Overview

Credit is ubiquitous in modern financial life. Maybe you’re new to credit, or perhaps you’ve had credit for a long time but just can’t seem to grasp how to make it work for you instead of against you. Wherever you are with credit, this article is for you. We will go over what credit is, why it is important, and give you some real-world recommendations for how to build, maintain, and improve your credit.

What is credit?

Simply put, credit is your ability to borrow money or access goods and services with the understanding that you will pay later. Almost anyone can access small amounts of credit, but to get higher limits and lower interest rates, you have to have a proven record of paying back what you have borrowed. The best way to understand credit might be to just dive in and explore some of the different types.

Credit Reports

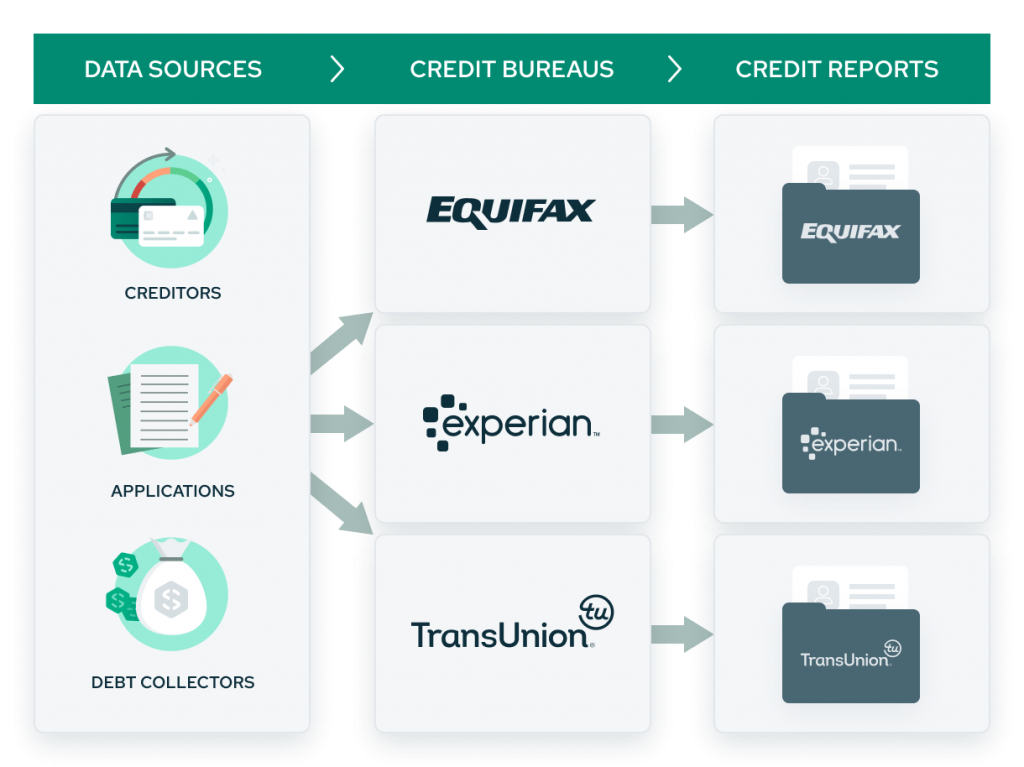

When learning about credit, one of the first things you’ll need to understand is credit reports; what they are and how they are used. First, let’s talk about credit bureaus, the source of credit reports.

The 3 Bureaus

Credit bureaus are organizations that collect information from creditors, credit applications, and debt collectors in order to create credit reports. There are three major credit bureaus:

- Transunion

- Equifax

- Experian

Each bureau operates similarly, but they gather information independently, so there is often variation in what each bureau includes on your credit report.

What is included on a credit report?

It may surprise you just how much information is on your credit report. However, understanding what is included helps you know where to focus in your day-to-day financial decisions.

1. Public records

First, a credit report includes information from public records about you, including:

- Repossessions

- Bankruptcy filings

- Foreclosures

- Judgments and tax liens (though these are going away)

2. Debts

Second, a credit report includes information about your debts, including:

- Current and past credit accounts

- Payment history

- Credit inquiries

3. Personal information

Last, a credit report contains personal information to identify you, including:

- Social Security Number

- Aliases, or names you have used in the past on official documents

- Current and past addresses

- Employment history

What is NOT included on a credit report?

