A few weeks ago, I attended a conference covering several business topics. One of the most interesting speakers was a futurist who discussed trends in technology. One of the comments he made was that we are entering the algorithmic age. I agree that we are seeing profound changes in our society as we use computers to model and predict human behavior. This technology is being used in ways we could have scarcely thought of a few years ago. For example, have you noticed that after you search certain terms on your computer, you suddenly see advertisements for great deals on the items you were searching?

As I listened to this presentation, I thought about the fact that these algorithms have been around for quite some time. For years, businesses have used computers to predict human behavior using scoring systems. One of the most common examples of this is a credit score.

So, what really is a credit score? Simply put, a credit score is an algorithm, or a set of mathematical equations, used to gauge the financial risk an individual poses to a potential lender. It is a points-based system and the higher your score, the less risk you pose. These scores are generated by credit bureaus using the information provided to them from the businesses and organizations that report your financial history.

Who has access to my score?

Initially, credit scores were only used by financial institutions in making lending decisions. However, other industries have learned that these credit scores can be used to judge other areas of risk. Now, credit scores are used by insurance companies, utility companies, renters and future employers. There is now a widespread understanding that the way a person handles financial affairs indicates how they will handle responsibility in other areas of life.

When credit scores were first developed in the late 1980’s and continuing into the 1990’s, it was very difficult for individuals to find information on them. There was a feeling that the calculation of these scoring systems was proprietary. If the method was known, anyone could calculate the score. The opposing view was that the information about a person’s credit history belongs to the individual and that person has a right to it. Pressure from the public built up to force more transparency regarding credit reporting information. Legislation was finally passed in 2003 entitling consumers to a copy of their credit report free of charge each year. Subsequent legislation was passed entitling consumers more access to the credit score itself. Now, it is relatively easy for people to find their credit scores.

How is a credit score calculated?

There are three major credit bureaus in the United States. These bureaus are Equifax, Experian, and TransUnion. Each credit bureau uses basically the same model to calculate a credit score. While the exact formula is kept confidential, the factors in credit scoring are widely known. The largest component is the payment history of an individual. Making your mortgage, car and credit card payments on time and never missing is the most important way that you can maintain a good credit score. Excessive delinquency, charge-offs or bankruptcy can severely impact your score for a long period of time. Most financial institutions report payment information to each of the three credit bureaus, though some choose to only report to one or two. Many other institutions like utility companies also report your payment history to the credit bureaus.

There are several other factors that can affect your score. One major component is how much debt you have compared to your capacity to borrow. Having several recent inquiries to your credit score can negatively affect your score. The length of time that you have had accounts reported to the credit bureaus will affect your score. As accounts age, they help improve your score if they are managed well. One thing to keep in mind regarding your credit score is that it is a lot easier to make it go down than it is to increase it.

