There are few elements of a financial plan more important than your savings rate. Get it wrong, and you’ll either be retiring late or running out of money early. Get it right, and just about everything else falls into place. In this article, we’ll cover what a savings rate is, how to calculate it, how to determine what yours should be, and then we’ll go over some actions you can take to increase your savings rate. And don’t stress! It’s easier than you may think.

What Is Your Savings Rate?

Your savings rate is the amount of money you save each month as a percentage of your total or gross income. A higher savings rate equals more savings each month, and the more money you save each month, the more you can accumulate towards retirement, a down payment, your emergency fund, or any other savings goals you might have.

Why Is Your Savings Rate Important?

Your savings rate is arguably one of the most important components of your financial plan, but why? It’s what you have the most control over. You have little to no control over market returns or how long you’ll live, but you can control how much you spend and how much you save.

Stephen R. Covey’s calls this our “circle of influence” in his landmark book, “The Seven Habits of Highly Effective People.” In his book, Covey emphasizes the importance of focusing on the things that fall within our circles of influence, and not expending energy on the things that don’t. You have a significant influence over your savings rate through your ability to control expenses and increase your income. So, focus on your savings rate instead of what the market is doing, and you’ll be well positioned to achieve your financial goals.

In addition to being something you have significant control over, your savings rate is one of the biggest factors impacting whether you will have enough money to last through your retirement years. A higher savings rate means you’ll either be able to retire earlier or have more money during your retirement. Or maybe, both.

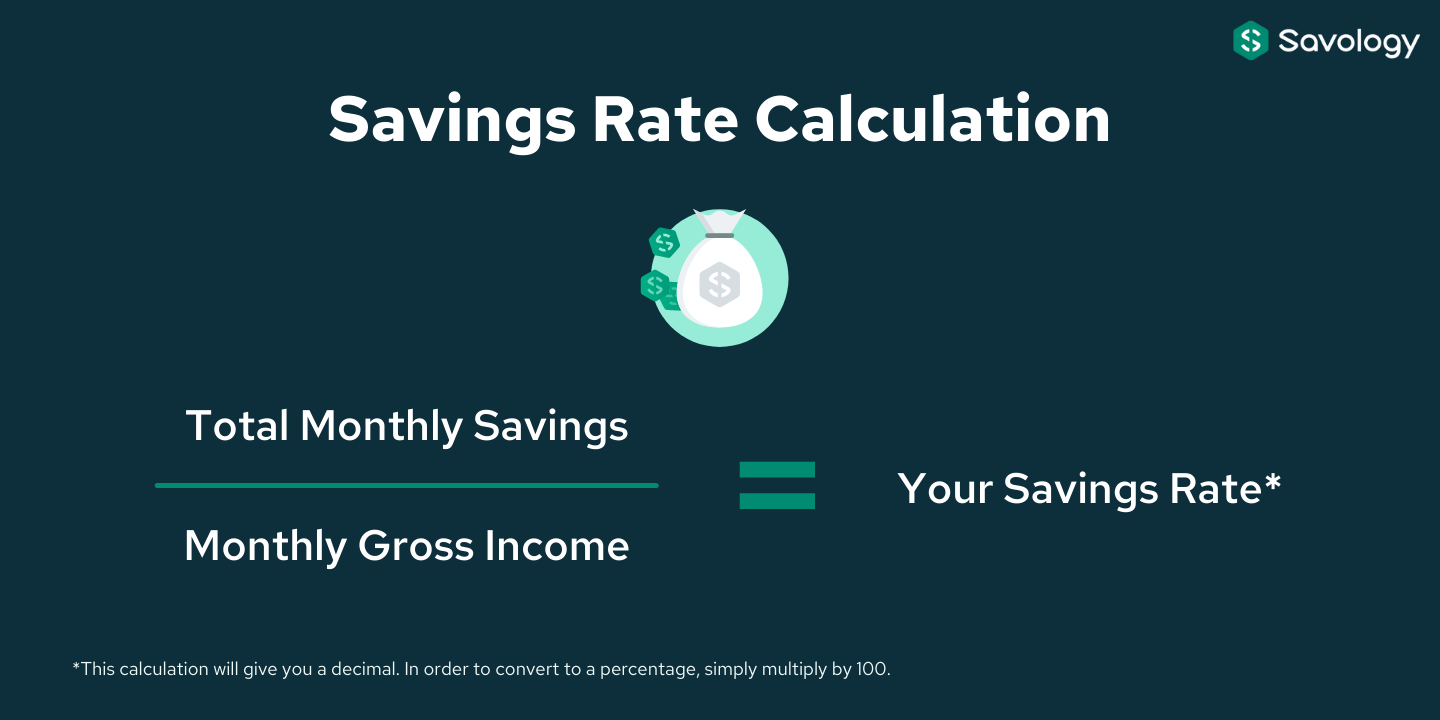

How To Calculate Your Savings Rate

Savings rate is calculated by dividing your monthly savings amount by your monthly gross income, and then multiplying that decimal by 100 to get a percentage. You can also use your annual savings amount and your annual gross income for this calculation. Either will give you the percentage of your income that is going towards savings.

