing and frustrating auto insurance space. They have filled their role well by leveraging a deep list of providers to choose from, many with specific quotes that are shared after a quick survey. It’s easy to use, educational, and efficient. One of the biggest fringe benefits is that your information isn’t shared and you don’t have to worry about a bunch of spam after the fact.

Pros & Cons of The Zebra

Pros of The Zebra

- Comparison: Instant quotes from over 100 top providers.

- Simple: Customize your insurance needs

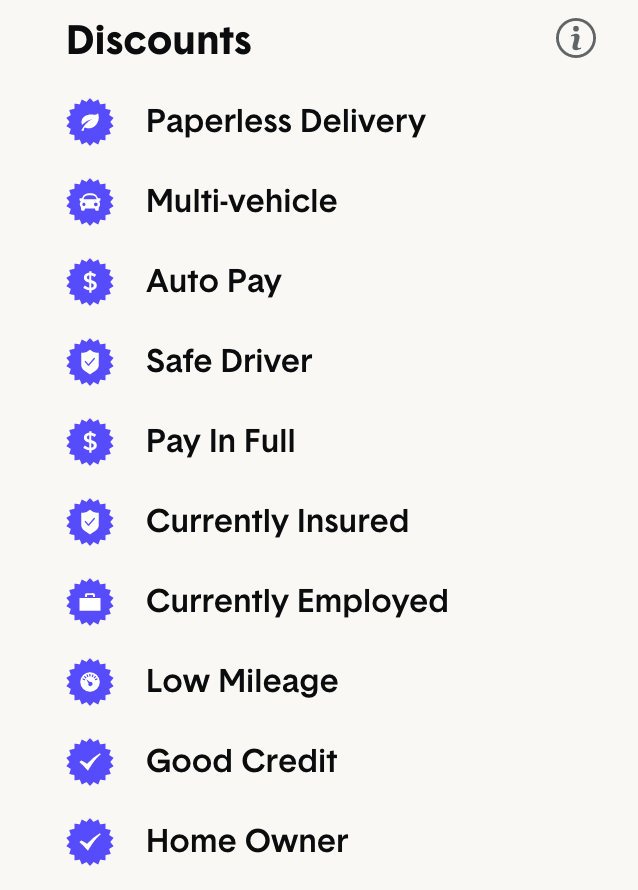

- Save: Save up to $670 a year by optimizing discounts

- Speed: Compare dozens of quotes side-by-side in just 90 seconds.

- Hassle-free: No texts. No unwanted emails. No spam.

- Backed by data: Original research and educational tools

- Independent and Unbiased: No allegiance to any one provider

- Major Provider Partnerships: Partner only with reputable insurance providers

- Additional Products: Home and renters insurance too, and more to come…

Cons of The Zebra

- Sealing the deal: All policies have to be completed with the provider of choice, and some insurance providers require visiting their site directly to finish the quoting process.

- All at once: The different comparison engines for home and auto insurance don’t share information so you need to re-enter that information for each.

The Zebra Pricing: 5 ★ / 5★

Using The Zebra is completely free and there’s no commitment required to get a quote for the best prices available. And the savings can be considerable – up to $670 a year or $54 a month. You’ll have plenty of options to consider when you’re done, and it really only does take a couple of minutes.

And if you’re not ready to pull the trigger right away, you can revisit your quote at any time via the site, or from the simple email, you receive right afterward. And because pricing changes so often, The Zebra will automatically refresh your pricing when you get there.

And as a bonus, you’ll get all this free of spam. The Zebra makes their money from insurance providers, not you. So, it’s a huge added bonus that you won’t get spammed as a result of taking a couple minutes to explore your options. Privacy and transparency really seem to matter to The Zebra, and they pledge to never sell personal information to spammers or bombard you with annoying calls, texts, and emails.

Remember, you’ll complete your transaction with the insurance provider of choice. So, what you pay may be influenced by subsequent interactions with an insurer. However, this is as efficient a process possible to get a quote and know what you should be paying prior to sealing the deal on a new policy.

The Zebra Service: 4.7 ★ / 5★

With such an easy to use tool, there isn’t much need for customer service from The Zebra. But in the event that your situation is unique, you will be provided with a way of reaching out to an agent throughout the process.

