Understanding the concept of financial risk, what it is, along with the different types of financial risk is helpful when it comes to protecting against the loss, or potential loss, of money.

There are many financial risks that we’re faced with nearly every single day simply just by enjoying the many benefits of life. Through having a family, earning an income, and investing your money, you’re ultimately exposing yourself to some form of financial risk whether you’re aware of it or not.

In this article, we are going to explore the different kinds of risks you might experience. By understanding these financial risks in more detail, you’ll be able to better prepare for them and protect both your money and your quality of life.

What is financial risk?

In the simplest terms, financial risk can be defined as any various types of risk associated with your finances. Notably, any types of various risks that have the potential of losing money.

It’s important to know that there are many risks associated with both life and investing. Let’s talk about investing for the purpose of understanding risk. The ultimate goal of investing is to build your wealth and grow your money to help you to accomplish your primary financial goals. When it comes to investing, the loss of money would be considered a very real financial risk.

But there isn’t just one way of losing the money, you can lose money in a multitude of ways. Which is why it’s important to understand the risks you face and the options you have to protect yourself against them.

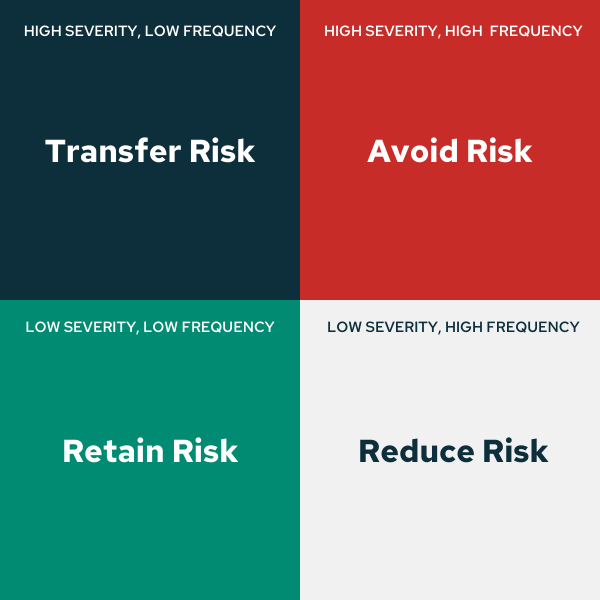

Different categories of risk

Risks, in general, can be categorized into one of four categories.

Category 1: Risks you should avoid

- High frequency and high severity risks.

- An example of this type of risk would be rock climbing without a rope, harness, and other proper equipment.

Category 2: Risks you should reduce

- High frequency and low severity risks.

- An example of this type of risk could be losing your car keys or spilling on your shirt.

Category 3: Risks you should transfer

- Low frequency but high severity risks.

- An example of this type of risk would be you passing away suddenly when you have people that depend on you financially.

Category 4: Risks you should retain

- Low frequency and low severity risks.

- An example of this type of risk could include damaged equipment or cracking your cell phone screen.

Alternative ways of classifying risk

Here are some alternative ways to look at risks:

Pure risk: Pure risks are the types of risks you would ideally transfer to insurance to protect against these risks. There is either a “loss” or “no loss”, meaning there is no middle ground or neutral outcome. This is a category of risk in which loss is the only possible outcome.

Examples: death, automobile accident, house fire.

Speculative risk: Speculative risk is a category of risk that can be taken on voluntarily and will either result in a profit or loss. All speculative risks are undertaken as a result of a conscious choice. This type of risk is uninsurable.

Examples: Investing in company stock, starting a business.

Subjective risk: Subjective risk depends on how an individual perceives the risk, making the level of risk open for interpretation.

Example: Luke and Miley recently moved to Sacramento, California. His coworker told him that the police department has a reputation for writing speeding tickets. As a result, Luke buys a radar detector because he perceives there to be a significant risk of getting a speeding ticket, while Miley does not consider it a significant risk at all.

Objective risk: An objective risk is an insurable risk where the probability of loss can be calculated. These risks are measurable and quantifiable. There is a percentage likelihood that they occur and a dollar amount to the expected loss.