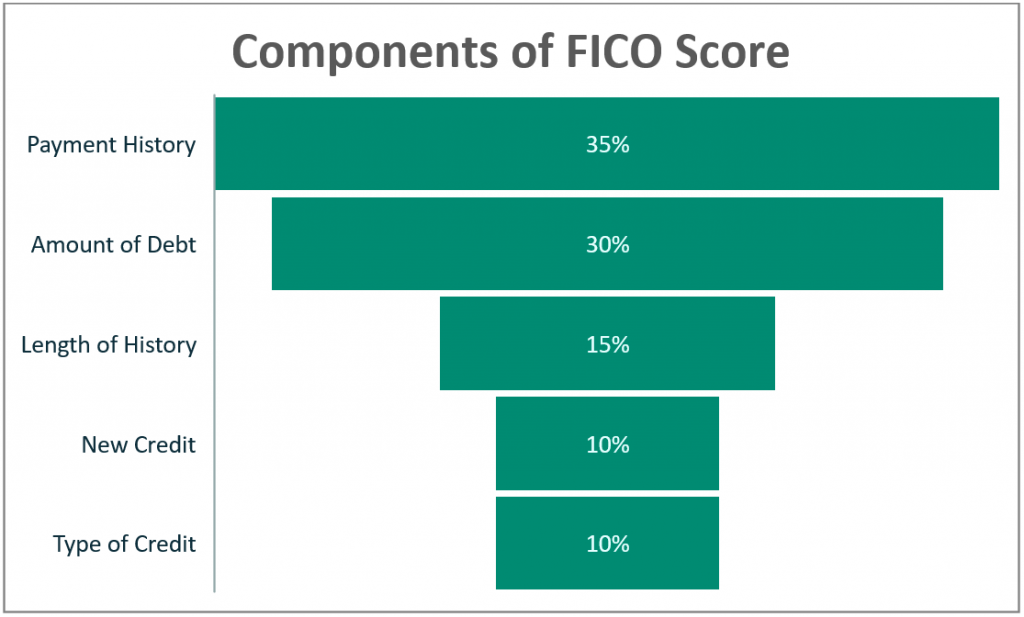

As mentioned earlier, the credit bureaus use the same basic model, called a FICO score. This system was developed by Fair Isaac Corporation and is the foundation of credit scoring. There are five basic components of a FICO score. These are listed below with the corresponding percentage of the score:

What is a good credit score?

Often people wonder what a good credit score is. That is a very difficult question to answer as it depends so much on circumstances. Each decision made with a credit score is based on a willingness to accept a certain level of risk. Credit scores range anywhere from 300 to 850. A good rule of thumb is if your score is below 670-680, you have some room to improve. If you are below 620, chances are you will have a difficult time getting credit.

In my experience, I have used the following as a general guide in looking at credit score ranges. There is no guarantee that these ranges will be used by a lender in making decisions and is only a general rule of thumb.

- 620 and below: Poor – A score in this range will make it difficult to get credit.

- 620 – 680: Fair – A score in this range should allow you to borrow money, but you will not be getting the best interest rates.

- 680 – 770: Good – A score in this range shows a lender that you know how to manage money and you should not have trouble borrowing.

- 770 and above: Prime – A score in this range is above average and you should expect the best interest rates.

What can I do if I have a poor credit score?

Each circumstance is unique and there is not one solution for everyone. However, here are some things to consider if you need to improve. The best advice I can give you if you have a poor credit score is not to panic. Remember that you will always have options and there will be help available. Don’t be afraid to talk about your concerns with trusted resources. Although rebuilding a score will take time, with consistent effort you can turn it around.

The first thing to do is to make sure you have a realistic budget. If you are having trouble managing your finances, it is most likely due to not planning. Once you have a budget, focus on making your payments on time. This is the biggest factor in your credit score and will have the most impact. If you are having difficulty making payments, reach out to creditors and discuss your situation with them. Most lenders will be willing to work with you if you put forth an honest effort. If you are having trouble controlling your spending, stop using your credit cards, but don’t cancel them. There are plenty of creative ideas on how to make them inaccessible, but one sure-fire way is to cut them up.

Monitor your credit report. Review it to make sure that the information is accurate. If it is not, notify the credit bureau that there is an error and they will provide information on correcting anything that is wrong. Avoid any advertisements that promise to fix your credit score quickly. Increasing your credit score is never immediate and takes demonstrated ability to manage your money.

What can I do to maintain my score?

I am a firm believer that each of us has a right and a responsibility when it comes to our credit information and our credit scores. It took legislation to guarantee the right to access credit bureau information. This information is valuable, and much business is transacted based on it. Organizations are willing to pay good money to access these scores. But because there is such reliance on this information, there are those in society who exploit this system for illegal means. Identity theft is a big problem in today’s world, and we need to protect ourselves by regularly monitoring our credit information.

Algorithms will increasingly be a part of our lives in the future. Understanding the basis for these systems will be an important part of being successful in the future. Understanding how credit scores work is essential to your financial well-being.