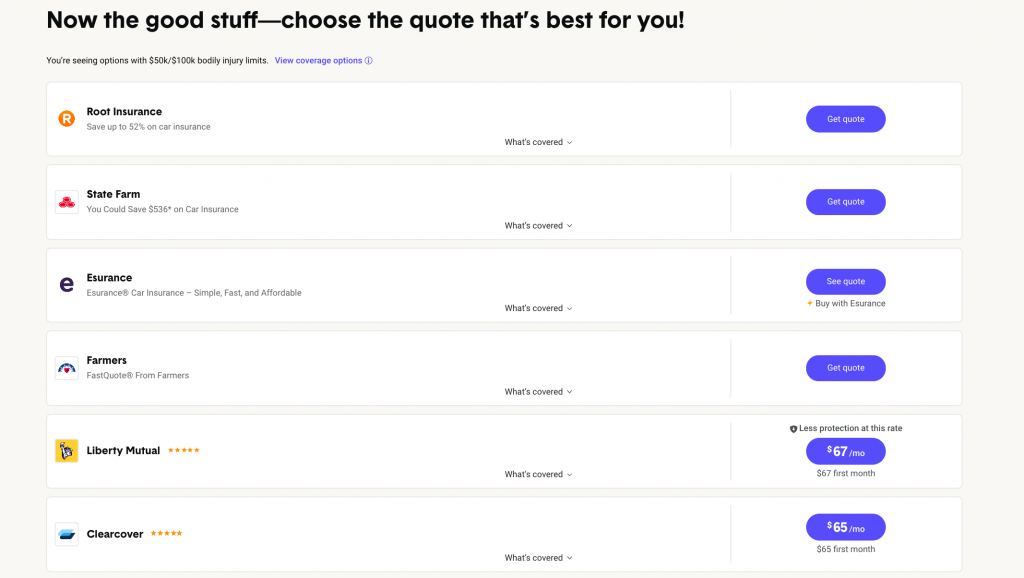

The Zebra does a great job listing the providers in order of relevance and savings. Not all quotes will have a price, but even then, the most likely opportunity for savings seemed to be at the top of the provider list. And you’ll get a summary email with your best price and top providers.

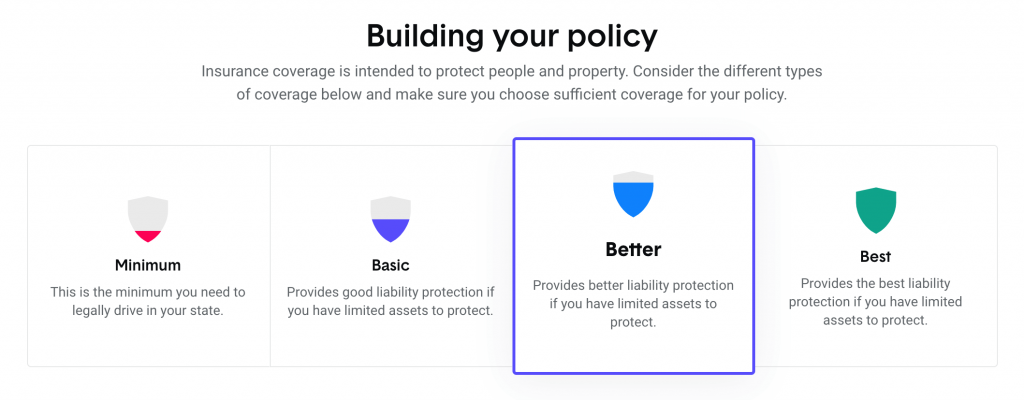

But perhaps my favorite service was the ability to customize my quote from templated coverage options of ‘Minimum’, ‘Basic’, ‘Better’, and ‘Best’. Not only does it help you get a more accurate quote to meet your needs. But it also teaches users how and where to look for savings best most relevant to them.

Another big win from The Zebra is that they promise a hassle-free savings without the spam. Some quote comparison engines will provide your email or phone number out to each provider and let them attack you with follow up. Committing to no text or email spam truly makes the experience risk-free.

You’ll also be sure to notice the refreshing simple and direct way that The Zebra communicates. They eliminate the jargon. And for anyone who has been swooned by a quick-talking insurance salesperson before, you’ll appreciate their approach.

The Zebra Reputation: 4.6 ★ / 5★

Having been around since 2012, The Zebra is well funded and has built a solid management team while leveraging an idea that initially proved itself out in Europe.

The Zebra takes great pride in being an independent, trusted voice of leadership in a category fraught with bait and switch tactics and deceptive, dishonest practices. Their ultimate goal is to be a trusted partner for consumers, successfully establishing the peace of mind that comes with securing the right coverage for their specific needs.

This approach has resonated with consumers as evidenced by The Zebra providing millions of quotes each year. And as a truly independent source for insurance, it is their promise to continue to provide transparency, offer educational tools, and create a frictionless experience for users.

The Zebra Ease of Use: 4.7 ★ / 5★

The process of comparing quotes on The Zebra centers on completing a simple survey. It’s quick and easy, and it even provided some education along the way. Plus, it was able to import some information along the way, so I didn’t need all of my personal records on hand. I could do everything from the top of my head.

As previously mentioned, The Zebra is refreshingly candid and easy to connect with. Self-aware enough to see their industry is far from perfect, they’re confident in their belief that they’re helping to make things better. With a wink and a smile, they see themselves as the study-buddy consumers need to help them to untangle the complicated insurance jargon while still knowing when they can have a bit of fun.

Unbiased and independent, they have nothing to lose and everything to gain by being as straightforward as possible. They educate and empower. They speak from experience for the benefit of their audience. But that doesn’t mean they talk at (or even worse, talk over the heads of) the folks they’re trying to help. Their aim is to add value and make information accessible, and easily understandable, for all.