Example: Statistics published for the number of speeding tickets written per licensed drivers living in a city would confirm or disprove the subjective risk perceived by Luke in the previous example.

Investment risks

When it comes to investing in the capital markets of stocks and bonds there are two types of risks: systematic risk and unsystematic risk.

Let’s take a look at each of the two below in a little more detail.

Systematic investment risk

Systematic risk is also known as a non-diversifiable risk which is the risk that exists in a specific firm or investment that can be eliminated through diversification. Through ownership of several different securities or investments, investors are able to eliminate this risk and protect their investments.

Below are five (5) identified types of systematic risk:

Purchasing power risk: Purchasing power risk is the risk that (1) inflation will erode the number of goods and services that can be purchased, and (2) a dollar today cannot purchase the same amount of goods and services tomorrow or the day after. Purchasing power risk impacts both stocks and bonds.

Reinvestment rate risk: Reinvestment rate risk is the risk that an investor will not be able to reinvest at the same rate of return that is currently being received. Reinvestment rate risk mostly impacts bonds.

Interest rate risk: Interest rate risk is the risk that changes in interest rates will impact the price of both stocks and bonds. There is an inverse relationship between interest rates and both stocks and bonds.

Market risk: Market risk impacts all securities in the short term since short-term gains and losses of the market tend to take all securities in the same direction.

Exchange rate risk: Exchange rate risk is the risk that a change in exchange rates will impact the price of international securities.

Unsystematic investment risk

Unsystematic risk is also known as a diversifiable risk which risk is the lowest level of risk one could expect in a fully diversified portfolio. It is an inherent risk of investing in a “system” or market that provides no guarantees.

Below are seven (7) identified types of systematic risk:

Accounting risk: Accounting risk is the risk associated with an audit firm being too closely tied to the management of a company.

Business risk: Business risk is the inherent risk a company faces by operating in a particular industry. As an example, Halliburton faces vastly different risks in the oil industry than Microsoft does, which is primarily selling intellectual property and protecting copyrights.

Country risk: Country risk is the risk a company faces by doing business in a particular country. For example, Halliburton faces unique risks doing business in Iraq. For international and global organizations, there are several considerations that need to be addressed before operating in certain countries or even new territories.

Default risk: Default risk is the risk of a company defaulting on their debt payments. Default risk can be thought of as the likelihood of a firm being able to satisfy its debt obligations on time.

Executive risk: Executive risk is the risk associated with the moral and ethical character of the management executives running the company.

Financial risk: Financial risk is the amount of financial leverage deployed by the firm. Financial leverage is the ratio of debt versus equity the firm has deployed, or the financial structure. The higher the percentage of debt deployed by the firm, the more assumed risk.

Government/regulation risk: Government or regulation risk is the risk that tariffs or restrictions may be placed on an industry or firm that may impact the firm’s ability to effectively compete in an industry.

How is risk assessed?

When it comes to making personal investments, risk is primarily measured by what’s known as risk tolerance and risk capacity.

Risk tolerance

One’s personal risk tolerance is the amount of risk that an investor is comfortable taking or the degree of uncertainty that an investor can, or is willing to handle. In other words what kind of investment volatility can one handle and still be able to sleep at night. Risk tolerance often varies with age, income, financial goals, current lifestyle, and family status. Typically, risk tolerance declines the older people get.

Risk capacity

Risk capacity is the amount of risk that any investor “must” take to reach their financial goals. The rate of return required to reach these goals can be estimated by examining time frames and income requirements. Then, the rate of return is used to help investors make a decision on the types of investments to engage in and the level of risk that is required. The more money you have saved and accumulated, the less risk you will need to take with your investments to reach their goals. This is why understanding the impact of your savings rate is so critical to your financial future.

How do financial risks apply to you personally?

Now that you have a good understanding of what financial risk is, how to categorize risk, and understand the types of risks when it comes to investing, it’s always a good practice to know and better understand many of the common financial risks we’re all faced with.

These are risks that you should pay particular attention to while making sure that you have a proper financial plan in place to protect against them.