Almost as important as understanding what is included on your credit report is understanding what is not included. Some pieces of information that are not included on your credit report include:

- Race

- Religion

- Education level and history

- Criminal history

- Marital status

- Medical information

- Transactional data

- Bank account balances

Who uses credit reports?

Credit reports are primarily used by lenders and credit providers to run background checks and make lending decisions. Your credit report is also used to evaluate lease applications, set insurance rates, and determine utility deposit amounts.

However, many lenders will make decisions purely based on one number: your credit score.

Credit Scores

Your credit score is determined by several factors on your credit report, and lenders use it to gauge the financial risk you pose. It is a points-based system based on your credit history. The higher your score, the less risk you pose, and the more likely the lender is to work with you.

You can get a credit score from a number of places. Most banks or credit card issuers will provide you with a credit score that you can track within your banking app. If your bank does not provide you with a credit score, you can also get one through Credit Karma.

There are two major credit score types: FICO and VantageScore. Both scores range from 300-850, and the scoring methodology is also much the same. However, lenders will generally look at your FICO score when considering you for a loan application, even though most credit scores you’ll see in your banking tools use VantageScore. For this reason, it’s helpful to check both.

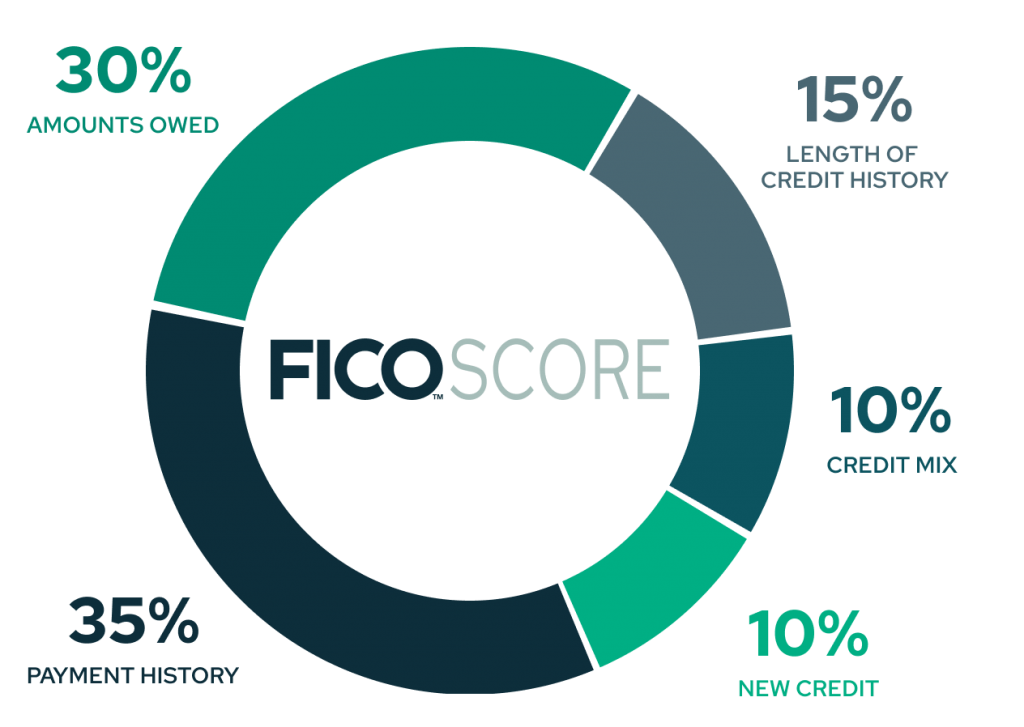

What factors affect my credit score?

Many factors determine your credit score, and each is weighted differently. Let’s break it down. For simplicity’s sake, we’ll just be looking at FICO for this article, but VantageScore’s method is very similar.

Payment History

Your payment history makes up 35% of your credit score. Payment history includes all credit payments you’ve made over the last seven years, both on-time and late payments. Fortunately, more recent activity is weighted more heavily than older activity, so even if you had a rocky start with credit, keeping up with payments now can put you back on track in no time.

