There is a lot of information out there about life insurance. A quick Google search pulls in 2 billion results, and a search on Amazon shows more than 3,000 books listed on the topic. The abundance of information and opinions can be overwhelming, but is it really as complicated as it seems?

While there are some advanced planning strategies, and it can get complicated, basic term life insurance is relatively straightforward, and it is a vital part of any holistic financial plan.

In this article, we will touch on a few important questions you may have about life insurance, show you how to calculate your need, and go over the best ways to get a policy. My hope is that after reading this article, life insurance is less of a mystery and you can feel confident in doing what’s best for you and your family.

What is life insurance?

Life insurance is a contract between a customer and an insurer that guarantees that the insurer will pay a death benefit to the customer’s named beneficiaries if the customer dies during the term of the policy. In exchange, the customer pays premiums for that coverage during the term of the policy.

As you may have surmised, the purpose of life insurance is to provide financial protection for the policyholder’s dependents in the case that the policyholder passes away unexpectedly.

Here is an example:

Meet Alex. Alex is an attorney. She has a husband and two kids, ages 5 and 10, who depend on her income. So, she goes to a life insurance provider and applies for a policy. After determining her needs, she applies for a policy with a $900,000 death benefit. Let’s say the insurance company asks for a premium payment of $50 per month to keep the policy active for the 20-year term. Several years later, let’s say Alex is involved in a fatal car accident. The insurance provider would then pay out the $900,000 benefit to Alex’s husband. He could then use these funds to pay for Alex’s medical bills, cover the cost of the funeral, pay off their home and other debts, create a college fund for his kids, and further his education so he can get a better-paying job and become the primary breadwinner for the family.

If Alex had not applied for and obtained a life insurance policy, things would look very different. Her husband would be left responsible to pay for the medical bills, funeral expenses, their home, and more out of pocket without any support from a death benefit. In practice, this often results in people having to take on significant debt or even file for bankruptcy.

Do I need life insurance? If so, how much?

If you read the example of Alex above, it should be clear that there are very few families who would not stand to benefit from life insurance. Unless you are quite wealthy or have no one depending on you financially, you should absolutely consider getting a policy.

One of the easiest ways to determine if you need life insurance or assess whether you have enough coverage is through your Savology financial plan. Savology will analyze your unique situation and provide expert analysis on the amount of coverage you need to properly protect your family.

As for how much coverage you need, the short answer is that every family’s situation is different. Luckily, there are people who have spent a lot of time coming up with simple ways to calculate your life insurance coverage need so you can make sure your bases are covered.