And they’ve got the experience to do so. The Zebra’s 2019 State of Auto Insurance Report analyzes more than 61 million auto insurance rates to examine how dozens of risk factors affect pricing, what trends are causing rates to skyrocket or plummet, and where that’s happening nationwide.

The Zebra Offering: 4.4 ★ / 5★

Perhaps most important to The Zebra offering is that the platform is independent and unbiased. They’re not an insurance provider and do not hold allegiance to any one partner they work with.

But they do partner with major auto insurance providers, over 100 of them. And they only partner with reputable insurance providers that adhere to the same level of professionalism and quality control that they do.

It is great that they don’t just provide a list of potential insurance companies, but they offer many actual prices at the end of the process. Sure, those prices might be subject to change if you modify the options, but it guides you to a comfortable starting point to close the deal.

Because these policies have so many details that can be customized, The Zebra lightens that burden a bit by providing some simple ways to think about and then start customizing your policy. These four buckets (listed as Minimum, Basic, Better, and Best) give you a solid starting point for your policy and then calculate the corresponding change to price for each. This is a great way to get a feel for if you are over- or under-insured.

The Zebra Innovation: 4.8 ★ / 5★

In today’s world it’s easy to take for granted how convenient comparison shopping like The Zebra can be. Keep in mind how difficult it is to be able to provide quotes from this many different partners. Each time a price is listed, considerable work had to be done to make that dynamic so you can see quotes in real time. The Zebra currently casts the largest net for auto insurance comparison quotes. Their work has been considerable and earns them some serious innovation points.

The Zebra’s initial entry to the market was focused on auto insurance, but recently expanded into homeowners and renters insurance. They have additional plans for the future including renters, RV, boat and more. Certainly, additional offerings will come with time and that is helpful because many consumers evaluate these different insurance providers at the same time and can receive a bundled discount for doing so, which is something built into The Zebra process.

Given the nature of the way the company started and has thrived, innovation does appear to be a part of everything they do (considering how the idea was birthed, to some of their early investors like Mark Cuban, and the management team that they’ve built).

The Zebra Onboarding: 4.5 ★ / 5★

Anyone who has shopped for auto insurance in the past can recognize how much time this process can take. While The Zebra doesn’t always send you off with a policy in hand, it does educate, prepare, and jump start that process well. Here are some of the claims they make to reference just how quick and robust the services are:

- Get instant quotes from over 100 top providers.

- Compare quotes side-by-side in just 90 seconds.

- Get dozens of quotes in just 90 seconds

Another important part of onboarding is the fact that finding quotes on The Zebra and having an auto insurance policy in place are two different processes. Getting onboarded to The Zebra is quick and seamless. The entire survey literally takes approximately 90 seconds, as advertised. That assumes you can rattle off a few specifics about your address and vehicle information. But this wasn’t a high bar, not once did I have to look anything up from my personal records.

Once you’ve got a list of quotes and potential auto insurance providers, you’ll need to click through to those specific insurers to create a binding policy. The only way this wouldn’t be possible was if The Zebra was insuring you themselves, which would eliminate the broad market net they are casting for you. So, it’s an inherent gap. Just don’t expect to leave the experience with a policy. But you can expect to have better auto insurance quotes than you currently do.

The Zebra Limitations

While there are some templated policy customizations you can make (i.e. minimum, basic, better, best) there is a limit to those customizations. And those details will have an impact on what you end up paying for a new insurance policy. And those details really require working directly with a selected insurance provider. So, there is still some room for frustration before you get a new policy, depending on which provider you choose.

Also, if you bundle your home insurance and auto insurance like I do, you’ll first be excited to see they offer comparison shopping for both. But then there is a bit of frustration that data won’t pull through from the first time you input everything. Regardless, not a huge inconvenience but it would be nice. And note that the homeowners survey is much lengthier than the auto insurance survey.

There was not a ton of information to distinguish between the various insurance providers. Obviously, price will be the one that most users are looking for and it’s not available for every insurance option. But of the various quotes we tested, there were at least a few specific prices listed each time.

Is The Zebra right for you?

If you’re looking for somewhere to start the auto insurance search process and either evaluate your current rates or decide what a competitive price to pay would be, you can’t ask for a more comprehensive solution. It might also teach you a lot about what goes into pricing a policy and provide some best practices or tips for pursuing your next policy.

Remember, don’t expect to leave with a policy in hand. You’ll still need to seal the deal directly with an insurance provider. But The Zebra can jump start that process and arm you with all the information you need to find a competitive auto insurance policy. This is great for anyone who is price sensitive and doesn’t want to take all the time required to research a bunch a providers and evaluate each on their own.

This review is provided by and expresses the opinions of Savology to help users make informed financial decisions. Many of the featured products on this site connect to our affiliate partners. Partners may provide compensation to Savology for referrals, which in turn allows Savology to provide the digital financial planning platform to more people. Compensation does not influence the product evaluations or recommendations.

This review is provided by and expresses the opinions of Savology to help users make informed financial decisions. Savology does not receive compensation for its provider recommendations.