Savings include retirement savings as well as other monthly savings. When doing the calculation on your own, be sure to include your employer contributions into a 401(k) or other retirement plan provided through your employer.

Why Gross Instead of Net income?

Gross income is used as the industry standard when calculating savings rate because taxes can vary from household to household and that variation can inflate your perception of how much you are saving. This is especially true if you are in a high tax bracket. Using gross income when calculating your savings rate levels the playing field and gives you an accurate picture of whether you are saving the amount that you need to be.

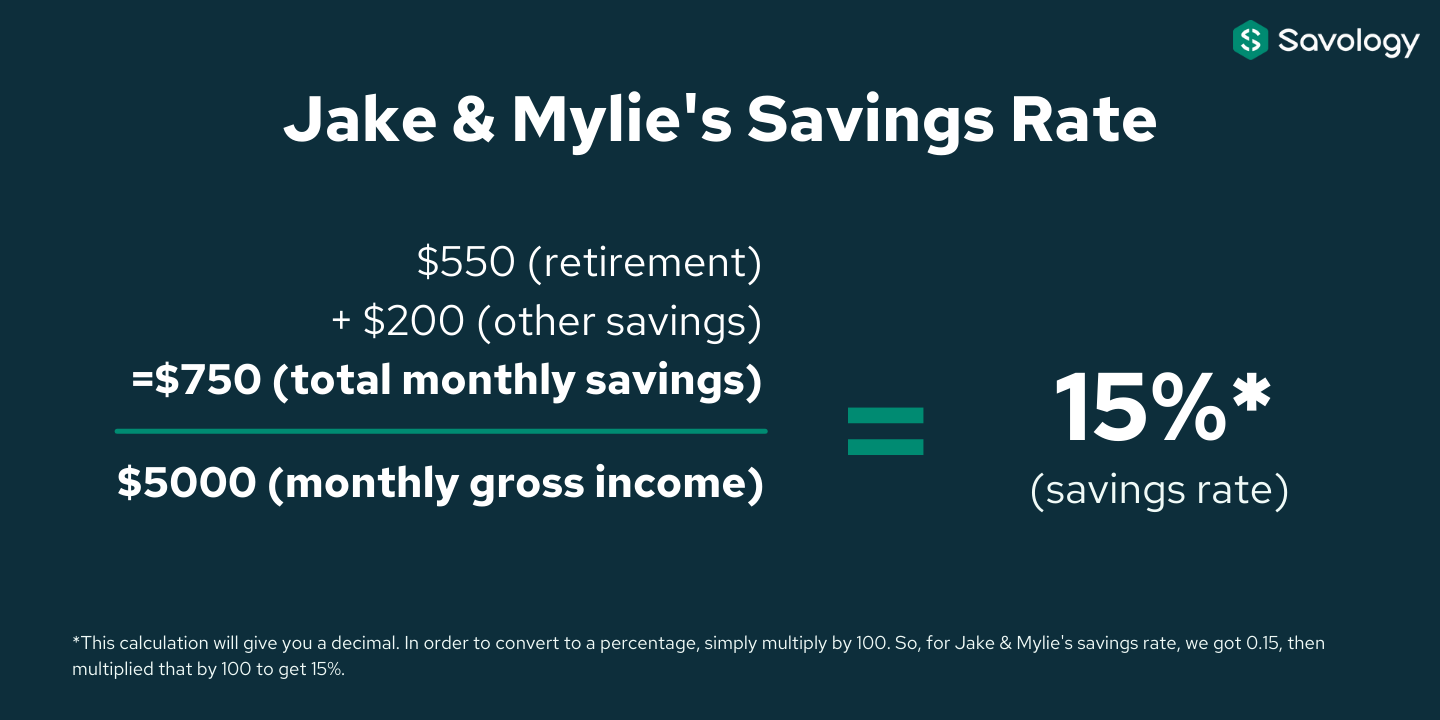

An Example of Calculating Savings Rate

Let’s say Jake & Mylie make $5,000 a month as a household ($60,000 per year). They save $550 a month towards retirement, and $200 each month for an eventual down payment on a home.

Here is how we would calculate their savings rate:

As shown in the example above, Jake and Mylie have a retirement savings rate of 15%. Their results would be the same if we calculated it on an annual basis, though sometimes it is more difficult to approximate your annual savings.

General Savings Rate Recommendations

Many personal finance experts recommend a flat savings rate of 15%. While that isn’t a bad rule of thumb, there are two primary factors that can affect that recommendation:

- The first is the age at which you start saving. The number of years you are able to save for retirement has a big impact.

- The second is how much money you need to have when you retire to support the lifestyle you want to live.

The CFP Board makes even more specific recommendations for savings rates based on when you start saving. For example, if you start before the age of 32, the CFP Board recommends a savings rate of 10 – 12% of your gross income. If you don’t start saving until you are 40, then the recommendation increases to 20-25% of your gross income.

If you want to retire before the general retirement age range of 65 to 70, or if you have other big goals, then you will need to adjust these savings rates depending on your goals and time frame. That is why it is important to get a personalized financial plan to help you to determine your recommended savings rate based on your age and goals. This can feel overwhelming, but if you create a financial plan with Savology, they do all the work for you.