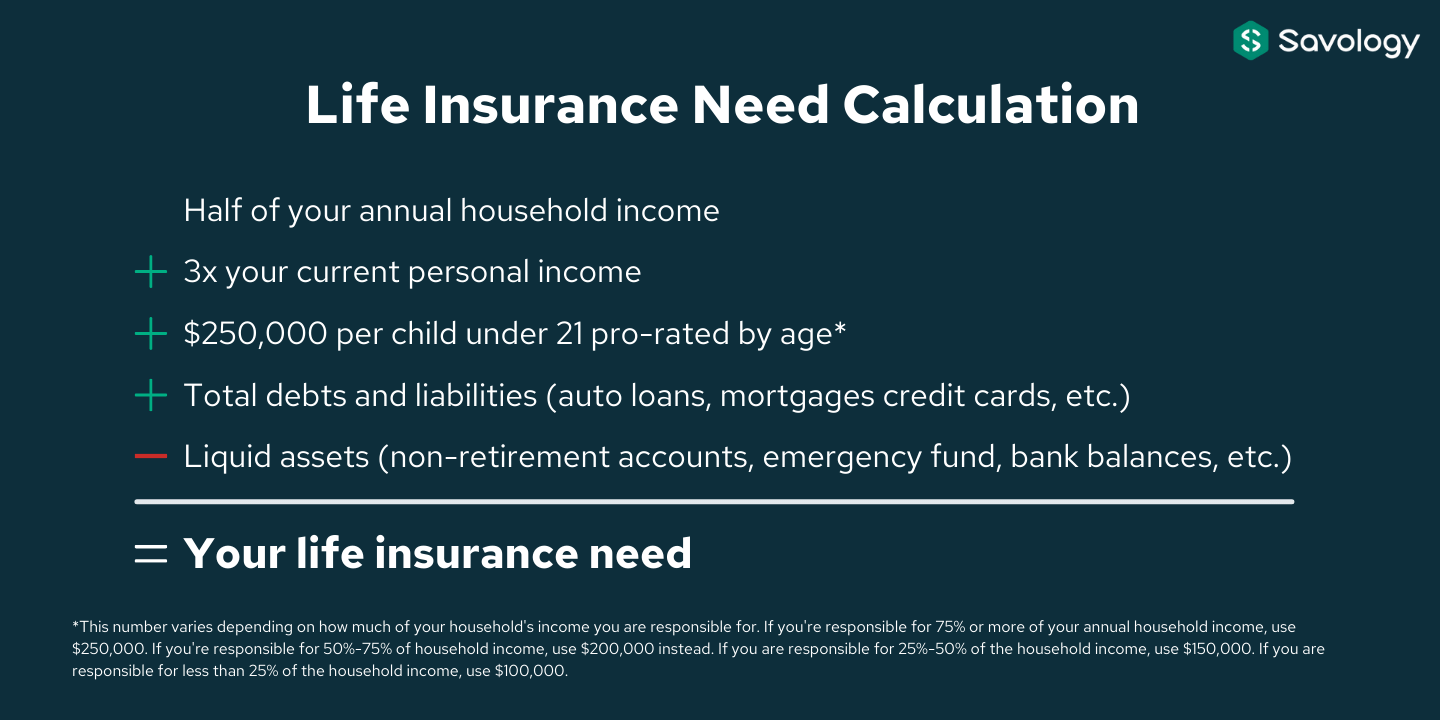

Savology’s life insurance methodology

Savology’s formula takes a number of factors into account when considering your life insurance need, including your income, net debts, and number of children. Here is how it works:

If you already had a life insurance policy, you could determine your coverage gap by subtracting the amount of coverage you already have from your life insurance need. That tells you how much additional coverage you need in order to close your gap and mitigate risk.

This calculation isn’t necessarily complicated, but when you create a free financial plan with Savology, you don’t have to worry about it because they do the work for you. They can also connect you with carefully vetted providers to help you get a life insurance policy that meets your needs, or close the gap if you are underinsured.

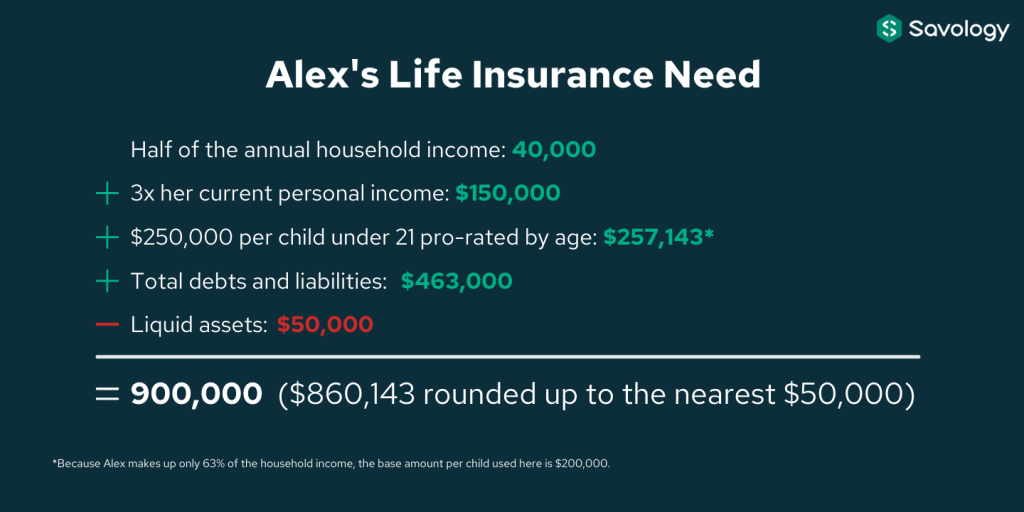

An example on calculating the coverage amount

Let’s go back to the example of Alex and her family again, this time with Savology’s life insurance calculation formula in action.

As we established, Alex is married and has two kids, ages 5 and 10. Let’s say that of their total household income of $80,000, Alex’s income makes up $50,000 or 63% of that. Their home is worth $500,000, with $450,000 left on the mortgage. They also have a car worth $20,000 with $13,000 left on the loan. As for assets, they have a total of $50,000 in liquid investments and cash. So, here’s how she would calculate her life insurance coverage need using Savology’s life insurance formula:

What kind of life insurance is right for my family?

Generally speaking, term life insurance is the way to go. Term life insurance is the easiest to secure, understand, and work with. It is also the most affordable.

As your financial situation becomes more complex, you may consider other types such as permanent life insurance, including indexed universal life or whole life.

You can also explore adding “riders” – added provisions in a policy to provide additional benefits at an additional cost – such as accidental death, disability, waiver of premium, child term, long-term care, or return of premium. However, you should not consider these other types of life insurance without the help of a knowledgeable and trustworthy professional who is genuinely interested in your needs, and not just the sales commissions they can get by selling you a more expensive product.

How can I get life insurance?

Traditionally, the process of getting term life insurance required you to find an insurance agent, talk to your agent about coverage, fill out a lengthy paper application, mail it in, get a medical exam, wait for the results, get a quote, and then decide whether or not to bind the coverage. However, the advent of the internet has made it so much more simple.

These days, you can get quotes online, fast and free. In some cases, you can apply online, bind the coverage right away, and forego a medical exam! You can often get a free quote from providers in minutes, then compare quotes and determine which policy is best for you and your financial plan.

Alternatively, you can work with financial professionals to find coverage that meets your needs. Consider working with a financial advisor, financial planner, or other insurance agent to find suitable coverage.

Moving forward with life insurance

When used correctly, life insurance can provide peace of mind for you and help mitigate financial risks for those who depend on you. Now that you have fundamental answers to some key questions about life insurance, you can determine how much life insurance you need and make a plan for obtaining it so that you can benefit from the peace of mind and protection that comes with proper coverage.