Financial planning can be a very confusing world to step into, regardless of your education and experience with money. It can be even more confusing when you are worried about your finances and wondering whether or not it is worth it.

While the profession, or practice, of financial planning has existed for quite some time, there are people who are extremely familiar with it, and others who are completely new to the world of financial planning.

Financial planning is one of those fields that has changed a considerable amount over recent decades due to a combination of transparency, regulations, and technology.

In this article, we’ll break down traditional financial planning vs the new era of financial planning, and how technology is helping financial planning evolve to better help consumers reach their goals. .

An introduction to financial planning

At its core, financial planning is there to help people better understand their current financial standing. Financial planning also serves to help people understand wealth and building wealth (primarily through investing and saving). However, financial planning is much more than that.

Despite what many think, financial planning is more than investments and savings. It takes into consideration every area of our financial lives ( taxes, estate, insurance and risk, etc) to make sure everything is working together like a well-oiled machine so you can reach your goals and live the life you want to live.

That sounds great, but how do you get there? First, we need to understand why financial planning is important.

Also, as a side note, basically everyone worries about their finances.

Why is financial planning important

Every single one of us has worried about our finances at least a few times in our lives, maybe even more. Trust me, it is not fun. Having a financial planner that understands the ins and outs of finances can save you from a lot of headaches and late nights trying to figure out how you are going to make it work.

Your financial plan (and advisor) can not only give you peace of mind that you deserve, but they can help you make money by helping you understand how to make your money work for you and build your net worth. One of the most common use cases for financial planning is to help people with retirement calculations and to plan their next steps to reach their desired retirement outlook.

Along with building your wealth, financial planning helps you reach important milestones. When you are able to understand and improve your finances, you start to gain more confidence not just in your finances, but in many other areas in your life as well.

Traditional Financial Planning

Traditional financial planning is typically where you will meet with a financial professional, often referred to as a financial planner or advisor. Financial advisors will go over your finances and help you find ways to make improvements. They can help you with retirement, wealth management, risk management, and much more. Below we will talk more about why you should consider a financial advisor, how much it will cost you and the pros and cons of having an advisor.

Why should you consider getting a financial planner?

The main job of a financial planner is to help manage your wealth, help you understand how your finances work and finally help you set and reach financial goals. They can also help you when the economy is unstable or in a crisis. The upside of having a financial planner, especially when the economy is going down, is that they keep you focused, accountable, and ensure that you avoid any irrational decision making.

With your personal finances, you might be able to get away with one irrational decision. However, a series of bad decisions could end up costing you thousands or hundreds of thousands of your own money.

That is why advisors can help you stay focused on your financial goals and look at the bigger picture rather than focusing on the little bumps in the road.

How much does traditional financial planning cost?

Financial planning has gone through quite the change in pricing over the years.

Traditionally, the most popular way to charge for a long time was based off of a certain percentage on the clients portfolio. In addition to that, advisors earned (and still earn) commission for specific types of products (insurance, investments, etc) that they would sell. This is something that has become frowned upon, especially if certain products have a greater commission than others – then acting in the best interest of the client becomes difficult.

More recently, the industry has seen a shift towards fee-only or fee-based planning. Fee-only financial planning is where the advisor will have a one time fee for the year. This is nice because it typically means that they will always act in your best interest seeing as they are not making any additional money on commissions.Fee-based planning on the other hand is where advisors make money on the fee and from commissions and other brokerages fees.

Pros of traditional financial planning

The traditional way of financial planning would have you regularly meeting with an advisor at their office where you would sit down and talk about your financial goals. There are a lot of pros to that, but the biggest benefit is having the human element due to the ‘personal’ aspect in personal finances. When you have an advisor that you can trust and rely on, then you’re in a very fortunate position.

Cons of traditional financial planning

The bigger the advisor’s client base, the less time you will have with that advisor to meet in person or have longer conversations with. While they will often be able to have access to more resources, they won’t always be able to dedicate the time you deserve as a client. For some people that is fine and even how they would prefer the relationship. However, for others, they would prefer more time spent with their advisor, especially nearing specific goals such as retirement.

Another downside is that not all advisors will act in your best interest. Historically, this has been influenced by specific products and services having higher commission payouts compared to others.

The last big con, or downside, is that financial planning can end up costing both a lot of time and money. If you feel you are not getting your money’s worth or your advisor is not putting your best interest first, then there’s a good chance you are overpaying. It’s critical to make sure that you fully understand how their fees are structured, how much you are expected to pay, as well as making sure that your expectations are communicated well.

What to look for in traditional planning

There are a lot of great financial planners trying to help people. First, you will want to look for a financial planner that has proper certifications and designations. The Certified Financial Planner (CFP) is the first one you should look for when looking for a financial planner. This shows that they have passed and meet the rigorous ethical standards, training and education that has been met by the CFP board.