Impact of Savings Rate On Retirement

As we have already discussed, savings rate has a big impact on your financial plan. The biggest impact on your projected retirement age is your savings rate. While rate of return and time are also important, savings rate is the most important of all. Keep in mind that the amount you are saving depends on your age.

Let’s look at a couple of graphics that illustrate the relationship between what age you start saving and how high your savings rate needs to be. The first is from Mr. Money Mustache’s article called The Shockingly Simple Math of Early Retirement.

Assumptions:

- You can earn 5% investment returns after inflation during your saving years

- You’ll live off of the “4% safe withdrawal rate” after retirement, with some flexibility in your spending during recessions.

- You want your “Stash” to last forever, so you’ll only be touching the gains, since this income may be sustaining you for seventy years or so. Think of this assumption as a generous safety margin.

Here’s how many years you will have to work for a range of possible savings rates, starting from a net worth of zero:

| Working Years Until Retirement | Saving Rate |

| 66 | 5% |

| 51 | 10% |

| 43 | 15% |

| 37 | 20% |

| 32 | 25% |

| 28 | 30% |

| 25 | 35% |

| 22 | 40% |

| 19 | 45% |

| 17 | 50% |

There is more to this chart but we’ve abbreviated it to show you the most important information. As you can see, the fewer years that you have left to save for retirement while working, the more you have to save.

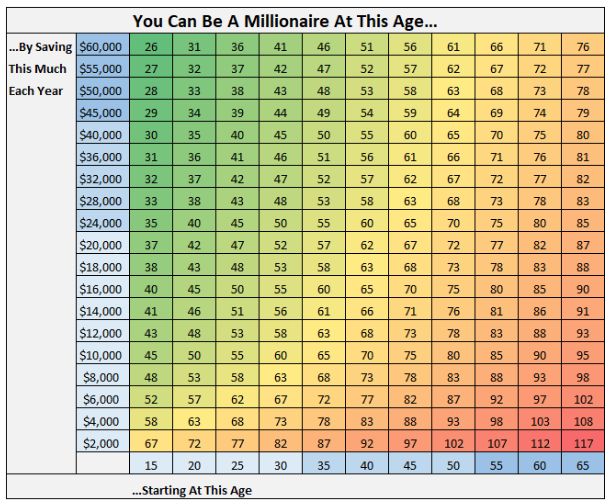

Another way of looking at the relationship between age and savings is shown in the image below. This graphic helps you see at what age you could be a millionaire depending on when you start saving and how much you save each year.

Ideas To Increase Savings Rate

1. Cut Back on Your Spending

An important step for increasing your savings rate is to take a look at your budget and determine areas where you can reduce your expenses. Cutting back on spending will allow you to put more toward saving.

You should review not only discretionary expenses like shopping and entertainment, but also your biggest expenses like housing costs or vehicles. Changing spending in any of these areas can result in big wins and have a sizable impact on your overall savings.

2. Increase Your Income

This may seem obvious, but making more money is a great way to save more money. You don’t have to make any changes to your current lifestyle, and you can still save more. Win-win!

You may not think you have much control over your income, but there are a number of ways that you can increase the amount you are earning including:

- Starting a side hustle

- Seeking out a new position (with your current employer or a new employer)

- Negotiating a raise

These are all proven ways to increase your income. Your earning ability is your most important asset. If you are constantly finding ways to earn more, you should have no problem getting your savings rate to a healthy level. For more information, check out our income guide as a resource to help you navigate ways you can improve your income.

As your income increases, however, it is important to watch out for lifestyle creep. You may not have heard this term before, but odds are you have seen lifestyle creep in action. Lifestyle creep is simply the all-to-common tendency for your lifestyle to get more expensive as your income increases. Former luxuries start to become needs and before you know it, you’re in the same place financially as you were before your income increased. While it’s okay to be intentional about increasing your spending in certain areas as your income increases, you should still take the majority of your increased earnings and put it towards savings.

Pay Yourself First

Paying yourself first means that when you get paid, you put money toward your savings goals before you put money toward anything else. It’s kind of like “Treat Yo’self,” but actually beneficial for your long-term financial situation. Of course you can manually transfer money to savings every payday, but it’s far easier if you just automate the process. Here are a couple of ideas on how to do that:

- Split your paycheck so that a predetermined portion of it goes to a savings account each time you get paid. Reach out to payroll at your employer to see how you can set this up.

- Set up scheduled transfers through your bank so that each time you are paid, a portion of that paycheck goes straight to savings without you having to lift a finger.

If you pay yourself first, frivolous spending will be less tempting and it will be that much easier to reach your goals.

Improving Your Savings Rate

As you can see, your monthly savings rate is an essential component of your financial plan and has a significant influence on whether you reach your financial goals, or not. This is why improving your savings rate is one of the key recommendations you will find in the financial plan you can get through Savology. Your Savology financial plan will tell you how much you need to increase your savings rate in order to reach your desired retirement outcome. If you haven’t created your digital financial plan yet, get started right now to see if you are saving enough to reach your retirement goals.