Amounts Owed

Your amounts owed comprise 30% of your credit score. “Amounts owed” is made up of several categories, including the amounts you owe on all debts, how many of your accounts have balances, and your overall utilization rate. Utilization rate is a significant component here. You calculate your utilization rate by dividing the amount of revolving credit you are currently using by the total amount of revolving credit you have available to you. The lower your utilization rate, the better.

For example, you could have a $10,000 credit limit across multiple credit cards or credit lines, and if you were only using $900 of it, that would be a 9% utilization rate, which is favorable. However, if you had a total credit limit of $1000 and you were using $900, that would be a 90% utilization rate, which is very high and would hurt your credit score.

Length of Credit History

The length of your credit history makes up 15% of your credit score. The longer you’ve had credit, the longer you’ve had to demonstrate your creditworthiness. Longer credit history will always have a positive effect on your FICO credit score. An excellent credit score could take 10+ years of credit history to establish, so don’t get discouraged if your credit score isn’t where you want it to be right at the beginning.

Credit Mix

Your credit mix makes up 10% of your credit score. It is preferable to have diverse types of credit on your report. For example, if you have an auto loan, a mortgage, and a few credit cards, your credit score would be more favorable than if you had credit cards and no other types of credit. That lack of credit diversity would negatively affect your score.

New Credit

New credit applications make up the last 10% of your credit score. This includes any new credit cards you’ve applied for or other credit inquiries you’ve made over the previous two years. Credit inquiries always go onto your credit report, so they influence your credit score whether or not your credit requests were granted, something to keep in mind if you’re thinking about applying for credit on a whim.

What is a good score?

FICO and VantageScore each have a credit score rating system ranging from “very poor” to “excellent.” FICO designates any credit score above 670 as “good.” For VantageScore, a “good” credit score is anything above 661. Either way, having a “good” credit score can increase your odds of getting approved for a loan. The higher your credit score, the higher your chances are of getting a favorable interest rate or other cost-saving terms.

The tables below outline what you can expect from lenders based on what your credit score is:

Building or Improving Credit

Now that you know what shows up on your credit report and which factors make up your credit score, let’s talk about what you can do to build or improve your credit.

How to build credit from scratch

First, if you don’t have any credit history, let’s discuss some simple ways to start building credit.

1. Become an authorized user

Becoming an authorized user is a relatively quick and easy way to start building your credit. It entails being added to another person’s credit card, so you can use their credit line and benefit from their credit history without the added responsibility of managing credit on your own.

As you can imagine, becoming an authorized user can be a blessing or a burden depending on how good the other person’s credit is. Ideally, you’ll want to be added to a friend or family member’s account where they maintain a low balance and have no history of late payments. Avoid getting added as an authorized user on an account where you know there are already existing problems, i.e. history of frequent late payments and high balances.

2. Apply for a starter credit card

Another accessible way to start building credit is to apply for a credit card targeted at people who are new to credit and have no prior credit history. Check with your bank or financial service provider to see if they have any current credit card offerings designed for beginners. One example of a beginner credit card is a secured credit card.

A secured credit card requires you to make a security deposit before receiving a limit on the card. This makes it less risky for lenders and easier for you to get approved. By using a secured credit card responsibly, you’ll be able to steadily boost your credit score safely, helping you to qualify for unsecured credit cards with higher limits in the long term.

3. Take your time increasing your credit limits

As you start building credit, don’t overdo it with your credit limits. While a higher credit limit might seem enticing, a slow and steady approach is usually the best way to go. Remember the factors that go into your credit score. Pay off your balance often so you can maintain a low utilization rate and favorable payment history.

Watch out for common pitfalls

It can be easy to make financial mistakes when you’re just getting started with credit. This is a normal part of the process, but knowing which actions can be detrimental to your credit score will make you a more responsible credit user.

Keep the following tips in mind when you’re beginning your credit journey:

Limit applications for new credit

Each time you apply for credit, credit bureaus will add that inquiry to your credit report. Too many credit inquiries in a short amount of time can harm your score because it looks as though you’re desperate for credit and at risk of taking on too much. One of the best ways to build your credit safely is to only apply for credit when necessary.

Be cautious of credit offers that guarantee approval

You might have come across offers like these online or seen them advertised on street corners: “Instant loans, no credit history needed!” Many offers like these are credit card scams that will cost you much more than you are able to borrow.