Another certification you can look for is the Chartered Financial Analyst (CFA) which focuses on financial analysts used for investing type planning. If you have a lot of large assets, such as properties, in your name then you will want to look for financial planners that have the Chartered Trust and Estate Planner (CTEP accredited estate planner), Accredited Estate Planner (AEP), Certified Trust and Fiduciary Advisor (CTFA) are the main certifications to look for if you want to focus more on estate management.

New era of Financial Planning through technology

As technology becomes more integrated in our world, how is the financial planning industry going to survive, and how can technology make financial planners better and help build better connection with consumers?

Accessibility

In the past, individuals and households working with an advisor could only see their accounts in person or their advisor would need to email it to them or call over the phone.

Now, things look much different. You can access and for the most part manage their accounts from anywhere in the world thanks to technological advances. You can even make changes to your account settings directly on your phone or laptop, within minutes.

This also provides a lot of flexibility when it comes to customizing your account and your financial plan. One of the biggest areas that technology benefits financial planning is the data (information) management, all of which can be updated, displayed, and updated again in just minutes.

As a quick example, meeting with an advisor would historically take a few hours, and then several additional hours for them to work with your numbers and determine your next moves. Between taxes, income, savings, debts, insurance coverage, there is a lot to process. Thanks to technology and algorithms, all of this information can be entered, analyzed, reviewed, and compiled into a personal financial plan with actionable next steps in minutes.

The same rings true when it comes to updating information critical to your plan. Things such as an increase in income, eliminating your debts, etc. Typically, this has once again taken several hours through a traditional advisor to make these updates—With technology, this only takes minutes.

Flexibility

Not only does technology provide flexibility for consumers, but it also provides a lot of flexibility for advisors as well. Instead of having to schedule a meeting or resort to email, advisors and financial planning companies have a lot of available options, which significantly benefits the client. From online live chat and SMS to even taking video calls, technology makes it easier than ever to connect with others.

Human touch

While this one might not have been your most obvious guess, technology is actually a great way to facilitate human interaction. It can help free up time so advisors can get more interaction with their clients and help support them in anytime that they need. Having a level of human interaction is very important for everyday consumers to know and feel that there is someone, a real person, on the other side that cares about their future.

Affordability

One of the biggest benefits of technology-enabled financial tools, such as financial planning services, is that technology allows companies to provide services at scale for a fraction of the cost. Ultimately, this allows companies to provide the same level of service, in most cases, at a price point that works in favor of an individual’s future.

Additionally, because many of the major areas such as budgeting and investing can be automated, it allows people to gain back their valuable time which they can put to use for other important areas such as quality family time and looking for ways to increase their income.

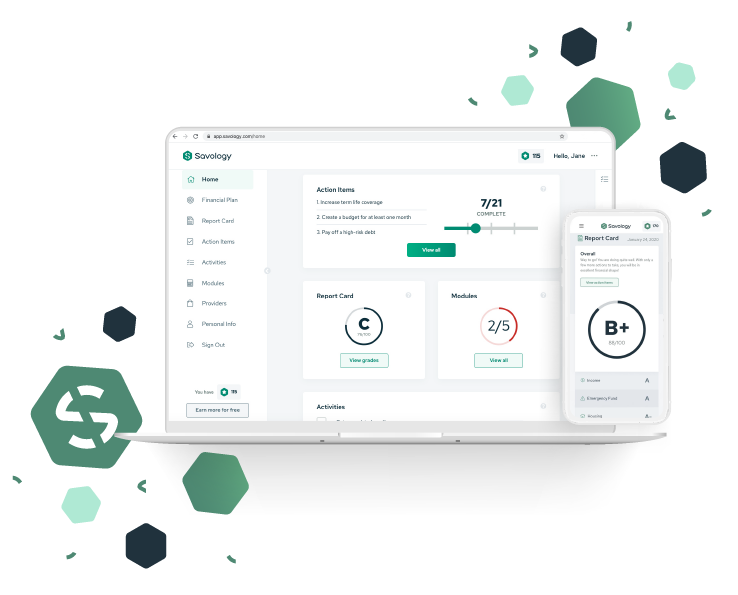

With Savology, you can create a personalized financial plan in just five minutes, for free. By creating your free account, you’ll have unlimited access to different resources and tools to help you continue improving your literacy and working towards your goals.

Moving forward with financial planning

Both traditional financial planning and technology-first planning have pros and cons. While accessibility, affordability, and time-consumption are major benefits of the new era of tech-enabled financial planning companies, there is still a need for traditional financial planning.

As a consumer, you’re likely wondering what the best option for your plan and your future is. The answer is that it depends. But the good thing is that you have plenty of options to choose from, and with technology being able to provide affordable solutions, it gives you an opportunity to explore more options that will get you closer to reaching your goals.

With Savology, we are providing people with a fast and easy way to access free financial planning that actually works. Not only will you get access to a holistic financial plan, you’ll also get access to personalized recommendations helping you reach your goals along the way, just as you would with a traditional advisor. Additionally, you’ll have access to some of the best-rated financial service providers at a discount, financial tools, and plan-specific activities that are all used as a way of helping you make steady improvements to your financial life.