Running out of money

Unfortunately, this is a very real risk for many Americans. Too many people are entering their golden years of retirement with not enough saved for their life expectancy. In the recent annual report published by Savology, it was determined that only 28% of households are on track to reach their goals and that the average retirement shortfall exceeds 10 years!

This is why it is so important to start saving early and to make sure that you are saving enough. It is also important that you are investing your money and that it is growing enough each year to sustain your goals and spending.

Passing away early

While it sounds morbid, it’s a very real risk that needs to be taken seriously. There are two risks with passing away early.

The first is dying when you still have others that are dependent on you financially. You can mitigate this risk through term life insurance.

The second is dying early without enjoying your money and hard work. We need to remember to balance our savings with our spending. It does not make sense to be so focused on the future that you are miserable now. Tomorrow isn’t guaranteed for anyone, so we need to make the most of the time we have today while still being prudent and planning for the future.

Investment risk

There are natural ups and downs that come with investing your money. Remember, increased risk brings an increased expected return. When we understand this, we can use it to our advantage by having more money for our goals well into the future.

As I mentioned earlier, we need to understand our risk tolerance and risk capacity to set up an investment plan that we’re able to see through and stay the course. Important considerations in your investment plan are the fees you will pay, your overall investment strategy, and the discipline through both the good times and in bad times.

Inflation risk

Everyone is subject to the risk of inflation. The purchasing power of our dollars goes down each year. For example, in 2000, $100 could go much further than $100 can for you in 2021. You would need more than $150, generally speaking, to get the same amount of goods and services today as you did in the year 2000 at $100.

In other words, to protect against this risk it is important to make sure your money is invested and growing. If it is not, you are guaranteed to lose every single year as a result of inflation. While inflation doesn’t seem like a lot from year to year, it significantly adds up over the long run and can be detrimental to your retirement plan. This is why being invested is so important.

If you’re interested in understanding the impact, I’d recommend getting familiar with how to calculate inflation.

Tax risk

Taxes are often the biggest expense that individuals have in their lives. This is why understanding taxes or hiring a professional is important in helping you make sure you are doing the right things to pay less tax. Common ways to save on taxes are to use tax-advantaged accounts for your investments such as a 401(k) or a Roth IRA.

Liquidity risk

Liquidity risk is the risk of not having enough money when an emergency comes up. An emergency fund is an extremely important, and must-have, financial tool that can protect you and your assets in the event of unexpected expenses. If you personally own a business or invest in real estate, having additional liquidity for unexpected expenses can no longer be seen as a nice-to-have financial tool. It’s absolutely essential for your long-term success.

Credit score risk

Credit score risk is essentially the risk that your credit will not be high enough, or in good standing, to qualify for secured loans which can result in being forced to pay higher interest rates. Without good credit, it can be extremely difficult for just about anyone to get approved for things such as a mortgage loan. Lastly, having good credit provides more flexibility and opportunity with your money.

Creditor risk

This is a type of risk where the assets you have worked so hard to acquire and build could be taken away from you through means of a lawsuit or a creditor. This is why it is important to consider having a trust set up along with liability insurance through homeowners/renters insurance, and/or an umbrella policy. Retirement accounts such as a 401(k) and IRA also have legal protection against creditors. For more information about creditor risk, it’s in your best interest to seek the advice of a legal professional.

Moving forward with managing your financial risk

In life, risk is inevitable. There are several risks that will come our way and challenge us to make difficult financial decisions. This is why it is extremely important to protect against the many risks that can be detrimental to your financial life. The good news is that there are several effective ways, such as building a financial plan and padding your emergency fund, that can be used to self-insure against smaller risks and to keep you on track towards your goals.

Additionally, through proper insurance and risk management strategies with estate planning, you’ll be able to better protect your family’s financial future against many larger and severe types of risks.

The best financial risk strategy starts with having a financial plan. Fortunately for you, Savology’s financial plans consider risk management (insurance and estate planning) as an important part of your financial life. Your plan will review your current financial situation, assess the risks you’re facing, and provide actionable steps and recommendations to help you mitigate and protect against all risks.