Limit the number of credit cards you take on

A common credit myth is that having multiple credit cards will always positively impact your credit score—quite the opposite. If you take on too many credit cards in a short amount of time, you can actually hurt your credit score, not to mention the added risk of juggling multiple payments and racking up an unmanageable amount of debt. Starting with just one credit card is typically the best decision. Then, if you feel the need, you can apply for a second or even a third card. But remember, don’t overdo it!

5 Ways to Maintain Good Credit

We’ve already gone over this, but again, the five key pieces of information used to calculate your credit score are:

- Your payment history

- Your amounts owed

- The length of your credit history

- Your credit mix

- New credit

Remembering these five components can help you make better decisions when it comes to building and managing your credit. So, let’s look at some practical things you can do to ensure you are addressing each of the credit score factors.

1. Pay your bills on time each month

Paying your bills on time is the best thing you can do to build a good credit score. Remember, your payment history makes up a whopping 35% of your credit score. So, by paying on time and avoiding any late payments, you’ll help yourself steer clear of bad credit.

For payments to be considered on time, you must make at least the minimum payment by your due date each month. Make it a goal to pay at least the minimum every month, but if you can afford to pay more, do it! Contrary to some credit myths out there, carrying a credit card balance month to month does NOT improve your credit score, and can often lead to interest charges. The best case scenario is to pay your credit card balance in full each month. That way, your payment history is spotless and you avoid paying interest.

2. Keep your credit balances low

The second most significant influence on your credit score is your overall level of debt. Credit scores take into account the total amount of debt you have, as well as your credit utilization.

Your credit score will suffer if you run up a big credit card balance without paying it off, not to mention the compound interest charges you will incur. Keeping your credit card utilization below 30% is ideal for building good credit. However, it’s always best to pay off any credits or outstanding debt in full when you can.

One of the best ways to always maintain a low balance is to make sure that you’re only using your credit card, or other types of credit when you need to, and that you’re staying on top of upcoming payment dates. If you’re especially worried about racking up your credit balance, pay it off as you go. Don’t wait until the end of the month. When you use your credit card for a purchase, pay it off immediately. That way, you always maintain a low balance.

3. Keep credit cards open

The length of your credit history has a smaller impact on your overall credit score than payment history and amounts owed, but it’s still nothing to sneeze at. When you close a credit card, the issuer will no longer send updates to credit bureaus, and the credit scoring formula will place less weight on inactive accounts. After ten years or so, the closed account’s history will be removed from your credit report. Once you lose that credit history, your average credit age will decrease and your overall score will drop. To maintain a lengthy credit history, keep lines of credit open, even if you’re not using them that much.

Closing a credit card will also affect your credit score because it reduces the amount of available credit you have. For example, if you had three cards that held a combined credit limit of $10,000, and you closed one with a $2,500 limit, your overall credit limit would be reduced to $7,500. Remember that your credit utilization goal is 30%, so by closing that card, you make it much easier to go over that threshold.

4. Build your credit with more than a credit card

Remember, credit cards are not your only way to build credit. You should mix up the types of credit you have, maintaining both installment accounts like auto loans and mortgages and revolving credit like credit cards and other credit lines. Maintaining different types of credit accounts demonstrates your ability to handle multiple payments. This reflects favorably in your credit score.

5. Check your credit score regularly

Your credit report can affect many parts of your life, so it’s highly recommended that you check your score regularly. The first reason to check your score is that you’ll know where you stand. Your credit score is an integral part of your total financial health. Whether you’re in good or bad standing, it’s much better to know your credit score than to have no idea how you’re doing. Remember that if your score is bad, there are steps you can take to improve it. On the flip side, if your credit score is positive, you can focus your energy on maintaining it.

When you build a free financial plan with Savology, you can get access to a credit score module that will help you analyze and manage your credit score.

Conclusion

Whether you’re new to credit or a credit veteran, we hope that you now have a clearer understanding of how to build and maintain good credit. If you would like to delve deeper into any of the topics we discussed, be sure to check our our other articles on how to build credit, credit scores, and how to use a credit card. And remember, reading about building credit isn’t the same thing as actually building credit. That requires action! For support and motivation on your credit journey, you can’t do much better than a digital financial plan with Savology.